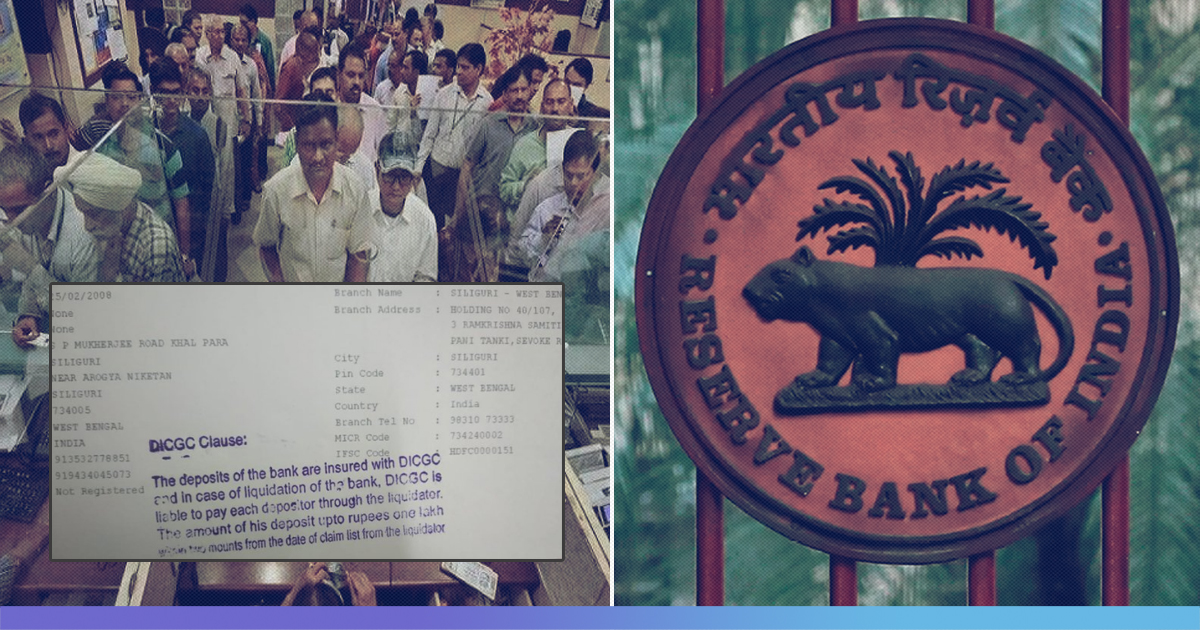

The government could consider raising deposit guarantee limit from existing ₹1 lakh, news agency IANS reported, citing Finance Minister Nirmala Sitharaman. Her comments come after the crisis at Mumbai-based PMC Bank.

A deposit insurance coverage ensures that the depositor gets a certain amount before the bank pays other parties at the time of liquidation. In India, deposit insurance is provided by the Deposit Insurance and Credit Guarantee Corporation of India (DICGC), which collects a premium of 0.05% on the entire outstanding deposit. As per the current bank deposit insurance scheme, deposits up to ₹1 lakh is insured and given back to the depositor, in case of the bank’s failure. This scheme insures all types of bank deposits which include savings, fixed and recurring with an insured bank. This deposit guarantee can be released only if the bank shuts operations. What this means is that risk-averse people who choose bank deposits to park their life savings could lose a large chunk of their fund in case of a bank failure.

Over the years, insured deposits as a percentage of assessable deposits have declined from 60.5 per cent in 2007-08 to 28.1 per cent in 2018-19, as per DICGC data.

“Given this backdrop, there is a dire need to revisit the insurance coverage of bank deposits. In particular, the current upper limit of Rs 1 lakh per depositor has outlived its shelf life and there is a need to revisit it,” State Bank of India’s group chief economist Soumya Kanti Ghosh said in a statement.

Major highlights of the current deposit insurance scheme on bank deposits:

- The ₹1 lakh limit covers both principal and interest amount.

- All deposits maintained by the depositor across all branches of the failed bank are clubbed. This means, if a person maintains deposits in different branches of a bank, they are paid a maximum of up to Rs. 1 lakh only on the aggregate amount.

- However, deposits maintained with different banks are not clubbed together.

- A single-ownership account will only get an insurance cover of a maximum of up to ₹1 lakh irrespective of funds kept in one or more branches of the same bank.

- If a depositor has two separate accounts in two banks and both shut down, then they are covered separately.

- If individuals jointly hold more than one deposit account in one or more branches of a bank, and if their names are registered in the same order everywhere, then all these accounts are considered as one.

- However, depositors get a separate insurance cover of up to Rs.1 lakh for joint accounts where the names appear in a different order or the set of names are different in each account.

- The deposit insurance scheme covers all banks operating in India including the private sector, co-operative and foreign banks in India. There are some exemptions like deposits of foreign governments, deposits of central/state governments and inter-bank deposits.

According to a report by the State Bank of India (SBI), in India, deposits are insured up to Rs 1 lakh, while the number for countries like Brazil and Russia stand at ₹42 lakh and ₹12 lakh, respectively. The report states that since 1993, there has been a paradigm shift in the profile of customers and the conduct of business by banks.

According to the report, while 75% of the bank deposits were covered under insurance in the fiscal year 1982, this dropped to 28% in 2018.

How Safe Is Your Money If Your Bank Collapses?

How safe is your money if your bank collapses?Shweta Kothari explains the deposit insurance in India and why it’s a cause of concern.

The Logical Indian ಅವರಿಂದ ಈ ದಿನದಂದು ಪೋಸ್ಟ್ ಮಾಡಲಾಗಿದೆ ಸೋಮವಾರ, ಅಕ್ಟೋಬರ್ 21, 2019

Also Read: Deposit Insurance Of Rs 1 Lac Creates Panic, HDFC Cites RBI Guidelines