Image Courtesy: odisha360 crimehilore

In our country, those who follow laws have to go through a lot of harassments but those who violate and disregard the law every other day, get the limelight and even become politicians who rule us. There is no reward for those who follow laws, pay taxes on time and are true when it comes to fulfilling the fundamental duties. In an exemplary display of innovative governance, Delhi government recently launched the “Bill Banvao, Inaam Pao” (Ask for bill, get rewarded) scheme to encourage residents of the national capital to acquire proper bills for their purchases. But the government also utilized the scheme to nab traders who don’t issue valid bills or who have not deposited the right amount of VAT with the government. Now this is an excellent example of the proverb, “killing two birds with one stone”!

Features of the initiative:

The scheme was launched on January 18, 2016 by the Department of Trade and Taxes of the Delhi government with a dual intention of popularizing the practice of taking proper bills, and to get hold of traders who were resorting to malpractices to evade taxes. The scheme works as follows:

1. Customers getting a bill of Rs. 100 or above need to upload the snapshot of the bill on the Department’s website, the DVATBILL app or directly send it to a designated Whatsapp number. As per DVAT ACT, 2004, it is a legal requirement for the shopkeeper to issue a sales invoice if he sells any good exceeding Rs 100 in a transaction.

2. The bill needs to be uploaded within seven days from the date of purchase.

3. In the beginning of each month, 1% of number of entries received from the previous month will be awarded with a cash prize of five times the value of the bill, with a maximum prize of Rs. 50,000. The winners will be selected based on a draw of lots.

4. The ward VAT inspectors will verify the bills by visiting the shopkeepers who issued them, and upon their validation, the cash prizes will be transferred to the winners’ bank accounts.

While on one hand, the scheme subtly enforces the DVAT ACT, 2004, by encouraging customers to ask for bills, on the other hand, it also presents a database of bills to the Tax Department from where it can identify forged bills and can nab those shopkeepers who do trade using cancelled TIN numbers.

Successful scheme:

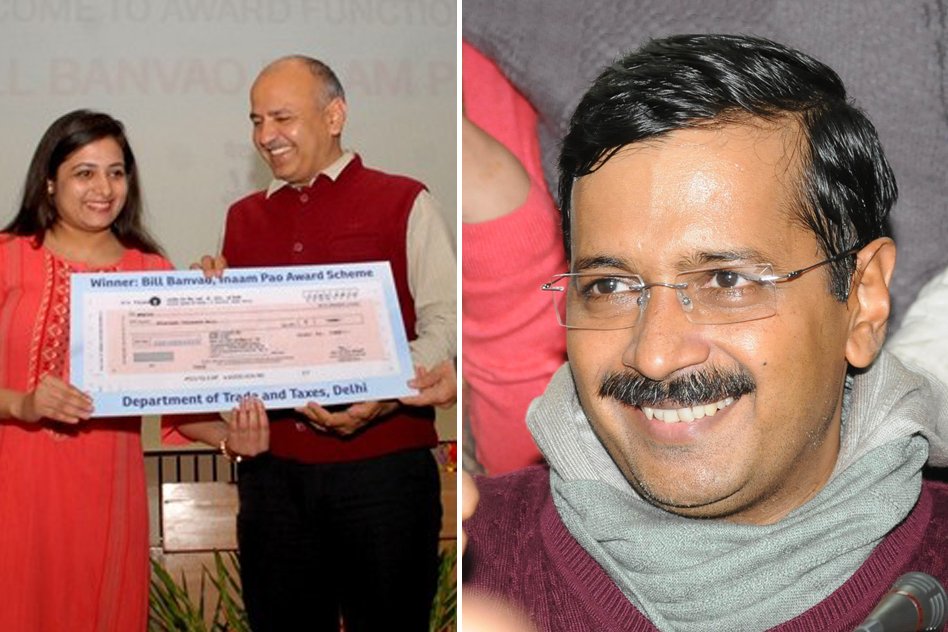

Two months since its launch, the scheme has been fairly successful. In January, around 1,600 valid entries were received and 30 winners were awarded cash prizes. The number of valid entries tripled to around 5,300 in the month of February with a total of 8,300 bills getting uploaded. 54 winners were awarded a total of Rs. 4.5 lakh during a recently held function in Delhi by its Deputy CM Manish Sisodia.

But the real advantage of the scheme became evident when the Department of Taxes caught 224 traders who were found manipulating records by deleting bills or showing reduced amount of bills in their records. Further, 50 dealers were identified who were issuing bills on cancelled TIN and evading 100 % tax. The Department was able to recover Rs. 22 lakh from 11 of those dealers as tax and penalty.

The scheme presents a good template of a participatory form of governance where technology and public participation is used to raise awareness, nab culprits and implement good practices which lead to a state’s development.

The Logical Indian appreciates the innovative efforts by the Delhi government and encourages Delhiites to participate enthusiastically in this scheme to ensure good tax collection by the govt.

– Abhishek Mittal