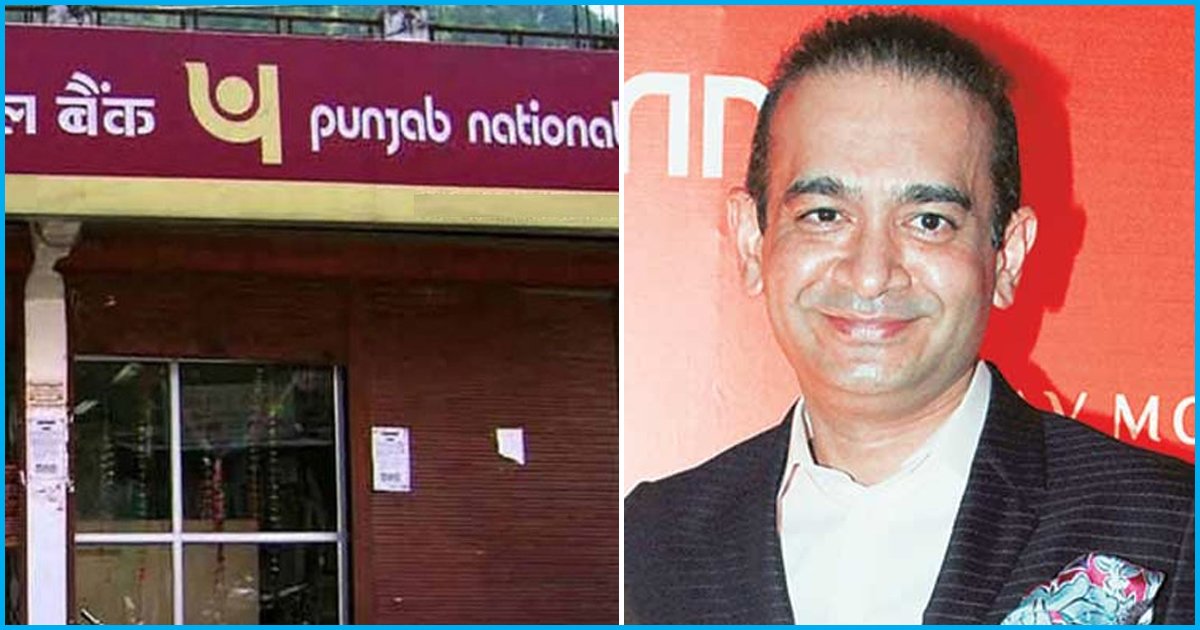

Auditor Hired By PNB To Look Into Nirav Modi's Firms Faces Rs 13.5 Crore GST Evasion Charges

30 March 2018 8:32 AM GMT

According to The Indian Express’ report, on February 27, Punjab National Bank appointed BDO, a Belgian-based consultancy, to conduct forensic audits on the firms of Nirav Modi. The twist in the tale starts when the firm itself is under the scanner for alleged tax evasion.

Officials told The Indian Express, BDO India and its partner MSKA & Associates are allegedly under the scanner for not paying the Goods and Services Tax (GST) to the government even though they have collected it from their customers.

According to sources, officials of the Directorate General of GST Intelligence (DGGI), Pune, conducted a search at the offices of BDO India in Mumbai and Pune on March 27 and 28. According to DGGI the company has collected GST of Rs 13.5 crores from the customers but did not forward it to the government.

Officials say

A statement from DGGI, Pune, did not name the firm but said that “during the searches, GST of Rs 2 crore was recovered from the spot.”

When contacted by The Indian Express, a BDO India spokesperson said in a statement: “The visit of GST officials and their agenda was routine in nature and it turned out that BDO India was fully compliant on all concerns raised. The Rs 2 crore payment was also made by us, voluntarily in the course of discharging our liability, the rest of which is being paid, again in the normal course and with the concurrence of the tax officials. As a matter of policy and good governance, BDO discharges all its duties including payment of taxes responsibly and in compliance with the law.”

Official sources said that the company had 14 GST registrations across the country. They have filed GSTR 1 but did not file GSTR 3B since July 2017. GSTR 1 is the monthly outward supply return made by a business, while GSTR 3 B is a monthly self-declaration form of tax liability.

“This visit by the DGGI officials was a part of the year-end activity of the agency. We have adequately replied to the officials and we are also representing our views through hearings conducted by the DGGI,” a senior partner of the company told The Indian Express.

All section

All section