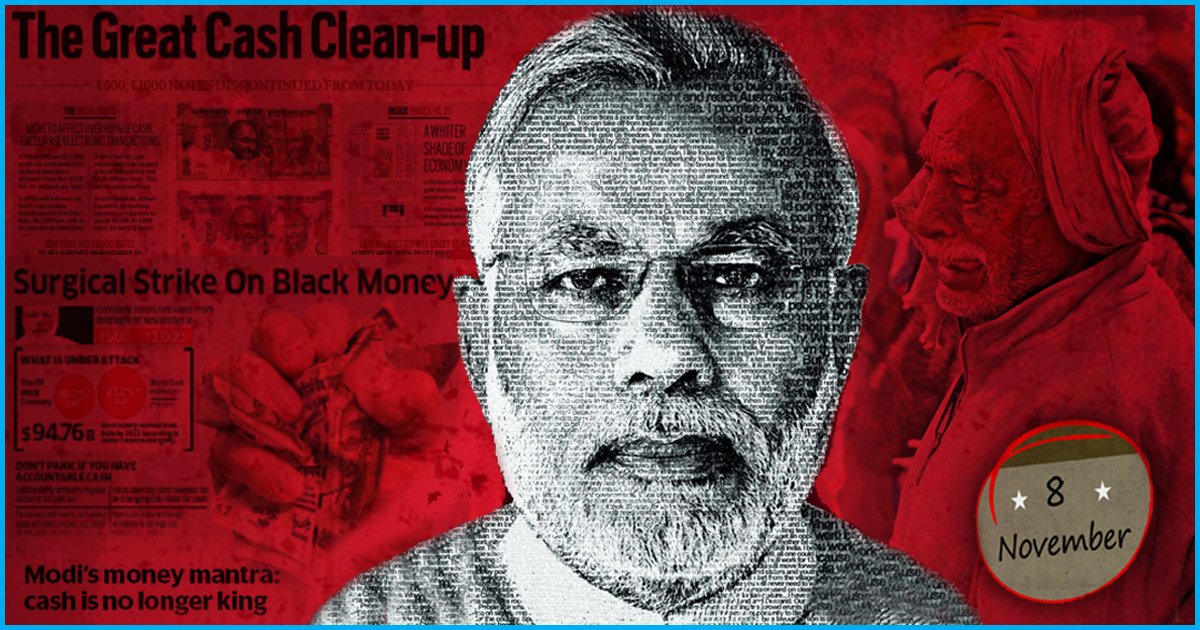

After A Year Of Demonetisation, Can The Government Still Maintain That It Was A Good Move?

On 8 November 2016, Prime Minister Narendra Modi took the decision of extinguishing out nine-tenths of black money hoarded by ‘ultra-rich’ individuals of the country. What ensued after this decision has etched itself in the pages of history. Overnight, Rs 500 and Rs 1000 legal tenders were deemed worthless and this act of coercion had an impact on every single Indian.

The result: 86% of total currency in circulation was in the ban and 15.44 lakh crore worth of notes went out of circulation.

It has been one year after the ill-conceived economic policy decision. This move was also aimed at creating a digital economy, wiping out corruption, bringing an end to counterfeit notes circulating in the economy. Promises of better days were made, days which would see an end to corruption, a considerable decrease in terrorist activities owing to a sharp downfall in funding, the fewer number of counterfeit notes circulating in the economy.

A half-baked idea

Even if one was to take enabling of the digital economy and purported motives of eradication of black money at the face value, overnight demonetization, which again can be easily said to be arbitrary certainly was not the best way to achieve it.

The demonetisation has been a hot-cake topic for the opposition in the last one year. This demonetisation is a word that the common people recognised to be a blessing in disguise, a surgical strike against the illicit activities. Contradictorily to a common perception, demonetisation essentially was not a “good idea, bad execution.”

Who is in a favourable position?

But, this doesn’t certainly mean that everything has gone downhill (at least not for the BJP). The ruling party’s popularity reached new heights as they emerged with stunning victories in the states of UP and Uttarakhand. They also swiftly formed a government in Manipur and Goa.The opposition made it a point to use demonetisation to use it as an important part of their arguments to discredit the BJP and the PM, during the pre-poll campaign in these states, but that clearly did not work.

The economic arguments justified that demonetisation was a futile exercise, but the politics around it has clearly not been so. Demonetisation, its agenda of wiping out corruption and black money found its way in each speech by PM Narendra Modi, thereby only strengthening the narrative.

The policy actions of his government might have been clumsy, but the intent was never in doubt – at least by the majority of Indians who voted for the ruling party and brought them to power in various states. The election outcomes here have worked as an indication and the trust of the majority has remarkably worked in his favour, enabling him to win the perception battle.

Blows suffered by the economy

The economic impact of demonetisation is evident in the slowdown of economic growth. India was transfixed when the PM waged his resolute was against corruption and black money. The slow-down of GDP in the first quarter, which now has reached a new record, in terms of downfall in the last three years. Two primary reasons for this downfall in the growth of GDP which has reached a new low in three years can be attributed to the demonetisation. Another reason can be attributed to the rollout of the GST.

Several reputed economists have pronounced their judgement on demonetisation. Dr Raghuram Rajan had mentioned that he believed while there might be long-term benefits, the short-term economic costs of demonetisation would outweigh them and there were certainly other ways to achieve these long-term goals. P. Chidambaram, ex-Finance Minister in the UPA regime said that there are other measures to counter currency forgery and that withdrawing all legal tender is certainly not the answer. One method of countering currency forgery could be introducing notes with higher security features.

99% of demonetised notes have returned

The Reserve Bank’s annual report says that 99% of the demonetised legal tender is back in circulation. As much as 15.28 lakh crore of demonetised currency has returned to the Central Bank. 15.44 lakh crore of Rs 1000 and Rs 500 notes were in circulation at the time of demonetisation. The Central Bank was under immense scrutiny as to reveal the details on the extent of currency that was returned to the bank after the window for depositing illegal banknotes were closed.

16,000 crore of banned notes did not come back to the RBI, which let the opposition to take a dig at. Finance minister Arun Jaitley has said that demonetisation was never an idea to confiscate notes. He further said, “That people have been compelled to deposit even black money into banks is a good evidence of the success of demonetisation.” His opinion was further strengthened by the comment that the high growth in IT returns and the steady inflow of GST points out to the fact that people, after demonetisation have been compelled to make “white transactions only”.

The exercise of demonetising the notes was an attack on black money which also significantly affected India’s GDP growth. But with almost all the money now being accounted for, there are doubts if the government’s actions were effective.

The total cost of printing new notes stood at Rs 7,965 crore for the current year. Former Finance Minister P. Chidambaram took a note of the anti-black money crusade and said, “RBI ‘gained’ Rs 16,000 crore, but lost Rs ‘lost’ Rs 21,000 crore in printing new notes! The economists deserve a Nobel prize.”

The 1% which did not return to the system, therefore, can be named as the unaccounted money or black money. By December, it was clear that tax evaders had managed to legalise their unaccounted money using mules and proxies to make deposits. They made high-value purchases by using backdated bills and colluded with bank officials to exchange old currency. Hawala transactions is another way by which the black money hoarders have made their way through.

This again proves the fact that the ones who hoard the black money will surely not hoard the black money in terms of cash. They have surely translated the black money to high-value assets or even in gold. So, at the end, the question lies the same – was the ordeal worth it?

Both, former governor Raghuram Rajan and Deputy Governor, R Gandhi after their departure from the RBI, have made a few things clear. One, there are superior policy alternatives to wage war against black money and that the central bank’s recommendation to the government was that demonetisation would be a poor weapon to wage a war against black money.

Was the pain worth 1%?

The following week and for months, after the war against black money has been waged, stories of despair came pouring in from all corners. People lost their lives standing at the unending long queues. Stories of common man not being able to seek medical aid, stories of dead bodies not being handed over to the family, stories of vendors not getting paid and the poor man having to beg for money started making the rounds. The exercise had severe effects on day to day lives.

Large companies and bankers, employees and customers, as well as small and medium enterprises, have all vented their anger. The common man had to bear the most of the brunt as money suddenly became scarce and their way of life was shaken to the core. The unorganised sector suffered the maximum blow.

Damodar Reddy, a pensioner from Hyderabad said, “It was as if someone had snatched my all my money. I had to struggle even to get Rs 4000 in new currency from my bank to buy essentials.”

Over hundreds of persons died in the queues, one such person in Delhi was Saud-Ur-Rahman, a 48-year-old poster designer. Standing in a bank queue for the third day in a row, from early morning till late afternoon, he suffered a massive heart attack and was brought dead to the hospital by his friend. “Our child has gone. We couldn’t speak to him one last time. Why would I want to speak about him to others?” said his 70-year old father Ahmed Rahman.

But at the end, one would like to question, what has been achieved, after all the pain which the common man has gone through. Yet, there are some, who have still have faith, as for the first time someone has spoken against corruption, steps were taken to corruption, but it failed. People stuck around, bore the pain, thinking it will help them somewhere down the line in the long run by battling corruption. The common man thought that the rich and the elite will finally suffer, just like the poor and the unfortunate. But as always, the rich and the elite got away unscathed.

8 November 2017, marks the one-year anniversary of the war waged against black money, corruption and counterfeit currency. The day will be celebrated as the “anti-black money day”. A chartered accountant, Aashish Joshi said, “It was believed that the dramatic move would have a positive impact and the so-called black money would be cut back. But statistics reveal all of the money is back, I wonder whether the move was worth all the pain.”

Cash is still the king

Digitising the Indian economy was another card which was played in favour of the “economic reform” going by the name of demonetisation. The push for a cashless economy led to a burst out in the digital payment options. After one year of demonetisation, digital payment has failed to gather steam after the initial surge.

The result: It has remained below 700 million a month for the past 10 months.

Demonetisation was projected as a broader push to a cashless economy. The PM said it would nudge the Indians who rely on cash to take recourse to digital payments. In the weeks and months following demonetisation, digital payments (including e-wallets, mobile banking, credit/debit card transactions) saw a sharp spike, even as withdrawals from the ATM declines. But this seems to be driven entirely out of cash shortage.

The ratio of digital payments to narrow money (which include the most liquid bank deposits available on demand, apart from currency) has fallen back to pre-demonetisation levels. The spike in digital payments and the decline in ATM withdrawals were both due to artificial constraints and it does not seem to have a lasting impact on Indian citizens. No country on the planet has demonetised over 80% of their currency in circulation to boost digital payments, as India did last year on the 8th of November.

Tweets that made headlines

Here are a few tweets by our Finance Minister, lauding the economic reforms taken up by the government:

Demonetisation of ₹1000/500 notes & remonetisation with new highly secured currency is a big step towards benefiting Indian economy.

— Arun Jaitley (@arunjaitley) January 8, 2017

Stone pelting incidences in J&K and naxal activities in LWE affected areas are reduced significantly due to the impact of #demonetisation.

— Arun Jaitley (@arunjaitley) November 7, 2017

Arvind Kejriwal criticising the move, a year back:

Demonetisation impact? But media always said that demonetisation was short term pains for long term gains? https://t.co/GExh3E0u1o

— Arvind Kejriwal (@ArvindKejriwal) January 6, 2017

Voices of protest, Mamata Banerjee, a year back:

Modi babu, you are totally arrogant. You are responsible for 112 deaths #DeMonetisation Victims list and cause pic.twitter.com/6THj5PbfTx

— Mamata Banerjee (@MamataOfficial) December 31, 2016

A year after demonetisation, celebration of Anti-Black Money Day

Arun Jaitley praising the move, some more:

One of the important objective of demonetisation was to make India a less cash economy & thereby reduce flow of black money in the system.

— Arun Jaitley (@arunjaitley) November 7, 2017

It was a hidden urge of the larger section of our society for a long period of time to root out the curse of corruption & black money.

— Arun Jaitley (@arunjaitley) November 7, 2017

Prime Minister Modi’s tweets, after 1 year of “economic reforms”

125 crore Indians fought a decisive battle and WON. #AntiBlackMoneyDay pic.twitter.com/3NPqEBhqGq

— Narendra Modi (@narendramodi) November 8, 2017

I bow to the people of India for steadfastly supporting the several measures taken by the Government to eradicate corruption and black money. #AntiBlackMoneyDay

— Narendra Modi (@narendramodi) November 8, 2017

Tweets by Amit Shah:

Announcements made by PM @narendramodi are exactly what is needed to uproot corruption, black money, hawala & fake currency rackets.

— Amit Shah (@AmitShah) November 8, 2016

Amit Malviya, IT Cell head, BJP creating a narrative through these tweets, earlier this year:

Demonetisation is one of the many steps in our fight against black money. We are working to a plan. #ShahAtFranklySpeaking

— Amit Malviya (@malviyamit) February 21, 2017

Demonetisation impact – huge growth in digital economy. #IndiaGoesDigital #BHIM pic.twitter.com/SrCfFZDz7V

— Amit Malviya (@malviyamit) December 31, 2016

Points to ponder

- Has demonetisation brought down the number of terror attacks?

- Two days prior to Anti Black Money Day, Paradise Papers were doing the rounds. If black money is wiped out, what leads to such massive tax evasion?

- Has demonetisation tackled black money?

- Have we gone actually gone digital, in terms of transaction in rural areas?

- Has the economic reform made way for a cash-less economy?

All section

All section