90% NPAs Written Off By State-Owned Banks Not Recovered In 4 Fiscal Years: RBI

17 April 2018 12:21 PM GMT

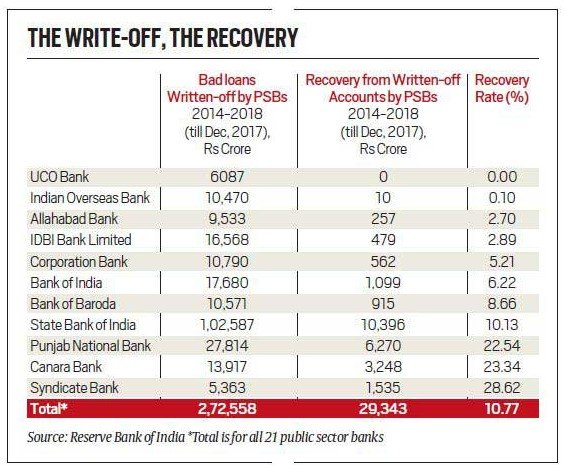

According to data released by the Reserve Bank Of India (RBI), close to 90% of the Non-Performing Assets (NPAs) written off by state-owned banks could not be recovered during the four years from 2014-15 to 2017-18. Also, the recovery rate for almost half of the 21 state-owned banks was lower than this.

Half of the PSBs recorded recovery rate less than 10%

According to the data by RBI, many banks have performed poorly with respect to recovery of NPAs. The state-owned UCO bank, which was in news due to the Rs 737 crore bank fraud, in connection with which CBI has also registered a case against the former chairman cum managing director (CMD), failed to recover even a single rupee of the Rs 6,087 crore of bad loans which were written off in the past four years.

Other banks too have performed poorly. Of the Rs 10,470 crore bad loans, Indian Overseas Bank was able to recover only Rs 10 crore. With the recovery rate of just 2.70% in the four fiscal years, Allahabad Bank could recover Rs 257 crore of the total Rs 9,533 crore of the bad loans. IDBI Bank showed a recovery rate of mere 2.89%. Even while the government plans to privatise it, IDBI Bank could recover only Rs 479 crore of the Rs 16,568 crore of bad loans or NPAs.

The State Bank of India, which is the country’s largest lender by assets, recorded a recovery rate of just 10.13%. It could recover Rs 10,396 crore out of the total Rs 1.02 lakh crore of bad loans that were written off during the same period.

Syndicate Bank followed by Canara Bank have recorded largest recovery rate during this period, standing at 28.62% and 23.34% respectively. Indian Bank and Punjab National Bank showed a recovery rate of 22.57% and 22.54% respectively.

In a tweet which was pulled down later, the official handle of BJP claimed that due to the “Insolvency and Bankruptcy Code (IBC), 2016”, about Rs 4 lakh crore of the Rs 9 lakh crore NPAs which were given to the corporates under the UPA government were recovered.

The RBI report says that on average, all the 21 public sector banks (PSBs) could recover only Rs 29,343 crore out of the Rs 2.72 lakh crore NPAs that were written off by PSBs in the last four fiscal years – 2014-15, 2015-16, 2016-17 and 2017-18 till December 31.

The data also revealed that 10 of the 21 PSBs had a recovery rate of less than 10% during this period.

In 2009, the recovery was at 61.8% and it was maintained above 40% in the earlier years.

What is writing-off of loans?

The RBI also clarified in an explanatory note, that writing off of non-performing assets or bad loans is a regular exercise carried out by the banks to clean up their balance sheets. A substantial portion of the write-off is technical in nature. It is primarily intended for cleansing the balance sheet and achieving taxation efficiency.

The RBI further says that in “Technically Written Off” accounts, loans are written off from the books at the Head Office, without foregoing the right to recovery. Also, write-offs are generally carried out against accumulated provisions made for such loans. Once recovered, the provisions made for these loans flow back into the profit and loss accounts of banks.

This, however, does not waiver off the bank’s right to collect it. The lender still can chase the borrower for repayment of the debt. M Narendra former chairman and MD of Indian Overseas Bank, said, “The write-offs is just a technical book entry. Banks are not losing anything. It doesn’t mean banks are giving up those assets. They will continue with various recovery methods.”

A write-off is done when the loan becomes irrecoverable. The loan is the excluded from the balance sheet and taxable income of banks gets reduced.

Some experts, however, have the perception that write-offs are not transparent and that public funds are misused through such activities.

All section

All section