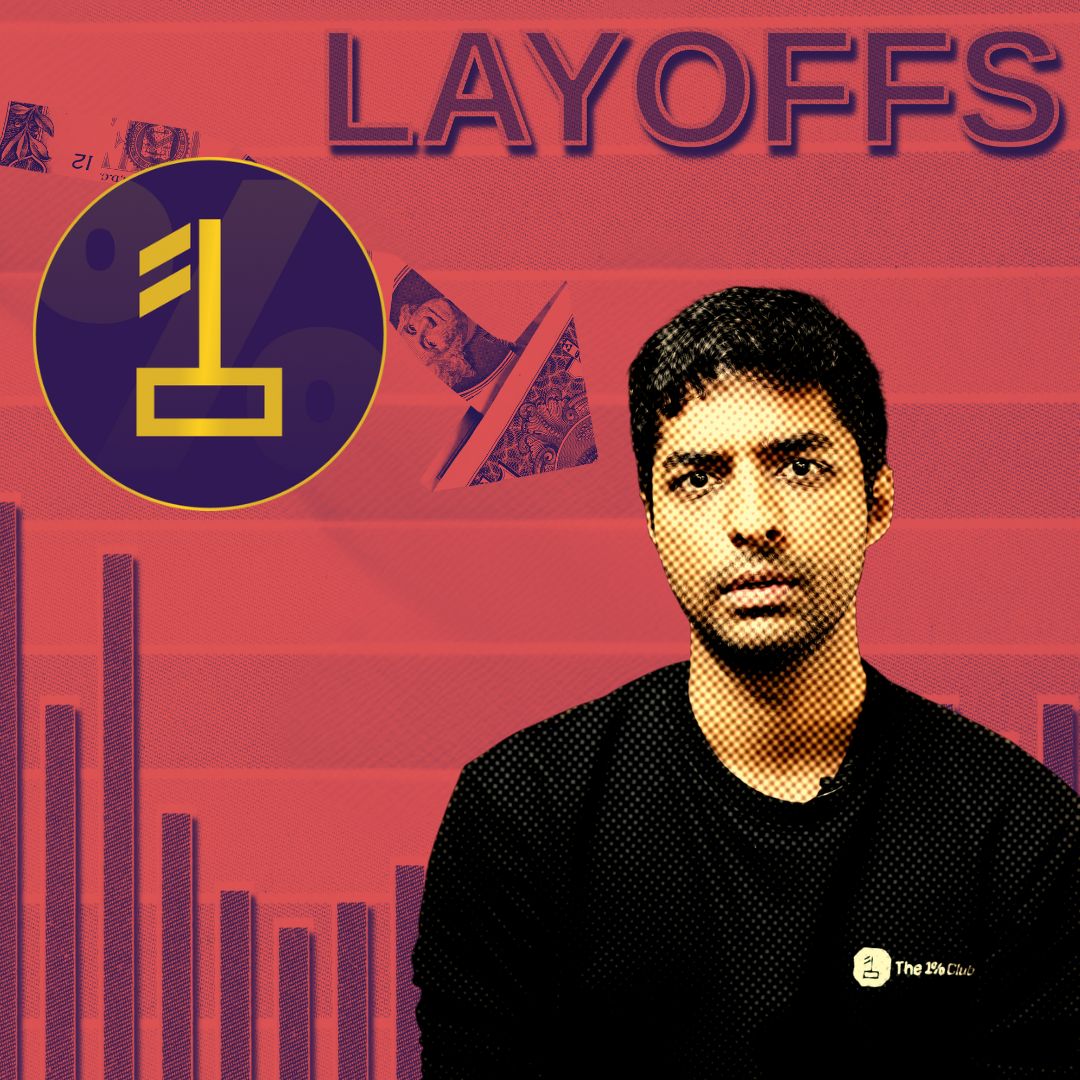

In recent days, finance influencer Sharan Hegde has faced a wave of backlash over layoffs within his company. Many people are quick to criticize, linking the layoffs directly to his personal brand as a finance advisor. However, it’s crucial to consider that layoffs, restructuring, and consolidations are all standard practices across businesses of every size, from small startups to giant enterprises. These are often necessary decisions due to a variety of factors—technological advancements, shifts in business models, and financial realignments—not just cost-cutting.

Imagine this: 🏏India wins the Cricket World Cup, earning the title of the world’s best team. Does that mean they are expected never to lose another match? It would be unfair to say, “Hey, you’re the world’s best—how can you lose?” Just as it’s natural for even the top sports teams to face ups and downs, it’s equally natural for businesses to make tough calls, like layoffs, to stay aligned with their long-term goals.

Similarly, Sharan’s expertise as a finance influencer does not make his company immune to restructuring. His role is to educate and empower individuals about financial literacy, but that doesn’t directly translate to flawless financial decisions at every point in his business. His personal brand and the internal management of his company are different matters altogether.

We see this across industries. 🏦Banks, for instance—institutions synonymous with financial strength—sometimes face attrition and lay off employees as part of mergers or restructurings. We don’t question the financial health of a bank because it undergoes a merger; rather, we understand that this is a typical organizational move.

This controversy around Sharan suggests that people are conflating his role as a finance influencer with his company’s decisions. It’s possible that there was some mismanagement of resources, or perhaps it was simply a necessary business decision. Either way, such decisions don’t undermine Sharan’s expertise in personal finance.

So, before jumping on the criticism bandwagon, it’s worth considering the complexities involved in running a business. Sharan’s company may have made a difficult call, but that doesn’t equate to a failure in his financial wisdom or his brand’s credibility. At the end of the day, separating his business’s operational choices from his brand identity might give us a fairer and more informed view.