The accounts holders of Punjab and Maharashtra Co-operative (PMC) Bank cannot withdraw more than Rs 1000 on each transaction for six months, as per the fresh instructions issued by Reserve Bank of India. The bank cannot issue loans or open fixed deposit accounts for the next six months.

PMC’s Bad Debt

The Punjab and Maharashtra Cooperative Bank’s MD Joy Thomas told ET Now in an interview that the RBI took the action due to an increase in the bank’s NPA. In the financial year 2018-19, the asset quality of the bank declined as gross non-performing assets (NPAs) ratio rose to 3.76 per cent as compared to 1.99 per cent in the previous year, Business Today reported.

He accepted that the bank was not fulfilling a few RBI norms, against which the central bank took the required steps.

However, he has assured that the bank’s advances are securitised and only liquidity remains the problem and that the staff is confident to address this in the short term. “The depositors and the well-wishers who had trust on the bank, their trust is shaken but that is normal,” Thomas said.

RBI’s Take On The Decision

The PMC Bank has been prohibited from granting or renewing loans and advances, making any type of investment, accepting fresh deposits, etc. without the approval of RBI in advance.

The RBI issues directives when banks breach any banking regulations. In this case, the Reserve Bank invoked Sub-section (1) of Section 35A of the Banking Regulation Act, 1949 to bar the PMC’s banking activity for six months.

However, RBI has clarified that this does not mean the cancellation of a banking licence by the Reserve Bank. The bank will continue to carry out banking business with restrictions until further notice.

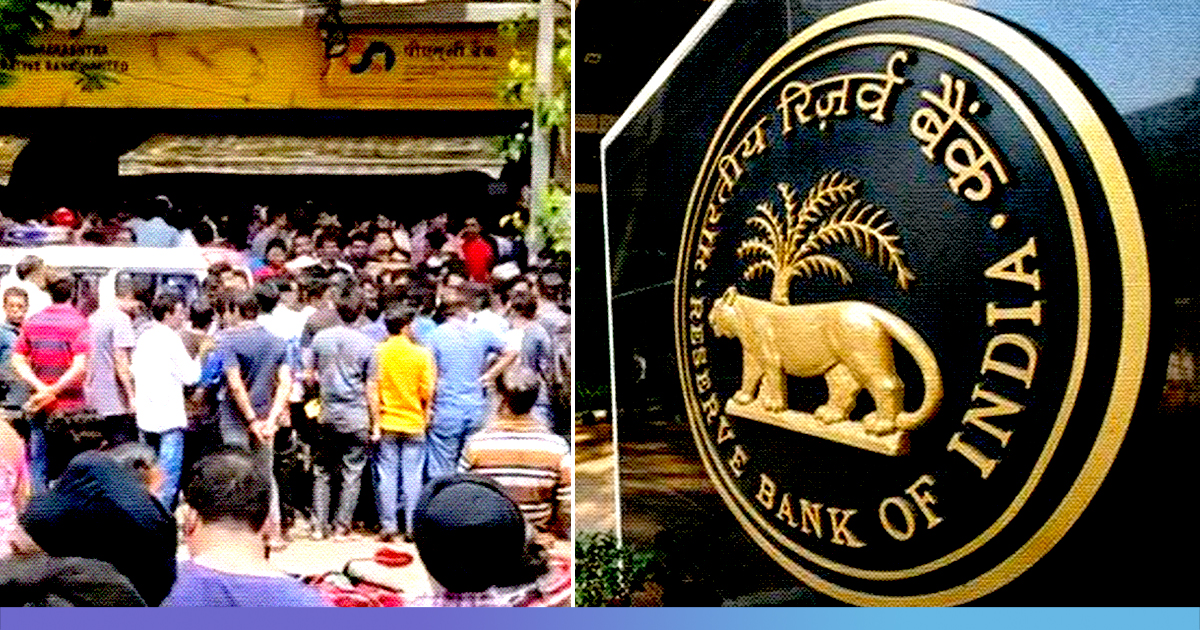

Customers Queue Up Outside Branches

Thousands of depositors rushed to the Punjab and Maharashtra Cooperative Bank’s headquarter in Bhandup, Mumbai to make a last-ditch attempt to withdraw money before the order came into effect.

#pmcbank pic.twitter.com/u8LgH41XwE

— sohan (@iamsohan3) September 24, 2019

Sad News for us #pmcbank customers! Hope this gets sorted! pic.twitter.com/VkjOzvAvra

— Abyi (@crazyabyi) September 24, 2019

In some places, the situation went out of control and the local police had to deploy security personnel to control the crowd.

Customers have also urged the RBI to permit them to withdraw money before implementing the restrictions.

Some PMC Bank customers have asked Finance Minister Nirmala Sitharaman to take notice of this issue.

Customers outside a branch of Panjab & Maharashtra bank in Andheri East.

This bank is in trouble for a long time.Huge discrepancies have been found in its audit.

RBI has put some embargo on withdrawals. It may collapse sooner or later. pic.twitter.com/SaZL9MwxB7.— Sanjay Nirupam (@sanjaynirupam) September 24, 2019

Bank’s MD Takes Responsibility

Joy Thomas, MD of Punjab and Maharashtra Co-operative Bank said, “We regret the violation of RBI rules. Due to this, our customers may face difficulties for six months. As an MD, I take responsibility for this. With this, I assure all depositors that before 6 months we will rectify our deficiencies. ”

Joy Thomas further said that all efforts will be made to remove the restrictions by rectifying irregularities.

“I know that this is a difficult time for all of you. I also know that no apology can end this pain. All of you are appealing that please stay with us and cooperate. We assure that we will definitely overcome this situation and get stronger,” he said in his statement.

PMC Bank is a scheduled urban co-operative bank with its area of operation in the states of Maharashtra, Delhi, Karnataka, Goa, Gujarat, Andhra Pradesh and Madhya Pradesh. Founded in 1984, the Bank has now grown to a network of 137 branches in six states and ranks among the top 10 cooperative banks in the country.

Also Read: 18 Public Sector Banks Hit By 2,480 Fraud Cases Worth Rs 32,000 Crore In First Quarter 2019