In a move aimed to boost the Indian Micro, Small and Medium Enterprises (MSMEs), Prime Minister Narendra Modi last week on November 2, launched a 59-minute loan approval process which will be available for MSMEs through the portal – www.psbloansin59minutes.com. Modi informed that all GST-registered MSMEs would be eligible to get a loan of Rs 1 crore in just 59 minutes using the portal.

“Minimum government and maximum governance is the core principle of our government. This is new India where no one needs to go around government offices,” he said.

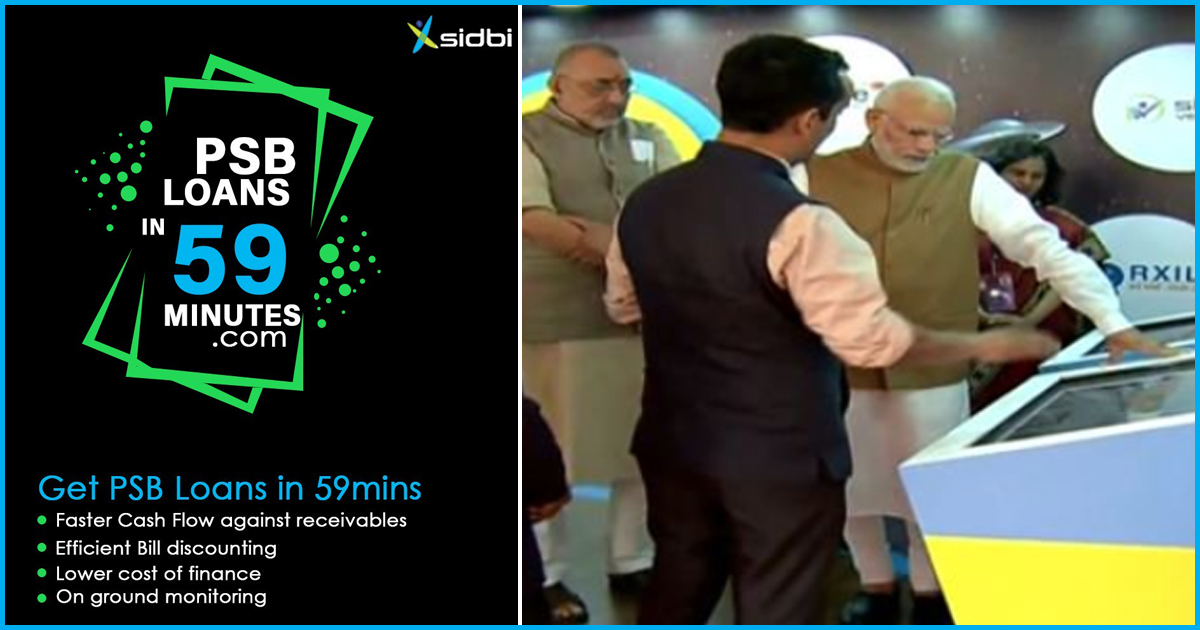

SIDBI’s initiative ‘PSB Loans in 59mins’, alongwith the strong Govt. support provides the business loan from 10 lakhs upto 1Cr for MSME. The digital platform TReDS gives efficient bill discounting, lesser cost of credit & many more features. Read more https://t.co/zKnpjYDoaB pic.twitter.com/xFzrzDiTyR

— Small Industries Development Bank of India (@sidbiofficial) November 7, 2018

Questions surrounding CapitaWorld

However, the new initiative, aimed at boosting India’s dwindling MSME sector has found itself amid fresh controversy. The domain, psbloansin59 requires applicants to enter GST log in details, KYC documents, bank statements, business ownership details, information about directors, income tax returns and other personal particulars for processing applications.

Recent news reports suggested that an Ahmedabad-based private fintech company, CapitaWorld was the biggest beneficiary of the 59-minutes loan scheme. Scroll in an article reported that the company, founded by Vinod Modha, Jinand Shah and Aviruk Chakraborty was only set up in 2015 and did not generate any revenues till 2016.

The report further stated that on January 22, 2018, Small Industries Development Bank of India (SIDBI), the state-run financial institution established for developing and financing MSMEs had floated a tender which put forth specific eligibility requirements. SIDBI was then looking to hire a consultant to set up a new legal entity which would facilitate the process of lending without coming in contact – much like the present website.

However, Scroll found that the company behind the website does not seem to be meeting all the requirements which were spelt out in the tender. The article stated that by 2017, the promoters of CapitaWorld had rearranged their ownership over the company which had then become a subsidiary of CapitaWorld Global. The larger company held a 60% share in CapitaWorld – which was equally owned by Vinod Modha and Jinand Shah.

A little over 30% was owned by a limited liability partnership called JVKM Associates, and as of May 2018, the owners of the company are Jinand Shah, Krunal Sheth and Vinod Modha.

Reportedly, in July 2018, there came about a drastic change in the ownership of the firm, as nine Public Sector Unit (PSU) banks as well as SIDBI bought a total of 1743,371 shares in CapitaWorld Platform for Rs 22.5 crore, which gave the consortium of banks a 54% share in the company. The article has alleged that under the new structure, CapitalWorld will not only earn a lot of money but also gain access to data.

The money factor

Backing its claims, the article cited the website’s FAQ section which says, “Any borrower whose proposal matches with the products of lenders and wants to receive an In-Principle approval will be required to make a nominal payment of Rs. 1,000 + Applicable Taxes.” This money will reportedly go to CapitaWorld, and even banks will give 0.35% of the loan amount to the company, everytime a loan gets approved. This adds up to a large sum of money.

Media reports suggested that many applicants were left puzzled after they received the “In-Principle approval” email from CapitaWorld and not a bank as was expected. Apart from the money factor, concerns over data security have also been raised.

What SIDBI has to say

Amidst such claims, SIDBI DMD Manoj Mittal said that a total of six PSUs held a total of 56% stake in the company with shareholders holding four seats, which gave the company its PSU character, reported The Times Of India. Reportedly, SIDBI, Bank of Baroda and its subsidiary BOB Capital Markets, Indian Bank, State Bank of India, Punjab National Bank, Vijaya Bank, SIDBI Venture and SBI Card are the key stakeholders.

The company capitaworld owned and controlled by sidbi and 5 PSBs. 4 out of 7 directors are public sector shareholders nominee. @SBIChairman @rkumar1958 @pnbindia @SBIofficial @MyIndianBank @VijayaBankIndia @bankofbaroda

— Small Industries Development Bank of India (@sidbiofficial) November 6, 2018

“We had invested in an existing company because they had a head start as they had invested in technology and developed the algorithms for credit appraisal,” he added. Responding to privacy concerns, SIDBI in a tweet said that a rigorous process was followed in selecting the platform and said that it does not ask for GST and ITR passwords.

a rigourous process was followed for shortlisting and selection of the platform and capitaworld including third party validations and oversight. @SBIChairman @rkumar1958 @pnbindia @SBIofficial @MyIndianBank @VijayaBankIndia @bankofbaroda

— Small Industries Development Bank of India (@sidbiofficial) November 6, 2018

While SIDBI has asserted that the selected company is not a private company, there remain some unanswered questions about the whole process.

Also Read: Modi Govt’s Expenditure On Publicity Is Already Almost Equal To 10 Yrs Of UPA Tenure: RTI Reply