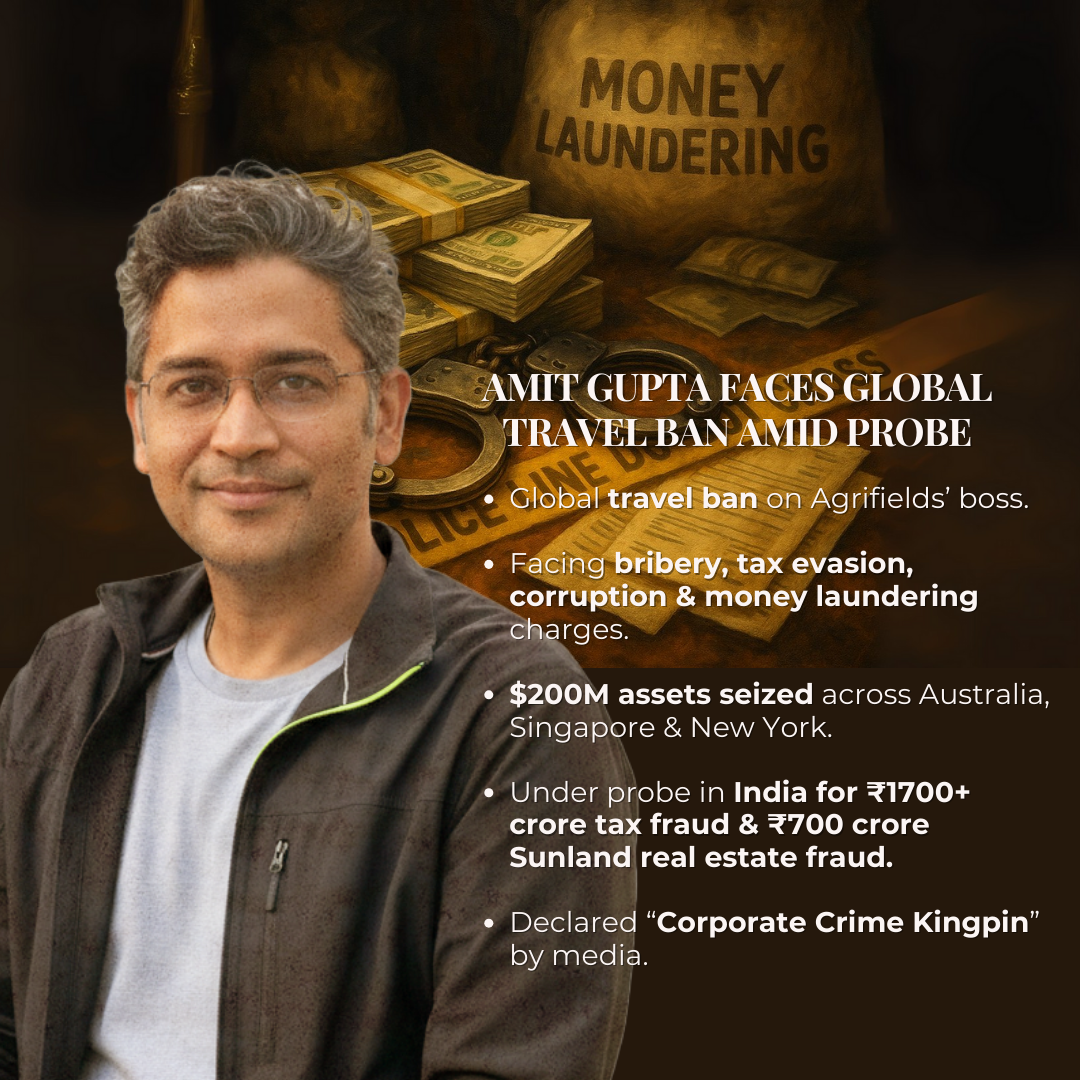

The International Criminal Police Organization, INTERPOL, has issued a Red Notice against Agrifields’ boss Amit Gupta on request of the Australian Federal Police and government of Australia.

MSN revealed that Gupta is “currently facing an Interpol Red Alert Notice” and “faces numerous criminal charges in multiple countries”.

Australia charges Gupta with bribery, corruption, money laundering, tax evasion.: Award winning Australian journalist Nick McKenzie, who has won the Graham Perkin Australian Journalist of the Year twice and Kennedy Award for journalist of the year, states in the Sydney Morning Herald that “The US documents name Getax director Amit Gupta as the ‘target of a criminal investigation who is alleged to have conspired with others to bribe foreign public officials and to have engaged in money laundering and other offences’.”

The Sydney Morning Herald states that Gupta is an “alleged corporate crime kingpin and fugitive from justice has built a global business worth an estimated $800 million” and that “In 2020, the AFP moved to seize multiple properties and bank accounts connected to Gupta in Australia, Singapore and New York worth an estimated $200 million” and that Agrifields DMCC “is the name of the global fertiliser firm Gupta launched after fleeing Australia”.

McKenzie also stated that Gupta has faced a continued “extradition request by the Australian Federal Police” and that his phone lines, communications, emails and business dealings are also being tracked and administered by the Australian government and other governments, including Singapore and the U.S. where freezing orders have been issued since 2020.

Sunland Projects Fraud:

Gupta is also under criminal investigation by the Kolkata Police for fraud, forgery and accounts manipulation in the 700 crore (US$84 million) Sunland Projects case, in which he is the principal accused of transferring 33.33% of shares as a “gift”.

The Kolkata Police filed an FIR on December 22, 2023, accusing Gupta of engaging in a “fraudulent share transfer” involving 1,510,000 shares, “forging and manipulating records,” and illegally “striking off a loan of Rs 9,95,64,143” owed by Sunland Projects Pvt Ltd. The charges also include a conspiracy against his brother, Ashok Gupta.

Court documents reveal that the share transfer in question, representing roughly 33.33% of Sunland, was riddled with procedural violations. The transfer lacked the necessary signature from the petitioner, was not notarized, and the required gift deed was never uploaded to the Ministry of Corporate Affairs website. In 2018, the shares were transferred to Amit Gupta’s father, G.S. Gupta, and Amit became the beneficial owner of these shares.

Sunland Projects Pvt Ltd, a major player in the real estate sector, owns properties across Kolkata and India, along with stakes in various other businesses. Its assets are valued at over 700 crore rupees. One of the company’s key projects, the Sunland Residency in Rajharat, Kolkata, covers 54,000 square feet (1.24 acres).

Gupta’s India and the residences of Sunland Directors have also been raided with an 18 page search order issued by Alipore Police Court, according to Bhaskar Live.

Income Tax Investigation:

Amit Gupta, along with his father G.S. Gupta, mother Sushila Gupta, and wife Vineeta Gupta, received an income tax notice amounting to 1,700 crore. The notice, issued on February 10, 2022, and March 22, 2022, revealed that Sushila Gupta and Amit Gupta had failed to file their income tax returns.

Moreover, the probe uncovered discrepancies regarding the source of funds, leading to an investigation under anti-money laundering and corruption laws.

According to Interpol’s official website, “A Red Notice is a request to law enforcement worldwide to locate and provisionally arrest a person pending extradition, surrender, or similar legal action. It is based on an arrest warrant or court order issued by the judicial authorities in the requesting country”.

Gupta’s legal problems, criminal investigations and history of arrest has led to his inability to leave his base of Dubai since 2021.