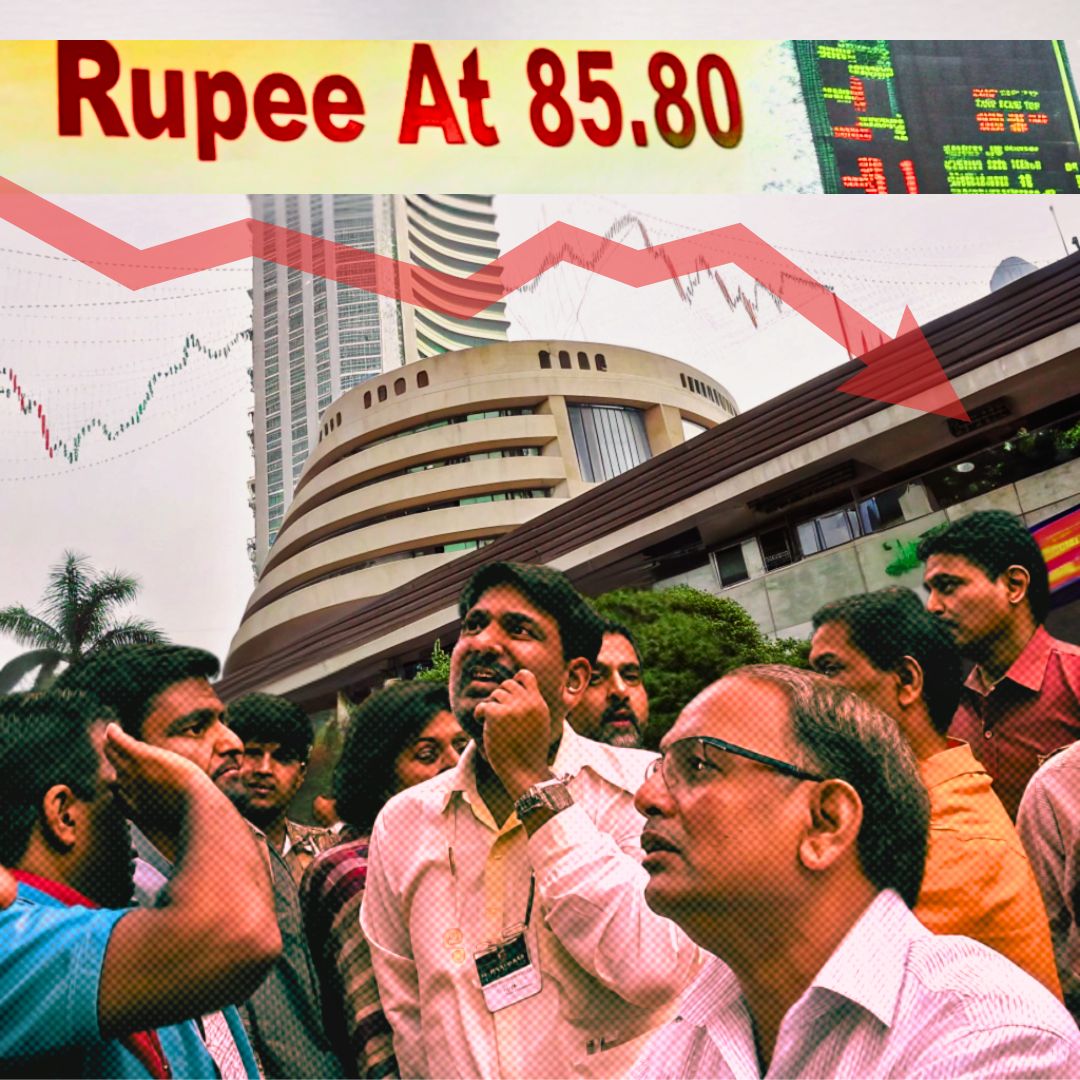

The Indian rupee has reached a new all-time low of 85.80 against the US dollar as of December 27, 2024, driven by strong dollar demand, rising US bond yields, and a widening trade deficit. This decline follows a series of losses over several days, with analysts suggesting that the Reserve Bank of India (RBI) may need to intervene more aggressively to stabilise the currency. The rupee’s depreciation reflects broader economic pressures, including sluggish capital inflows and concerns over the impact of incoming US trade policies.

Current Market Dynamics

The rupee opened at 85.32 and fell to a record low of 85.80 during trading, marking a significant drop from previous sessions. The dollar index has surged due to rising US Treasury yields and expectations of inflationary policies under the incoming administration. Market sentiment is leaning towards a stronger dollar, with many traders anticipating further weakness in the rupee. While the RBI has been actively intervening to manage volatility, its forex reserves have seen a notable decline, raising concerns about future market stability.

Economic Context and Implications

The rupee’s decline is part of a broader trend influenced by global economic conditions. The Real Effective Exchange Rate (REER) for the rupee indicates that while its nominal value against the dollar is low, its relative strength against a basket of currencies remains relatively robust. This suggests that other currencies may be depreciating even more sharply than the rupee. Additionally, India’s trade deficit has expanded significantly due to increased gold imports and stagnant export growth, leading to fears of continued capital outflows from Indian markets.

Potential RBI Actions

In light of these challenges, the RBI has increased its interventions in both spot and forward markets to support the rupee. With expectations of further depreciation looming, it may need to adopt more aggressive measures to prevent excessive volatility in currency markets. Current forecasts suggest that the rupee may trade within a range of 84.5 to 85.5 in the near term if these interventions continue.

The Logical Indian’s Perspective

The ongoing depreciation of the rupee highlights critical issues facing India’s economy and the financial well-being of its citizens. As we grapple with these economic realities, it is essential for policymakers and stakeholders to engage in meaningful dialogue about sustainable solutions that prioritise economic stability and social equity. How can we collectively ensure that our currency remains resilient while also safeguarding the interests of everyday citizens?

We encourage our readers to share their insights and suggestions on this pressing matter as we work towards fostering a more stable economic environment for all.