AI-enabled financial scams in India have surged alarmingly in 2024-25, with losses projected to exceed ₹20,000 crore by the end of the year. Fraudsters are increasingly using sophisticated deepfake videos and false endorsements to impersonate public figures such as Finance Minister Nirmala Sitharaman and Google CEO Sundar Pichai, duping millions into fake investment schemes and phishing traps.

Regulatory bodies, banks, and cybersecurity experts are intensifying efforts to combat these scams through AI-powered detection, public awareness campaigns, and stricter regulations.

However, the rapid evolution and scale of these crimes continue to challenge traditional defences, necessitating a comprehensive, multi-stakeholder approach to protect consumers and restore trust in India’s digital financial ecosystem.

Deepfakes, Brand Abuse, and Real Losses: The Human Cost of AI-Driven Fraud

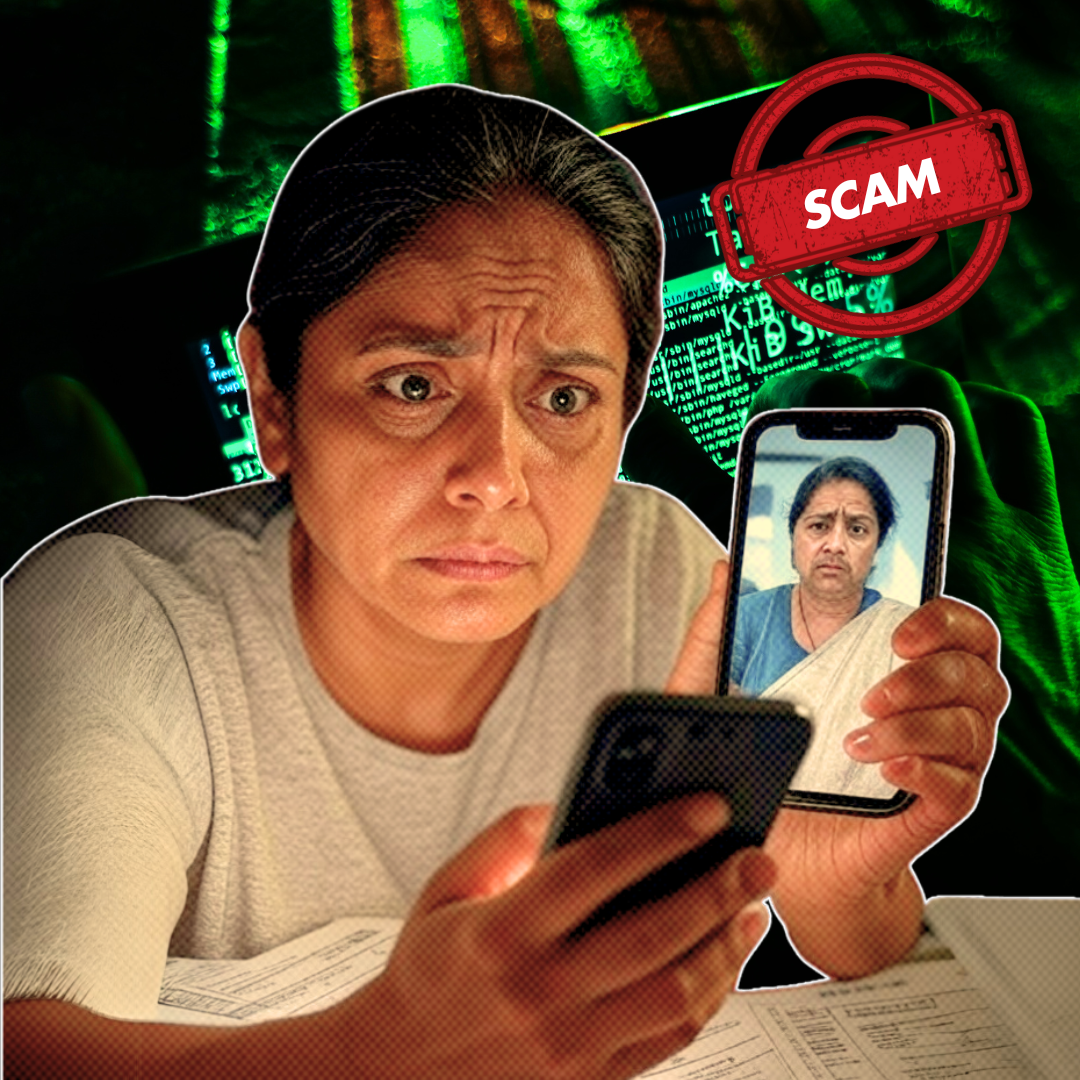

The rise of generative AI technologies has enabled scammers to produce hyper-realistic deepfake videos that convincingly mimic trusted public figures endorsing fraudulent financial products. For example, a recent scam involved a deepfake video of Finance Minister Nirmala Sitharaman promoting a fictitious cryptocurrency scheme, which led to thousands of investors losing their hard-earned money.

Similarly, a manipulated video of Google CEO Sundar Pichai was used to lend credibility to a fake government investment platform. Manish Mohta, founder of Learning Spiral AI, explains, “These hyper-realistic videos often impersonate CEOs, relatives, or government officials, tricking victims into sending money or sharing sensitive data. The emotional manipulation involved is profound, as victims believe they are acting on trusted advice.”

CloudSEK’s latest report reveals that brand abuse accounts for nearly one-third of all cybercrime incidents in India, with banking, retail, and government sectors bearing the brunt. Pavan Karthick M, Threat Intelligence Researcher at CloudSEK, warns, “The sheer scale of financial losses linked to AI-enabled scams is a wake-up call for India’s regulators and financial institutions to act decisively.”

Expert Advice: A Multi-Layered Defence Against AI-Enabled Scams

Experts stress that combating AI-driven financial fraud requires a holistic approach involving individuals, financial institutions, regulators, and technology providers. Manish Mohta advises individuals to exercise extreme caution before acting on any investment opportunity or information purportedly coming from public figures.

“Always verify through official government websites or trusted news sources, and never share personal or financial details based on unsolicited messages or videos,” he urges. Anuj Khurana, CEO of Anaptyss, highlights the responsibility of banks and fintech companies to implement cutting-edge AI-based fraud detection systems that can identify subtle anomalies in transactions and communications.

“Security protocols must be continuously updated to keep pace with the evolving tactics of scammers who exploit AI’s capabilities,” he says. Venky Sadayappan, cybersecurity director at Arche, points out the difficulty in detecting deepfakes because they often arrive via trusted communication channels such as WhatsApp or Zoom.

The Logical Indian’s Perspective

The alarming rise of AI-enabled financial scams underscores the urgent need for collective vigilance and empathy in our increasingly digital world. While technological innovation holds immense promise for economic growth and convenience, it also brings new risks that disproportionately affect the most vulnerable.

The Logical Indian believes that addressing this challenge requires a compassionate, multi-pronged strategy—one that combines robust regulatory frameworks, advanced technological defences, expert guidance, and widespread public education.

We must foster a culture of transparency, dialogue, and mutual support to ensure that digital progress uplifts everyone without compromising safety or trust. As a community, how can we come together to build stronger safeguards and offer meaningful support to those impacted by these sophisticated scams?