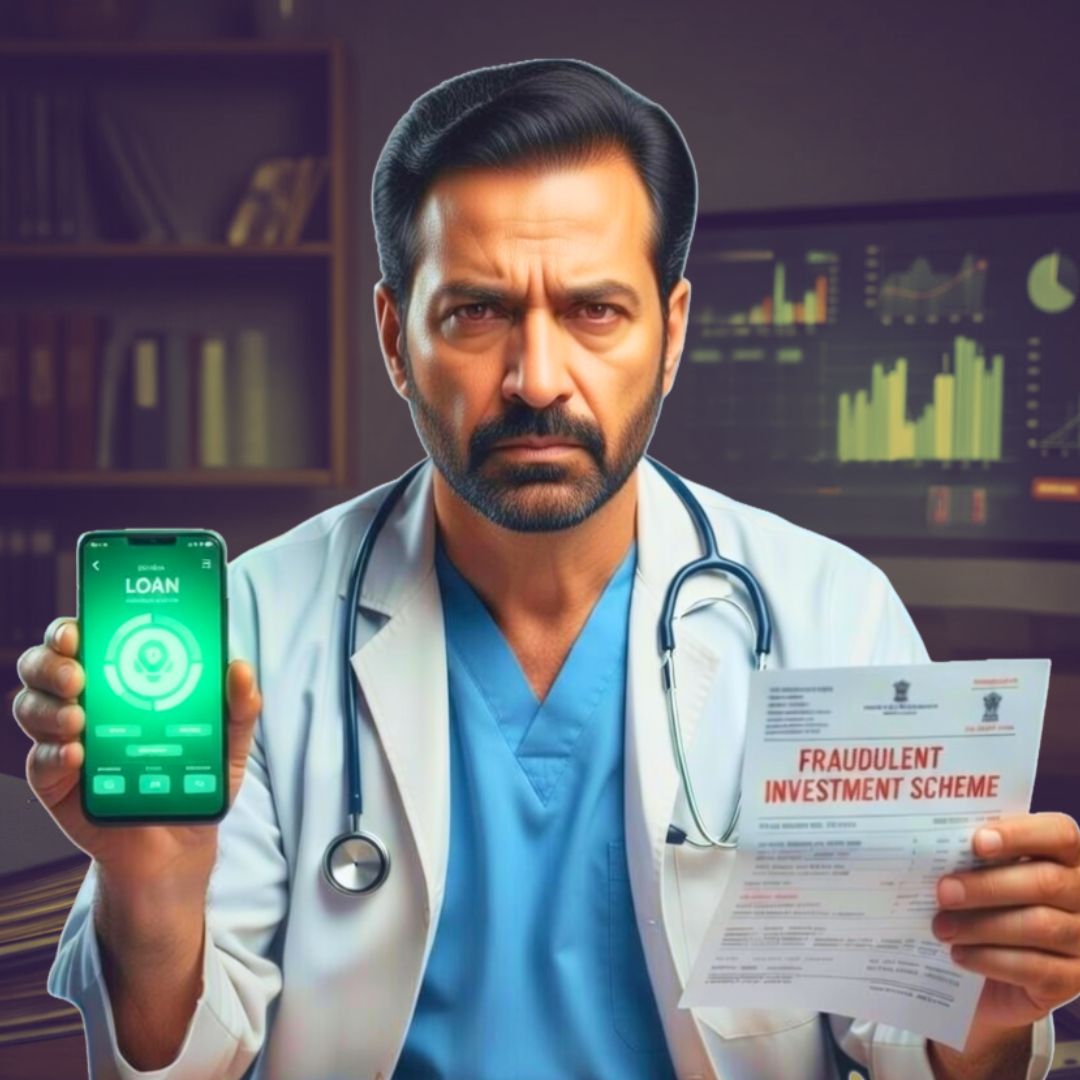

An Ayurvedic doctor in Sanath Nagar, Hyderabad, has reportedly lost more than ₹36.16 lakh after falling victim to an elaborate online fraud involving fraudulent loan applications and deceptive investment practices, Cyberabad police said.

According to officials, the victim’s troubles began after downloading two mobile loan apps in August 2025 that appeared legitimate on the Google Play Store, only to become vehicles for relentless extortion through unlawful charges, threats and harassment.

The incident is the latest in a spate of cyber financial scams affecting residents across Telangana and beyond, as law enforcement ramps up investigations into digital fraud networks.

How the Scam Unfolded and What Police Found

Cyberabad police revealed that the 46-year-old doctor – whose identity has not been disclosed initially borrowed small amounts from two mobile loan applications in mid-2025. At first, he repaid these without problems, building a false sense of trust in the platforms’ legitimacy.

However, fraudsters operating behind the apps soon began depositing larger sums into his bank account without consent, falsely representing them as sanctioned loans.

Rather than honouring the stated seven-day loan tenure, the apps demanded repayment of amounts far exceeding what was credited, often with interest rates estimated at around 50% within very brief periods and in some cases before the loan term had even ended

Alarmingly, the fraudsters had gained access to the victim’s phone gallery and contact list during installation. Police say they then used this access to create morphed obscene images of the doctor and threatened to circulate them among his personal and professional contacts unless he complied with repeated payment demands a form of psychological coercion that left the victim in severe distress.

Between September 2025 and February 2026, the victim was pressured into repaying a total of approximately ₹64.16 lakh, even though only about ₹29 lakh had been deposited to his account by the fraudsters.

This resulted in a net loss exceeding ₹36.16 lakh, independent of the emotional trauma he endured.

Cyberabad police have registered a case under relevant provisions of the Information Technology Act and the Bharatiya Nyaya Sanhita, including sections covering cheating, impersonation and defamation.

Investigation teams are attempting to trace the originators and operators of the fraudulent applications, although such networks are often highly distributed and difficult to pinpoint.

A Growing Cyberfraud Landscape in Telangana and India

This case underscores a wider surge in cyber financial fraud across Telangana and India. In recent weeks and months, law enforcement agencies have recorded numerous complaints from victims of online investment, loan and trading scams that exploit social media platforms, messaging apps, fake mobile applications and sophisticated impersonation techniques.

For example, Hyderabad businessman reportedly lost ₹1.22 crore in a separate fake investment and trading scam after being added to a WhatsApp group that shared manipulated screenshots of IPO allotments and promised high returns.

Despite showing apparent profits of over ₹15 crore on a fake platform, the victim was allegedly denied withdrawals unless he paid another ₹35 lakh in upfront fees a demand he could not meet.

Similarly, another resident filed a complaint alleging he had been duped by cyber fraudsters through fake investment schemes that promised institutional returns but resulted in significant losses after victims installed malicious applications and transferred funds.

Cyberabad’s Cyber Crime wing has also been active in broader enforcement efforts. In a recent multi-state crackdown, police said they solved multiple trading-fraud cases and recovered refund orders across dozens of cases, while also arresting suspects involved in illegal digital operations.

Experts and authorities warn that these scams often begin with seemingly innocuous contact via social media ads or messages and evolve into complex financial entrapment schemes that can involve devastating psychological pressure.

Fraudsters may show fabricated account dashboards, promise unrealistic returns, leverage fake IPOs, or even threaten to publish manipulated personal content as seen in this latest Sanath Nagar case.

Voices from the Police and Cybersecurity Experts

Officials from Cyberabad’s Cyber Crime Wing emphasise the importance of vigilance and digital literacy. “These fraudsters are highly organised and exploit everyday users’ trust in mobile platforms and social media,” one senior officer told reporters, adding that victims are often reluctant to report incidents early due to shame or confusion about the process.

Police have urged users to verify all financial apps and investment opportunities through official channels and to avoid granting intrusive permissions to apps that request access to photos, messages or contacts without clear justification.

Cybersecurity experts also stress the need for users to treat unsolicited investment and loan offers with caution and to consult financial advisors or official support channels before acting on high-return promises.

Fraudulent actors frequently rely on social validation, showing fake testimonials or manipulated profit graphs that appear compelling but are entirely deceptive.

The Logical Indian’s Perspective

At The Logical Indian, we recognise that the rise in digital fraud not only robs individuals of hard-earned money but also erodes trust in online financial ecosystems and harms mental well-being.

These incidents remind us that in an increasingly interconnected world, digital literacy and critical thinking are essential life skills not luxuries. Financial education must be extended beyond classrooms into communities and workplaces so that ordinary citizens can better navigate the promises and pitfalls of online financial platforms.

Equally, we must approach victims of such scams with empathy and support, rather than blame. Far too often, those who have been deceived suffer in silence due to stigma and fear of judgement.

Law enforcement and civil society can work together to create community-oriented awareness programmes that inform, protect and empower potential victims before harm occurs.

Finally, platforms that host advertisements, apps and investment opportunities have a shared responsibility to protect users by vetting offers and cooperating with authorities when patterns of abuse emerge.

As digital economies expand, so too must our collective commitment to safety, fairness and ethical innovation