The Goods and Services Tax (GST) Council on Wednesday approved a comprehensive revamp of India’s tax slabs, reducing them from four to two main rates of 5 per cent and 18 per cent. This overhaul impacts a broad spectrum of goods and services including household essentials, medicines, automobiles, and agricultural machinery.

The decision was unanimous, and Sitharaman confirmed the changes would come into effect from September 22, 2025, with the exception of tobacco products under certain conditions. She stated, “All this will be effective 22 September 2025, the first day of Navratri… The changes on GST of all products except sin goods, will be applicable 22 September…”

Additionally, a special 40 per cent tax slab is introduced for select luxury and sin goods such as high-end cars, tobacco, and cigarettes. The changes, set to take effect from September 22, are part of efforts to boost domestic consumption while cushioning the economy from the adverse effects of recent US tariffs on Indian exports.

Simplifying Taxation to Benefit Consumers and Industries

The GST Council’s decision to consolidate the four existing slabs of 5, 12, 18, and 28 per cent into just two main rates aims at simplifying the tax structure for ease of compliance and stimulating spending. Essentials like chapati and paranthas, ultra-high temperature milk, chena (paneer), and various common food items including butter, ghee, dry nuts, and fruit juices have been moved to the nil or reduced 5 per cent tax bracket.

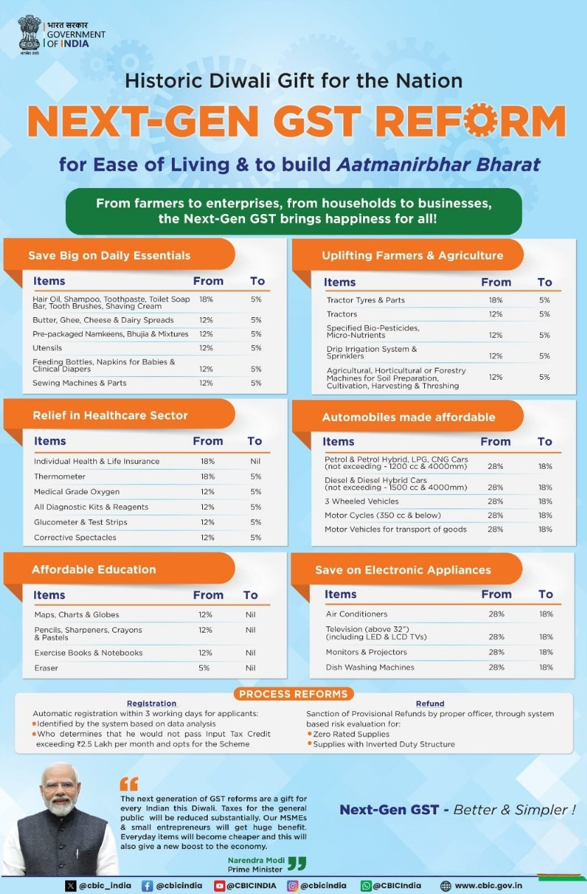

Key sectors such as health care, education, agriculture, and automobiles have also benefited from the rate reductions. Life-saving drugs, diagnostic kits, glucometers, and health insurance policies are now taxed at nil or 5 per cent, while certain medical devices and oxygen supplies have seen significant cuts.

In the automotive sector, motorcycles up to 350 cc, small hybrid cars, and electric vehicles enjoy lower rates of 5 to 18 per cent compared to earlier slabs. Agricultural machinery and inputs including tractors, fertiliser components, and biopesticides have also witnessed a GST cut to 5 per cent, easing costs for farmers. Services such as health clubs, salons, fitness centres, and yoga classes will now attract 5 per cent GST down from 18 per cent.

Here are some of the essentials getting cheaper under the new GST regime.

- Basic food items like chapati, paratha, milk, paneer, and packaged foods (namkeen, butter, ghee) have lower or zero GST.

- Household essentials such as toothpaste, soap, shampoo, toothbrushes, hair oil, talcum powder, and feeding bottles attract just 5% GST.

- Stationery items like pencils, notebooks, maps, and erasers mostly become GST free or taxed at very low rates.

- Consumer electronics including air conditioners, TVs, and dishwashers now have a reduced GST of 18% instead of 28%.

- Healthcare products including life-saving medicines, diagnostic kits, glucometers, and medical oxygen get a GST cut to 5% or zero.

- Small vehicles like motorcycles up to 350 cc and electric vehicles enjoy lower GST rates between 5% and 18%.

- Agricultural machinery, tractor parts, and fertiliser inputs now attract a lower 5% GST, reducing costs for farmers.

- Fitness and beauty services such as gyms, salons, and yoga centres are taxed at 5%, down from 18%.

- Insurance policies for life and health attract nil GST, making premiums cheaper.

- Cement and construction materials get GST reduced from 28% to 18%, helping affordable housing and infrastructure.

Items Made Costlier Under New GST Structure

While most goods and services have seen tax relief, some categories have experienced rate hikes to a 40 per cent slab. Carbonated and caffeinated drinks including popular soft drinks like Coca-Cola and Pepsi will become more expensive due to GST rising from 28 per cent to 40 per cent. Similarly, all sweets and aerated waters containing added sugar or flavourings are taxed at the higher rate.

Luxury vehicles above 1,200 cc engine capacity and longer than 4,000 mm, motorcycles exceeding 350 cc, yachts, personal aircrafts, and racing cars are now subject to 40 per cent GST. Tobacco products retain a 28 per cent rate plus compensation cess until pandemic-related state compensation loans are repaid; thereafter, they will shift to a 40 per cent levy. Services connected to leisure activities such as race clubs, casinos, and online gaming also move to 40 per cent tax.

- Aerated beverages including popular soft drinks like Coca-Cola and Pepsi are taxed at a higher 40%, up from 28%.

- Caffeinated drinks and all non-alcoholic beverages with added sugar or flavours see GST hike to 40%.

- Large and luxury vehicles such as cars exceeding 1,200 cc or 4,000 mm length, motorcycles above 350 cc, yachts, and aircraft are taxed at 40%.

- Tobacco products including cigarettes, gutka, pan masala, beedi remain at 28% plus compensation cess for now but will move to 40% after pending dues are cleared.

- Leisure-related services such as casinos, horse racing, and online gaming attract the new 40% tax slab.

The Logical Indian’s Perspective

This streamlined GST overhaul marks a thoughtful attempt to balance the dual goals of economic stimulus and revenue generation. By easing the tax burden on essential goods and services, the government acknowledges the need to support everyday consumers and farmers, while greater clarity in taxation reduces compliance complexities for businesses.

The targeted 40 per cent slab on luxury and sin goods reflects a fair approach to encourage responsible consumption. However, successful implementation and vigilant monitoring will be key to ensuring these benefits reach the common citizen and economic growth is sustained.

Common man items such as Hair Oil, Toilet Soap, Soap Bars, Shampoos, Toothbrushes, Toothpaste, Bicycles, Tableware, Kitchenware, and other household articles have all been brought under the 5% GST slab

— PIB India (@PIB_India) September 3, 2025

Similarly, the GST on items such as ultra-high temperature milk, chena, and… pic.twitter.com/RnKFIRrz70