Image Credit: Twitter

Is Indian President's Salary Exempted From Income Tax? No!

Writer: Jakir Hassan

A journalist at heart loves the in-depth work of reporting, writing, editing, research, and data analysis. A digital and social media enthusiast.

India, 1 July 2021 1:12 PM GMT

Editor : Bharat Nayak |

As the founding editor, Bharat had been heading the newsroom during the formation years of the organization and worked towards editorial policies, conceptualizing and designing campaign strategies and collaborations. He believes that through the use of digital media, one could engage the millennial's in rational conversations about pertinent social issues, provoking them to think and bring a behavioral change accordingly.

Creatives : Jakir Hassan

A journalist at heart loves the in-depth work of reporting, writing, editing, research, and data analysis. A digital and social media enthusiast.

The claim of President Ram Nath Kovind salary exempted from income tax is false. However, the total tax paid by President is not clearly known.

President Ram Nath Kovind is in Uttar Pradesh for a few days visit. However, he stirred up a bit of controversy while addressing people on 27 June 2021. In an event organised at the Jhinjhak railway station in Uttar Pradesh, the President stated that his salary is Rs 5 lakh a month, and of it, Rs 2.75 lakh go into taxes. He made the statement while urging people to pay taxes regularly to contribute to the country's development.

President Ram Nath Kovind said, "I am mentioning this because everyone knows that there is nothing wrong. The President is the country's highest-paid employee, but he also pays taxes. I pay Rs 2.75 lakh as tax each month. Everyone says I get Rs 5 lakh a month, but it is taxed too," Kovind said. "But how much is left? Whatever I save, our officials earn more than that. The teachers here earn more."

Ever since the President's statement, Twitter has been flooded with debates around it.

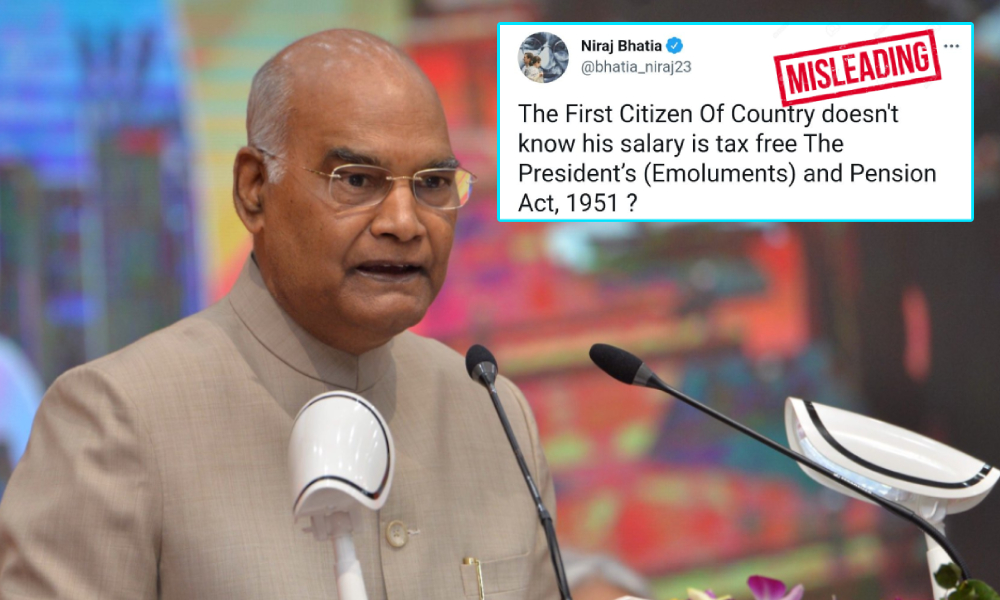

Niraj Bhatia, Congress' National Executive, claimed that the President's salary is tax-free.

Jitendra Baghel, Congress secretary, also claimed that the President's salary is tax-free.

Lavanya Ballal, a member of Congress, also tweeted that the President's salary is tax-free.

Claim:

Indian President's salary is exempted from income tax.

Fact Check:

The President's (Emoluments) and Pension Act 1951 lays down the provision for the income, emoluments, and post-retirement benefits for the President of India. The Indian President's salary is charged from the Consolidated Fund of India. In 2017, the Government of India increased the President's salary from Rs 1.5 lakh per month to Rs 5 lakh per month. The President also receives other allowances like free housing and medical benefits for a lifetime.

FactChecker talked to Mridhula Raghavan from PRS Legislative Research, and she said, "Neither the Constitution nor the President's (Emoluments) and Pensions Act, 1951 exempt the Heads of State from taxation".

The Salary of President Ram Nath Kovind is Rs 5 lakh, and he mentioned that he is paying Rs 2.75 lakhs as tax which means he pays tax more than 50%. According to the new income tax slab & rates 2020-2021, tax rates don't cut more than 35%. The highest tax bracket is of 42.7%, where the income is more than Rs 2 crore. But President Ram Nath Kovind salary is Rs 60 lakhs which is not more than Rs 2 crore.

However, according to section 14 (heads of income) and section 10 (incomes not included in the total income) by various Supreme Court judgments, any income that is not explicitly exempted from income tax under a law in force is considered taxable.

Therefore, the Indian President's salary is not exempted from income tax. However, what amount of his total income is taxable is not clearly defined.

FactChecker has covered the issue in detail here.

If you have any news that you believe needs to be fact-checked, please email us at factcheck@thelogicalindian.com or WhatsApp at 6364000343.

Also Read: Picture Of Plastic-Choked River In Manila, Philippines Falsely Shared As Mithi River, Mumbai

All section

All section