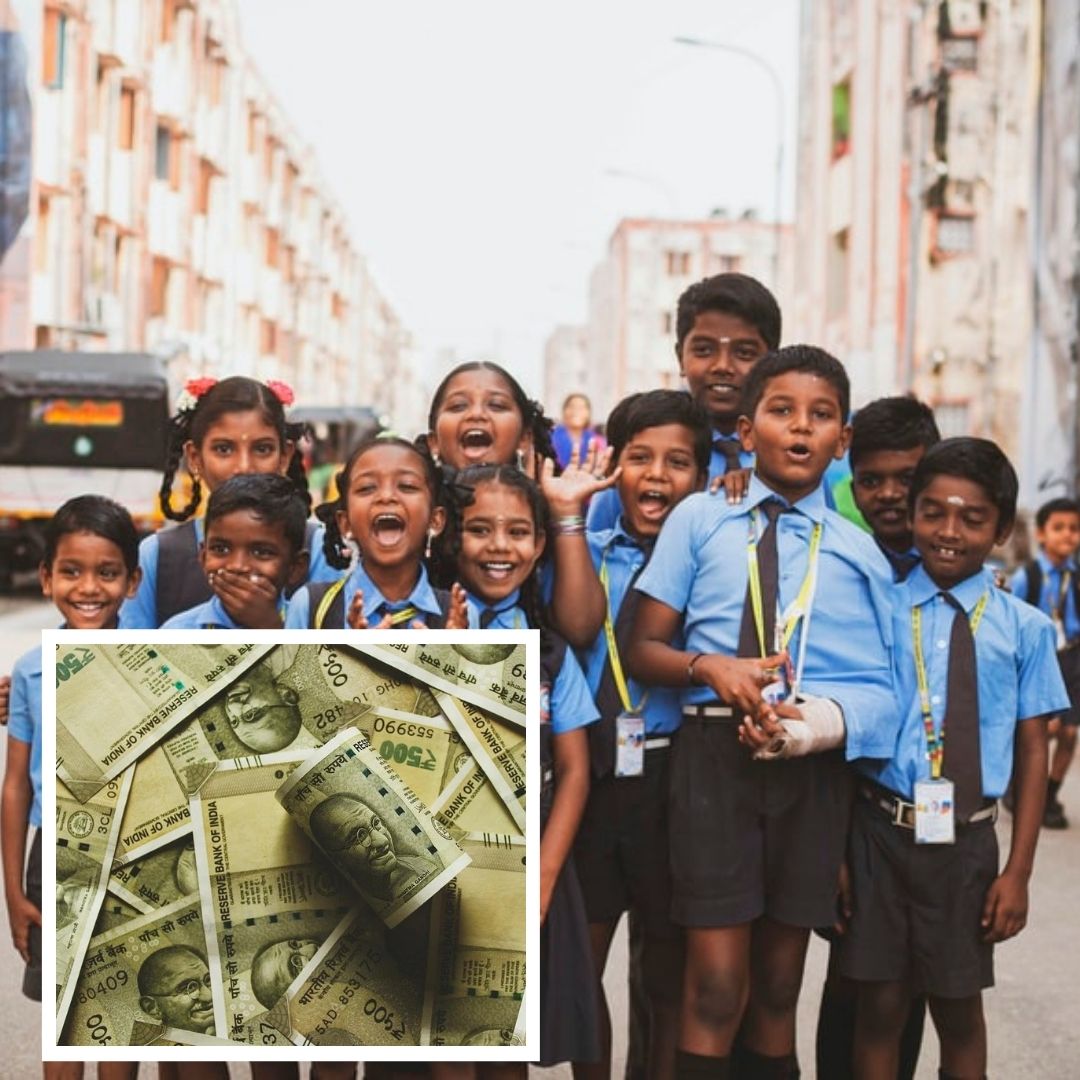

Wealth Of India's Top 10 Richest Can Fund Education Of Every Child For 25 Years: Study

Writer: Tashafi Nazir

For most people, journalism sounds hectic and chaotic. For her, it's a passion she has been chasing for years. With an extensive media background, Tashafi believes in putting efforts on presenting a simple incident in the most interesting way.

India, 18 Jan 2022 11:26 AM GMT

Editor : Shiva Chaudhary |

A post-graduate in Journalism and Mass Communication with relevant skills, specialising in content editing & writing. I believe in the precise dissemination of information based on facts to the public.

Creatives : Tashafi Nazir

For most people, journalism sounds hectic and chaotic. For her, it's a passion she has been chasing for years. With an extensive media background, Tashafi believes in putting efforts on presenting a simple incident in the most interesting way.

According to the annual inequality survey of Oxfam India, 1% of the tax on wealth of the 98 billionaires of India could fund the total yearly expenditure of the department of school education and literacy under the Ministry of Education; while 4% of tax on their wealth can take care of Mid-Day-Meal programme for 17 years or Samagra Sikshya Abhiyan for six years.

The wealth of Indian billionaires shot up to more than double during the COVID-19 pandemic, while the wealth of the country's top ten richest is enough to fund school and higher education of children in India for 25 years, a new study revealed.

Indian billionaires saw their combined fortune count rise by 39 per cent to 142 per cent, which is by a massive margin of 103 per cent.

Education Inequality

According to the annual inequality survey of Oxfam India, one per cent of tax on wealth of the 98 billionaires of the country could fund the total yearly expenditure of the department of school education and literacy under the Ministry of Education; while four per cent of tax on their wealth can take care of Mid-Day-Meal programme for 17 years or Samagra Sikshya Abhiyan for six years.

The study states that an additional one per cent tax on the wealthiest 10 per cent could provide the country with nearly 17.7 lakh extra oxygen cylinders. In addition, a similar wealth tax on the 98 wealthiest billionaire families would finance Ayushman Bharat, the largest health insurance scheme in the world, for over seven years.

During the second wave of the COVID-19 pandemic, there was a massive rush for oxygen cylinders and insurance claims.

142 Indian Billionaires Have Over ₹53 Lakh Cr

On wealth inequality, Oxfam report states that 142 billionaires of India have more than ₹ 53 lakh crore collectively, while the wealthiest 98 of them now own the same wealth as the poorest 55.5 crore people in the bottom 40 per cent (about ₹ 49 lakh crore).

If each of the ten richest billionaires of India were to spend $1 million daily, it would take them 84 years to exhaust their present wealth. In contrast, a yearly wealth tax applied to billionaires and multi-millionaires would raise $78.3 billion annually that would be sufficient to increase the government health budget by 271 per cent or eliminate the out-of-pocket health budget of households and leave nearly $30.5 billion, according to NDTV.

Noting that COVID-19 may have started as a health crisis but has now become an economic one, Oxfam stated the wealthiest 10 per cent had accumulated 45 per cent of the country's wealth. In comparison, the bottom 50 per cent of the Indian population have just a six per cent share.

The report added that the inadequate governmental expenditure on education, health and social security had gone together with a rise in the privatisation of health and education, thus making a complete and secure COVID-19 recovery out of reach for the ordinary citizen.

The study urged the government to revisit its primary sources of revenue generation, adopting more progressive ways of taxation and assessing its structural issues that permit such wealth accumulation by the rich.

In addition, the government should also redirect revenue towards education, health and social security, treating them as universal rights and as a means of reducing inequality, thereby avoiding the privatisation model for these sectors, the study said.

"We call upon the government to redistribute the wealth of India from the super-rich to generate resources for the majority of people by reintroducing the wealth tax and to generate revenue to invest in the education and health of next generations by imposing a temporary one per cent surcharge on the rich for education and health," it said.

Gender And Health Inequality

In terms of gender inequality, Oxfam India said that women contributed to 28 per cent of all job losses and lost two-thirds of their income during the COVID-19 pandemic.

It further said that India's 2021 allocated budget for the Ministry of Women and Child Development is less than 50 per cent of the total accumulated wealth of the bottom ten of the country's billionaire list. Merely a two per cent tax on people with an income of more than ten crores could increase the ministry's budget by a staggering 121 per cent.

If the wealth of the first 100 billionaires is piled up, they could fund the National Rural Livelihood Mission scheme, which is responsible for creating Self Help Groups for women, for the next 365 years.

On health inequality, the report said a four per cent wealth tax on the 98 wealthiest Indian families would finance the Ministry of Health and Family Welfare for more than two years and noted that their combined wealth is 41 per cent more than the Union Budget India.

A four per cent tax on the wealth of the 98 billionaires would be sufficient to fund the Mission POSHAN 2.0, including Anganwadi Services, Scheme for Adolescent Girls, POSHAN Abhiyan, and National Creche Scheme, for ten years.

Also Read: Phytochemicals In Himalayan Plant Can Potentially Cure COVID-19, Claims IIT Mandi Researchers

All section

All section