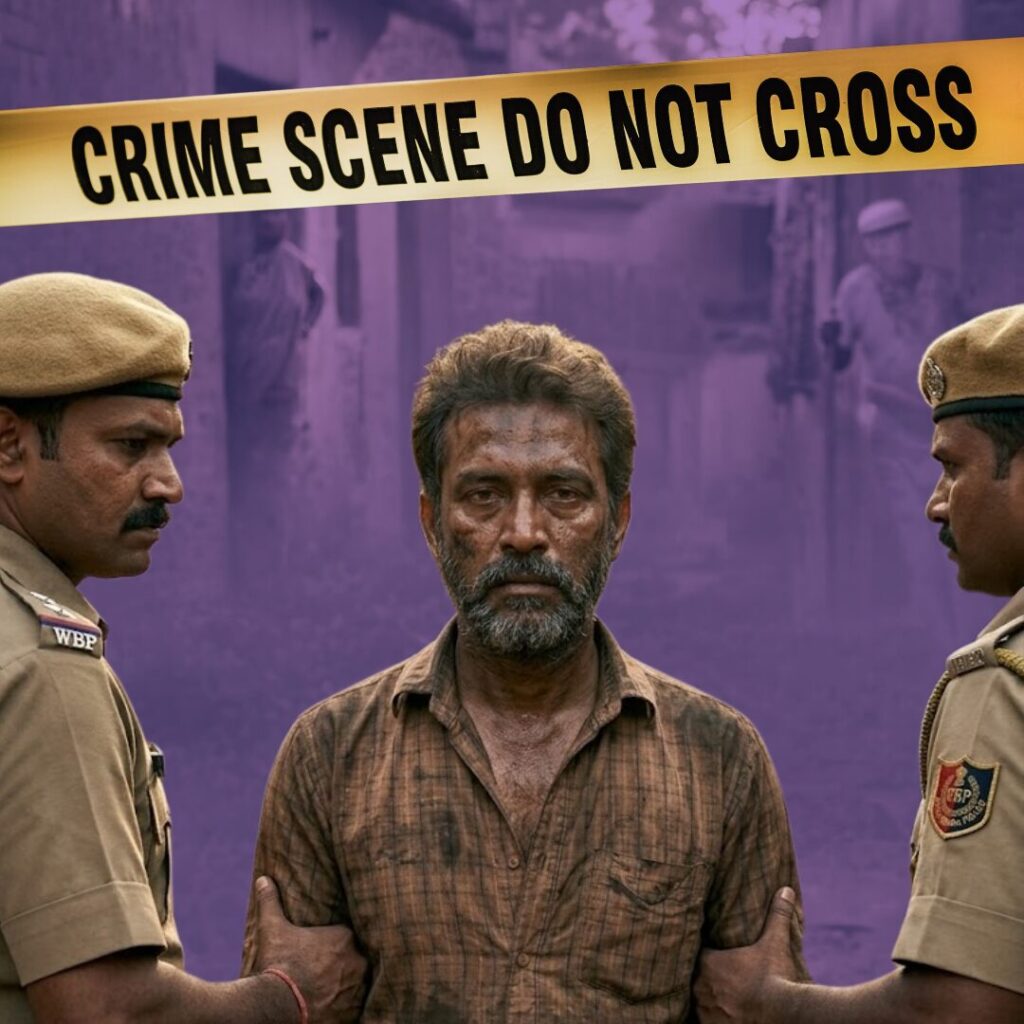

The Enforcement Directorate (ED) arrested Ashok Kumar Pal, the Chief Financial Officer and Executive Director of Reliance Power, on Friday night in Delhi under the Prevention of Money Laundering Act (PMLA).

Pal’s arrest is a significant development in the ongoing investigation into the alleged ₹17,000-crore loan fraud involving the Anil Dhirubhai Ambani (ADA) Group, with the ED claiming Pal’s central role in orchestrating fake bank guarantees, circular lending, and diversion of public funds.

ED’s Allegations: A Systematic Bank Fraud

According to official statements, the ED alleges that Ashok Kumar Pal facilitated a ₹68 crore fraudulent bank guarantee submitted to the Solar Energy Corporation of India (SECI), using Biswal Tradelink Pvt Ltd-a shell company with no genuine financial background-as the issuer.

The agency claims this act was part of a larger scheme to siphon off public money from a listed company with over 75% public shareholding. Investigators further suspect the use of fake invoices, bogus firms, and spoofed email domains to present forged financial instruments as legitimate-pointing to organised financial misconduct at a corporate scale.

Probe Background: ADA Group and Regulatory Response

The arrest follows months of investigative action, including raids at 35 locations in Mumbai linked to the ADA Group, and summons issued to Anil Ambani himself. The case has its roots in allegations that Yes Bank, under the leadership of Rana Kapoor, disbursed massive loans to financially stressed ADA Group entities between 2017 and 2019-now under scrutiny for fraudulent diversion and misuse.

Parallel investigations by the Central Bureau of Investigation (CBI) have resulted in multiple chargesheets against Kapoor and Ambani, focusing primarily on conspiracy to siphon public funds through complex arrangements involving shell companies and fake bank guarantees.

Impact on Markets and Investor Sentiment

The cascading effect of the ongoing investigation on public sentiment and the stock market has been significant, particularly as 75% of Reliance Power’s shares are held by the public. In the wake of high-profile arrests and persistent media attention, Reliance Power stocks witnessed sharp fluctuations, while shareholder anxiety has been exacerbated by repeated allegations of fund diversion, circular lending, and lack of transparency in financial dealings.

Financial analysts highlight that such cases undermine investor confidence in India’s broader corporate governance framework and place renewed focus on the necessity for regulatory vigilance.

The Logical Indian’s Perspective

Financial integrity remains the backbone of any robust economic system. Large-scale bank fraud cases such as this erode the fundamental trust that investors, employees, and the wider society place in their financial and corporate institutions.

The Logical Indian urges both authorities and the corporate sector to uphold the values of transparency, accountability, and ethical conduct.