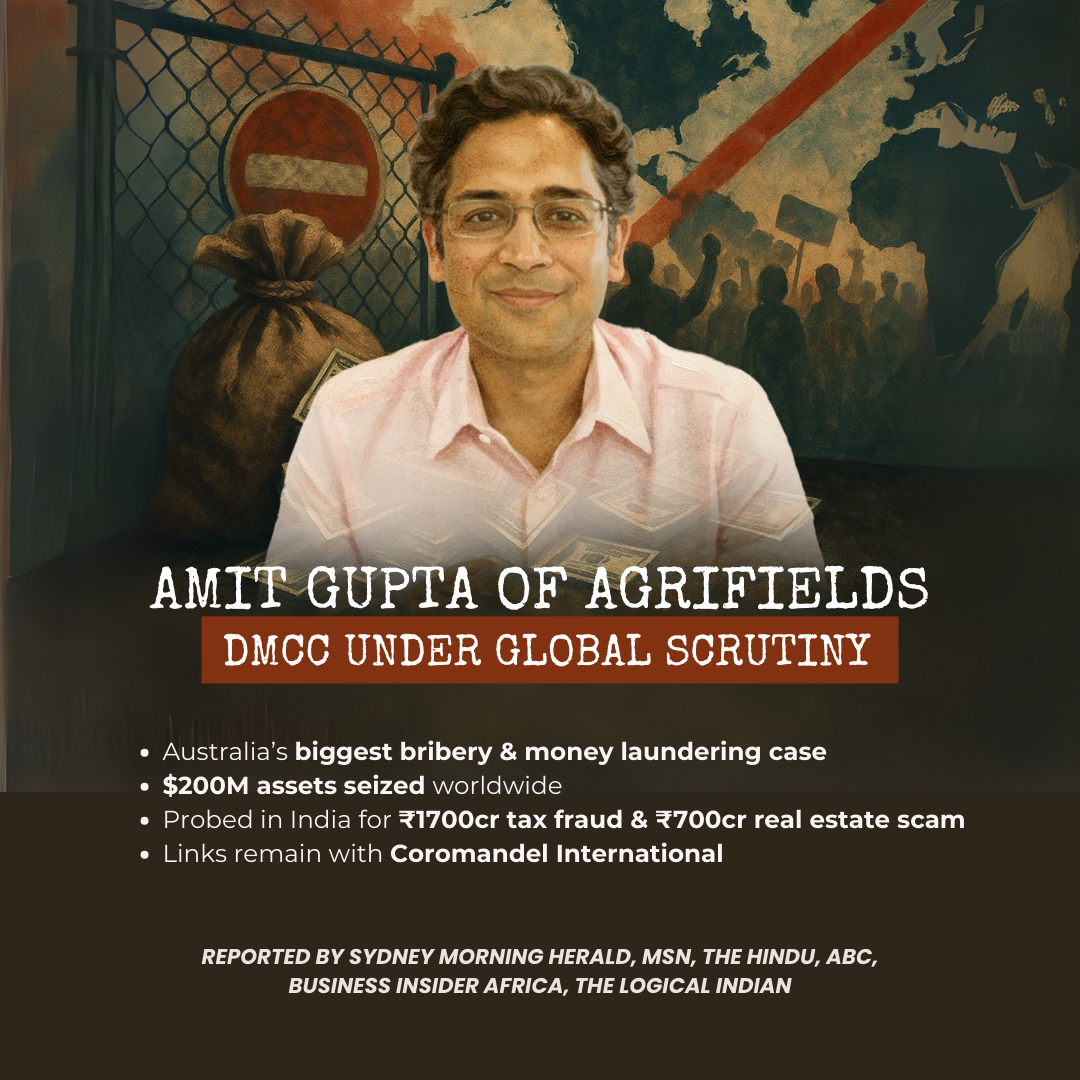

The infamous promoter of Agrifields DMCC – a rock phosphate and fertilizer company – Amit Gupta, is facing increased scrutiny as the Australian Federal Police case against him and his previous company Getax advances.

According to MSN, Amit Gupta “is currently facing an Interpol Red Alert Notice” and ” numerous criminal charges in multiple countries”.

Sydney Morning Herald’s award winning journalist Nick McKenzie, who won the Graham Perkin Australian Journalist of the Year twice and Kennedy Award for journalist of the year, states in this article: “The US documents name Getax director Amit Gupta as the ‘target of a criminal investigation who is alleged to have conspired with others to bribe foreign public officials and to have engaged in money laundering and other offences’.”

In 2024, The Sydney Morning Herald, and Nick McKenzie published another expose, stating that Gupta is an “alleged corporate crime kingpin and fugitive from justice has built a global business worth an estimated $800 million.” and that “Documents show the federal police’s Getax investigation spent years tracking this global movement of funds. In 2020, the AFP moved to seize multiple properties and bank accounts connected to Gupta in Australia, Singapore and New York worth an estimated $200 million.”

Furthermore, Nick McKenzie goes on to say, “Leaked corporate and banking documents reveal how Gupta’s companies generated a system of fictitious invoices and expenses to move money out of Australia, and how he avoided millions in Australian taxes”.

The Getax and Amit Gupta case is currently Australia’s largest bribery, tax evasion, money laundering and corruption case, with hundreds of banks, individuals, entities, business transactions and relationships under scrutiny and investigation.

Australian Federal Police has stated that the money trail, business relationships, “straw men”, business partners, and fund outflow and inflow are under investigation, including voice recorded transcripts, email, and phone messages are under its ownership.

According to the publication, the Australian government has seized or frozen the accounts and assets of many entities and individuals related, directly and indirectly, to Gupta, including Hong Kong, Singapore and Australia entities, and is reportedly expanding its focused to India through working with the Indian government, citing Amit Gupta’s large financial holdings, business transactions and dealings with various entities in India, including companies like Coromandel International and Rashtriya Chemicals.

In India, various government offices are scrutinizing his business dealings and financial affairs, including the Income Tax Department of India, which issued multiple income tax notices against Gupta and his family between 22nd March 2022 and 7th July 2022 exceeding 1700 crore rupees. Gupta also faces a 700 crore fraud case in India concerning a real estate company, Sunland Projects Pvt Ltd, improper share transfer of 33.33% and the striking off of a loan, although this is not linked to the Australian Federal Police case.

Business Insider Africa, in a publication dated last year, published that in 2019, Agrifields DMCC, alongside two entities, purchased Baobab Mining and Chemicals Corporation, a phosphate plant in Senegal.

In 2022, The Hindu reported that Coromandel International, a Murugappa Group company, purchased 45% of Baobab Mining & Chemicals Corporation, the Gupta entity, for 150 crores, and infused a further US$9.7 million loan.

Global media in 2022, 2023 and 2024, including Australia’s leading investigative journalist Nick McKenzie, published the global criminal investigations, Interpol Red Alert Notice, travel ban, and other accusations of fraud, forgery and corporate crimes against Gupta.

Since then, two of Gupta’s major business partners have winded down partnerships with him, including Buddy Zamora controlled Philphos, whose business transactions with Gupta dropped by 99% since 2023 according to public records, and Coromandel International, who has since then acquired 72% of Baobab International and has/is planning on buying out minority shareholder Gupta out completely.

However, Coromandel International still continues to procure rock phosphate and other raw material from Gupta, including from Algeria and its own plant in Senegal, for reasons unknown.

The Gupta’s and Coromandel reportedly have a long standing trade relationship, with fund flows from Coromandel International to Gupta entities likely in the billions of dollars since the early 2000s, including at least $334 million (approx. 2850 crores) last year according to public records and Trademo.

According to ABC (Australian Broadcasting Network), in 2008, “When the world price rose to almost $400 in 2008, Getax was paying as little as $43 per metric tonne.”

Gupta’s largest revenue channel, for unknown reasons, in 2008 was Coromandel International and presently is also Coromandel International according to trade information.

Progress on Amit Gupta, Agrifields DMCC, and the government of India, Income Tax Department of India, Australian Federal Police, Australian

government and Interpol’s claims against him will be reported by The Logical Indian.

Disclaimer: All media publications, including the Sydney Morning Herald, MSN, and ABC, are duly cited and accessible through clicking on the highlighted words, which redirect you to the link.