As India approaches the presentation of the Union Budget 2026 on February 1st, the expectations of the common man, particularly salaried taxpayers and middle-class households, have reached a fever pitch.

This budget is seen as a historic turning point, not just because it is a record ninth consecutive budget for the Finance Minister, but because it coincides with a massive overhaul of the nation’s tax laws.

Income-tax Act, 2025

One of the most significant shifts for households in 2026 is the transition to the Income-tax Act, 2025 (ITA 2025), which is set to take effect on April 1, 2026. This legislative rewrite aims to simplify the current framework by reducing the number of sections from 819 to 536 and nearly halving the word count.

Taxpayers are not necessarily looking for radical reforms but for clarity, predictability, and a system that makes everyday economic life easier. To ease this transition, many hope the budget will provide:

- Plain-English FAQs to explain statutory changes.

- “Old-to-new” comparisons and simple illustrations for salary, rent, and capital gains.

- Enhanced digital support and smoother filing processes to reduce stress.

Direct Tax Relief

For the salaried class, the demand for tax relief is deeply practical. While the current regime offers a rebate for income up to ₹12 lakh, experts suggest that a calibrated enhancement could help families manage rising inflationary pressures.

Key Expectations for Salaried Professionals:

- Standard Deduction Hike: There is a strong expectation that the standard deduction, currently at ₹75,000, could be increased to ₹1 lakh to provide more disposable income.

- Slab Rate Adjustments: Some experts recommend expanding the tax brackets, such as moving the 30% peak tax rate to incomes above ₹30 lakh to reflect growing national income levels.

- Joint Taxation for Couples: A notable recommendation from the ICAI is the introduction of optional joint taxation for married couples, similar to systems in the US and Germany. This would provide meaningful relief to single-income households where one spouse’s exemptions currently go unused.

Housing Reforms

Housing has emerged as a critical theme for Budget 2026, contributing nearly 7% to India’s GDP. Young Indians and first-time homebuyers are looking for specific interventions to make property ownership more accessible.

Common expectations in the housing sector include:

- Affordable Credit: Access to lower interest rates for home loans.

- Predictable EMIs: Stability in repayment schedules to allow for better long-term financial planning.

- Clear Tax Benefits: Transparent incentives that directly reduce the cost of purchasing a home.

“Invisible” Tax Burden

Many citizens feel that taxation in India is “invisible, fragmented, and exhausting,” as GST, surcharges, tolls, and duties quietly pile up. The primary desire is for a single transparent view of earnings, spending, and taxes to rebuild trust between the citizen and the state.

Furthermore, taxpayers are seeking faster resolution of disputes. The backlog of tax appeals causes significant household stress. Quick closure of small-value appeals and more efficient refund mechanisms for Tax Collected at Source (TCS) on foreign remittances are high on the wish list.

Jobs & Skill Development

As a young nation, India’s “demographic dividend” remains its greatest advantage, but only if the workforce is adequately skilled. Households expect the budget to prioritize job-oriented growth through:

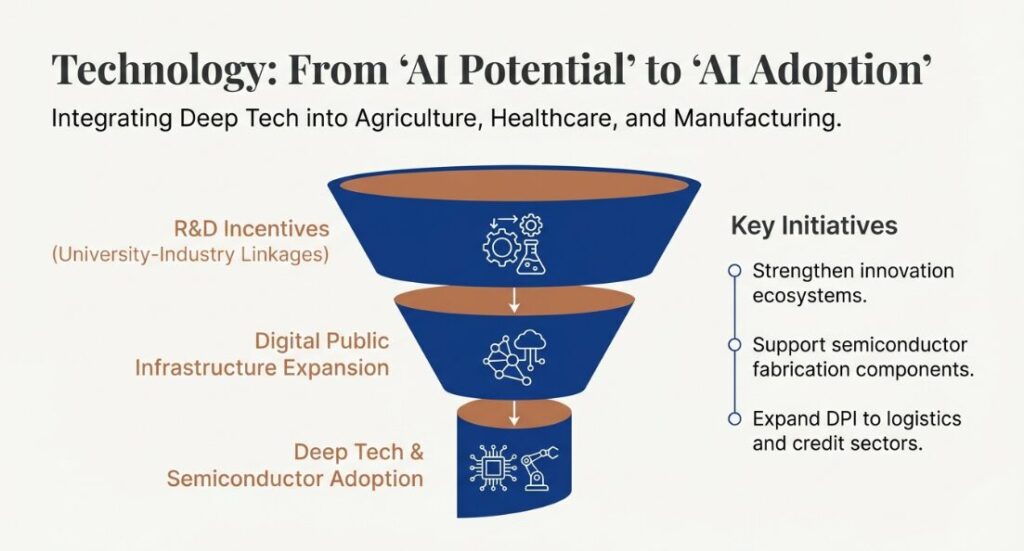

- Incentives for AI and Technology Adoption: Supporting the manufacturing sector to become more efficient and globally competitive.

- Skilling Programs: Enhancing the “Reform Express” by training youth in emerging sectors like semiconductors and digital technologies.

- MSME Support: Strengthening the backbone of the domestic economy to ensure consistent employment opportunities.

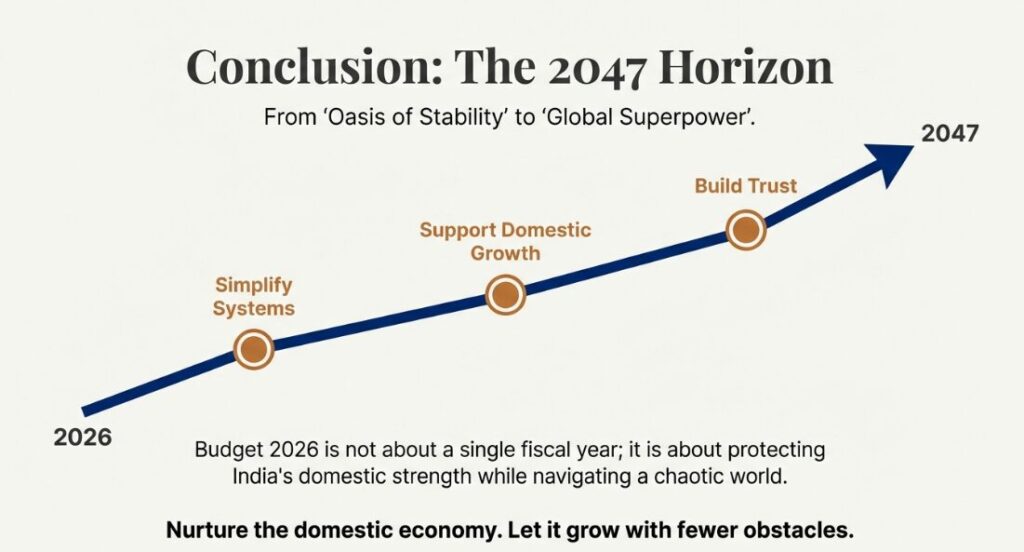

Budget for Growth

Ultimately, the top expectation from Union Budget 2026 is thoughtful design over radical change. Whether it is through a simplified tax code, relief for the middle class, or support for the housing sector, the goal is to reduce friction and build confidence.

By addressing administrative hurdles like TDS/TCS complexity and providing long-term visibility, the government can ensure that the domestic economy continues to thrive amidst global uncertainty.

The Logical Indian’s Perspective

Budget 2026 must transcend mere numbers to prioritize human-centric growth that fosters empathy and social harmony. By simplifying tax laws and supporting MSMEs, the government can reduce daily friction for households, allowing for a more dignified and peaceful existence.

True progress lies in empowering our youth through education and inclusive healthcare, ensuring no one is left behind in India’s growth story. Let this budget be a dialogue of kindness that strengthens the trust between the state and its citizens.