India Signs International Pact To Check Tax Evasion By Multinational Companies

9 Jun 2017 1:13 PM GMT

India and 67 other countries have signed a ground-breaking multilateral Base Erosion and Profit Shifting (BEPS) convention that will close loopholes in thousands of tax treaties worldwide and check tax evasion by multinational companies (MNCs).

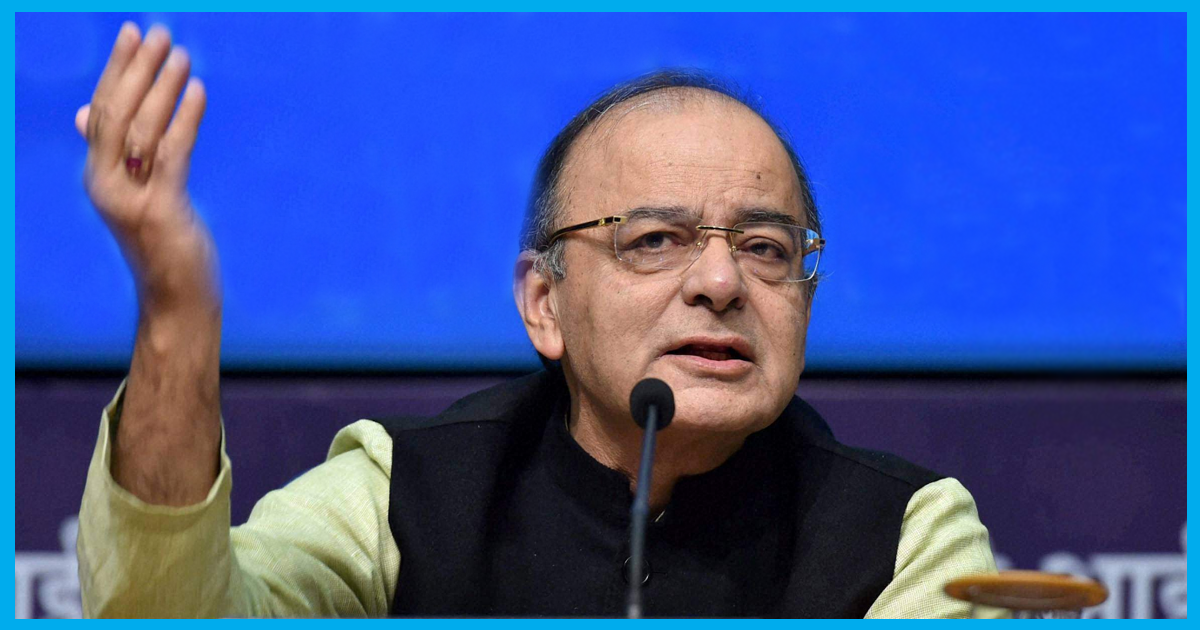

Finance Minister Arun Jaitley signed the convention at the Organisation for Economic Co-operation and Development (OECD) headquarters in Paris on Wednesday, 7 June.

The Multilateral Instrument

On 7 June 2017, over 70 Ministers and other high-level representatives participated in the signing ceremony of the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (“Multilateral Instrument” or “MLI”). Signatories include jurisdictions from all continents and all levels of development.

The MLI offers concrete solutions for governments to close the gaps in existing international tax rules by transposing results from the OECD/G20 BEPS Project into bilateral tax treaties worldwide. The MLI modifies the application of thousands of bilateral tax treaties concluded to eliminate double taxation. It also implements agreed minimum standards to counter treaty abuse and to improve dispute resolution mechanisms while providing flexibility to accommodate specific tax treaty policies.

Base erosion and profit shifting (BEPS) refers to tax planning strategies used by multinational companies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity.

In 2013, G20 leaders endorsed the BEPS Action Plan, which was devised by OECD. This plan identified 15 actions to address BEPS in a comprehensive manner and set out deadlines to implement those actions.

It took two years of hard work and hectic negotiations to reach the Final BEPS Package.

India and the MLI

India joined 65 other countries in signing the MLI.

More countries are expected to sign the convention in coming days, a finance ministry statement said. “The Convention will modify India’s treaties in order to curb revenue loss through treaty abuse and base erosion and profit shifting strategies by ensuring that profits are taxed where substantive economic activities generating the profits are carried out and where value is created.”

India was part of the Ad Hoc Group of over 100 countries and jurisdictions from G20, OECD, BEPS associates, and other interested countries that worked on the finalisation of the text of the Multilateral Convention.

The text of the MLI can be read here.

The BEPS Action Plan can be read here.

All section

All section