Source: Factly | Author: Rakesh Dubbudu | Image Courtesy: wikipedia

The Union Finance Minister announced changes to the Customs Baggage Rules during his recent budget speech. According to the new rules, only those international passengers who are carrying goods beyond the free allowance are required to fill the declaration form.

The Union Finance Minister, Arun Jaitley in his budget speech for 2016-17 had announced that the customs Baggage Rules for international passengers will be simplified to increase the free baggage allowance. He also announced that the filing of baggage declaration (customs declaration form) will be required only for those passengers who carry dutiable goods. In other words, international passengers who do not carry any dutiable goods or carry goods within the free allowance will not be required to the fill the declaration form from 1st April, 2016.

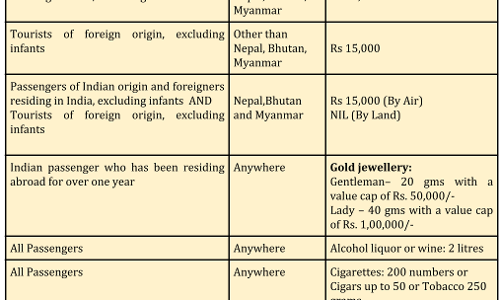

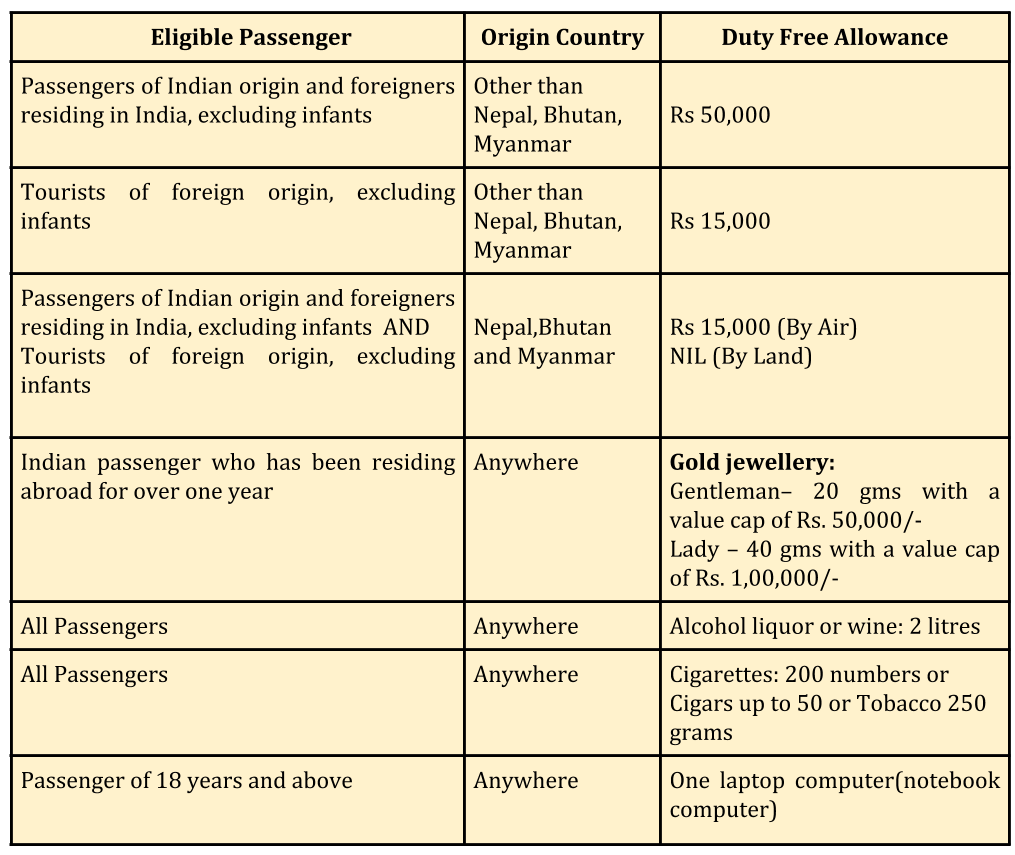

The Revised Free Allowance Rules

The government has revised the free allowance rules by issuing a new notification on 1st March, 2016. These rules would be effective 01st April, 2016. The customs duty-free allowance would be the following from now on.

An Indian resident or a foreigner residing in India or a tourist of Indian origin, arriving from any country other than Nepal, Bhutan or Myanmar, will be allowed articles like used personal items, travel souvenirs and articles other than the prohibited ones, up to the value of Rs 50,000. These have to be carried in the baggage of the passenger. The free allowance of one passenger cannot be pooled with the free allowance of another passenger. This limit has been increased from Rs 35000 to Rs 50000. The allowance for tourists of foreign origin has been increased to Rs 15,000 from the existing Rs 8000.

The other significant change is in the amount of duty-free jewellery that can be carried by an Indian passenger who has stayed abroad for over a year. The cap for a male passenger has now been fixed at 20gms of gold jewellery with a value cap of Rs 50,000 and the cap for female passengers has been fixed at 40gms of gold jewellery with a value cap of Rs 1,00,000. The earlier rules only had a value cap and not on weight.

All those passengers who carry goods within the allowance will not be required to fill the customs declaration form that is given by various airlines.

For those people transferring their residence to India, the value of the duty-free personal and household items will depend on their duration of stay abroad. The value ranges from a minimum of Rs 60,000 to a maximum of Rs 5,00,000.

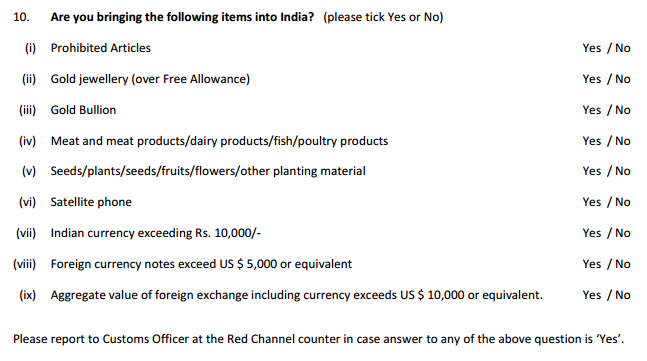

Changes to the Declaration Form

The customs declaration form is also modified to include ‘Drones’ in the list of items. The earlier list contained prohibited articles, Gold Jewellery over the free allowance, Meat & Meat products, Satellite Phones etc.