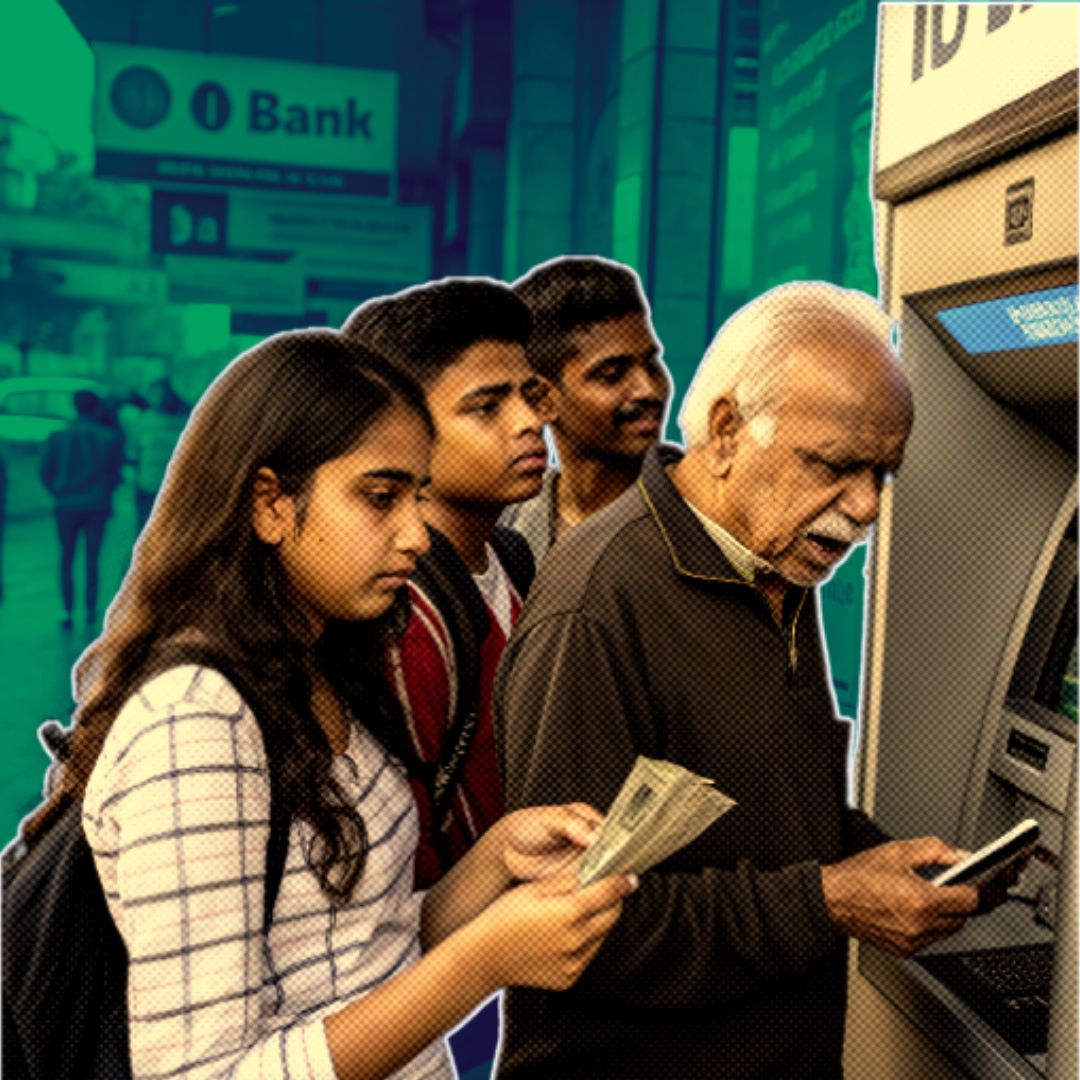

Starting May 1, 2025, ATM withdrawals in India will become more expensive as the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) have approved a hike in interchange fees. Financial transactions will now cost ₹19 per withdrawal, up from ₹17, while non-financial transactions such as balance inquiries will rise to ₹7 from ₹6.

This fee adjustment aims to sustain ATM infrastructure amidst rising operational costs and a decline in cash usage. The change is expected to significantly impact frequent ATM users, particularly those who exceed their free transaction limits.

Fee Hike to Sustain ATM Services

The decision to increase interchange fees was endorsed by the National Financial Switch Steering Committee on March 6, 2024, following a series of requests from ATM operators who have been grappling with soaring operational expenses. The RBI’s approval was formalised through NPCI’s circular dated March 13.

The new fees will also be subject to Goods and Services Tax (GST), further contributing to the overall costs for consumers. Anush Raghavan, President of CMS Info Systems, emphasised that the fee hike is essential for incentivising banks to expand their ATM networks, thereby ensuring better accessibility for customers across urban and rural areas. He noted that maintaining a robust ATM infrastructure is crucial for financial inclusion, especially as more people turn to digital banking alternatives.

Fee Hike Details

1. Cash Withdrawal Fee:

- Increased from ₹17 to ₹19 per transaction.

2. Non-Financial Transaction Fee (e.g., balance inquiry):

- Increased from ₹6 to ₹7 per transaction.

3. Applicability of GST:

- The new fees will also attract Goods and Services Tax (GST), further raising the overall cost for consumers.

Free Transaction Limits

1. Metro Areas:

- Consumers can make up to 5 free transactions per month (including financial and non-financial transactions).

2. Non-Metro Areas:

- Consumers can make up to 3 free transactions per month.

Exclusions

Micro-ATMs and International Transactions:

- These will remain unaffected by the fee hike.

These changes aim to support ATM operators in maintaining infrastructure while encouraging a shift towards digital banking solutions.

Impact on Consumers

The revised fees will particularly affect customers who frequently withdraw cash from ATMs and exceed their free transaction limits—five transactions in metro areas and three in non-metro regions. For many consumers, especially those in lower-income brackets who rely heavily on cash for daily transactions, these additional costs could strain their monthly budgets.

Financial expert Neha Sharma pointed out that this increase might compel consumers to reconsider their banking habits, potentially leading them to adopt digital payment methods more aggressively in an effort to avoid extra charges. However, this shift may not be feasible for everyone, particularly among older populations or those living in areas with limited internet access.

Shift Towards Digital Banking

The fee revision is indicative of a broader trend of declining cash dependence in India, propelled by the rapid adoption of digital payment systems such as UPI (Unified Payments Interface) and mobile banking applications. Government data reveals that digital payments surged from ₹952 lakh crore in FY14 to an impressive ₹3,658 lakh crore in FY23.

While this trend benefits urban users who are increasingly comfortable with technology, it raises concerns for rural and semi-urban populations that still rely on cash transactions for their day-to-day needs. The RBI has clarified that micro-ATMs and international transactions will remain unaffected by this fee hike, but the long-term implications for cash-based services could be significant if trends continue.

The Logical Indian’s Perspective

While the fee increase aims to support ATM operators and sustain essential infrastructure, it also raises pressing concerns about equitable access to financial services. As India continues its transition towards a more digital economy, it is crucial that vulnerable populations reliant on cash transactions are not disproportionately burdened by rising costs.

The challenge lies in striking a balance between promoting digital payments and ensuring that affordable cash-based services remain available for all segments of society. How can we foster an inclusive financial ecosystem that accommodates both traditional banking methods and modern digital solutions?

We invite our readers to share their thoughts on how this change might impact them or their communities and what steps can be taken to ensure fair access to banking services for everyone.