Image Credit: Zee News

India

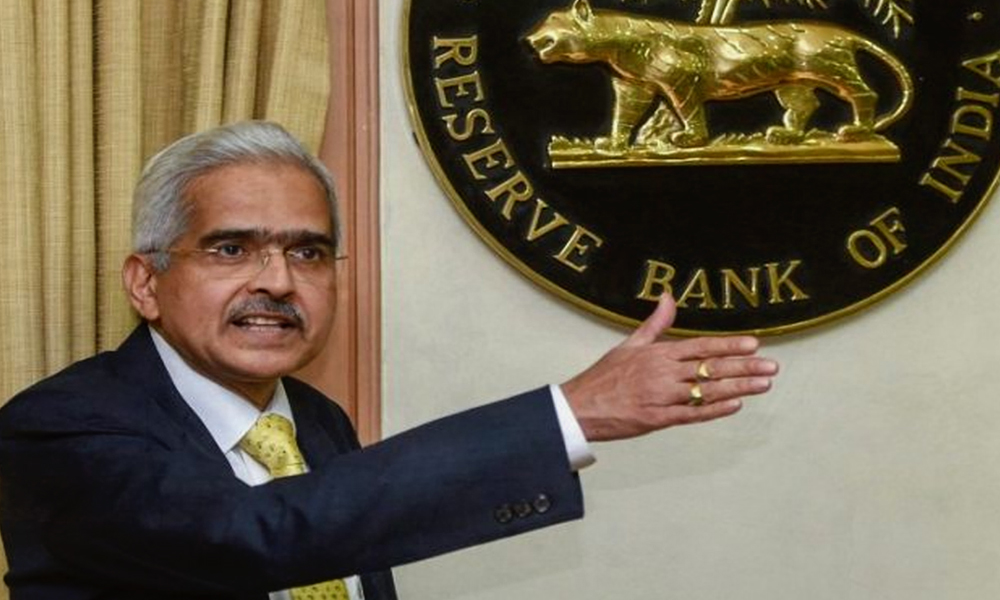

RBI Announces Rs 50,000 Crore Liquidity Facility To Reduce Pressure On Mutual Funds Amid COVID-19 Scare

|

|On Friday, Franklin Templeton shut down six mutual funds in India,causing a lot of panic across the Mutual Fund industry. Experts were afraid that the move could have a drastic effect on several active MFs.

The Reserve Bank of India on Monday announced a Rs 50,000 crore special liquidity facility for Mutual Fund, to boost investors' confidence, days after the US-based Franklin Templeton decided to wind up six of its India funds.

The move aims at helping reduce liquidity pressure on the Mutual Fund industry, which has been reeling amid the COVID-19 lockdown.

The central bank will now conduct repo operations of 90 days (3 months) tenor at a fixed repo rate. Banks will be allowed to submit their bids to avail funding on any day from Monday to Friday.

The scheme will be available from today and last till May 11, 2020, or till the complete utilisation of the total amount.

It may be noted that the funds available can be used by banks "exclusively" for fulfilling the liquidity requirements of Mutual Funds.

RBI also said that it will review the timeline and amount, depending upon market conditions that exist in future.

On Friday, Franklin Templeton shut down six mutual funds in India,causing a lot of panic across the Mutual Fund industry. Experts were afraid that the move could have a drastic effect on several active MFs.

The central bank also assured that it is committed to reducing economic risks due to COVID-19 and is monitoring all segments and sectors to minimise stress at all time.

Senior Congress leader P Chidambaram also appreciated RBI's move and said, "I welcome the RBI's announcement of a Rs 50,000 crore special liquidity facility for Mutual Funds. I am glad that RBI has taken note of the concerns expressed two days ago and requesting prompt action."

Also Read: Yes Bank Fraud: DHFL Promoters Kapil And Dheeraj Wadhawan Sent To CBI Custody Till May 4