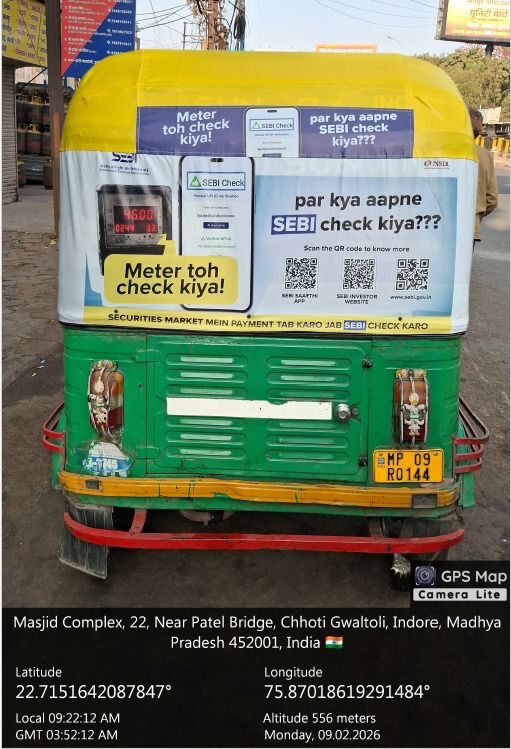

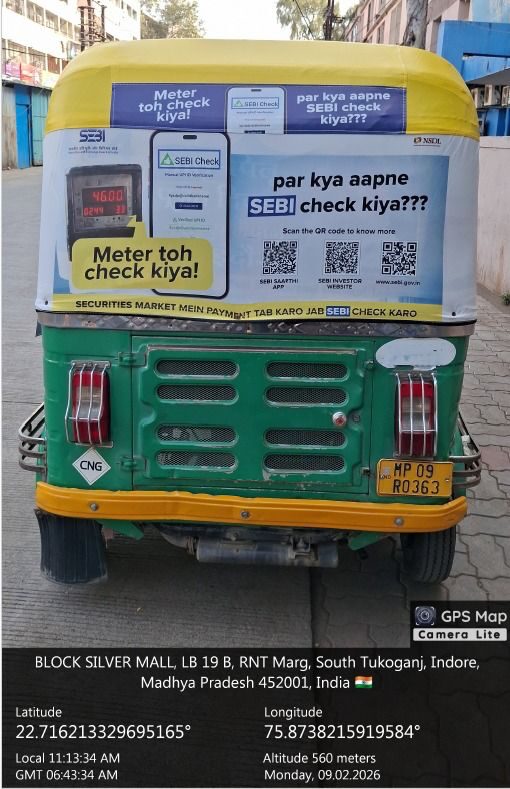

In February 2026, the Securities and Exchange Board of India (SEBI), in partnership with the National Securities Depository Limited (NSDL), launched a nationwide public awareness campaign using 1,000 auto-rickshaws to champion investor verification. Spanning major cities including Mumbai, Delhi, and Varanasi, the initiative urges citizens to perform a “SEBI Check” before making any securities market payments to shield themselves from digital fraud.

By turning these ubiquitous three-wheelers into mobile information hubs, regulators are ensuring that the message of financial safety reaches retail investors directly on the streets, emphasizing the verification of UPI IDs and intermediary credentials before any funds change hands.

From Fare Meters to Financial Safety

The campaign creatively taps into the common urban experience by adapting the well-known commuter phrase, “Meter toh check kiya”. By posing the question, “Par kya aapne SEBI Check kiya?”, the initiative draws a relatable parallel between checking a rickshaw’s fare and verifying critical financial details.

Each branded vehicle serves as a moving billboard equipped with QR codes that link commuters and pedestrians to the SEBI Saathi app, the SEBI Check portal, and the official SEBI Investor website. This strategic presence in high-footfall areas across cities like Patna, Indore, and Coimbatore aims to humanise regulatory advice, making the act of verification as instinctive and routine as starting a daily commute.

Bridging the Gap in Digital Vigilance

This on-ground activation is a vital component of a broader effort by SEBI and NSDL to curb the rising tide of digital payment-related fraud and build deeper trust in market processes. By embedding investor education into a familiar and highly visible mode of transport, the campaign moves beyond traditional digital and print channels to reach those who may be most vulnerable to fraudulent schemes.

The objective is to normalise financial vigilance as a standard part of everyday decision-making, providing retail investors with direct access to authentic resources and registered intermediary information. This proactive outreach ensures that the path to market participation is paved with transparency and informed caution.

The Logical Indian’s Perspective

At The Logical Indian, we believe that true progress is achieved when every citizen is equipped with the tools to protect their hard-earned livelihood. SEBI’s innovative use of the humble auto-rickshaw—a symbol of the common person’s journey—to spread the message of financial safety is a heartening example of inclusive and empathetic governance.

By transforming complex verification into a simple, relatable habit, this campaign fosters a community built on awareness and mutual security. In our rapidly digitising world, such grassroots efforts are essential to ensure that no one is left behind or exploited. We must continue to champion initiatives that prioritise transparency and empower the individual through knowledge.