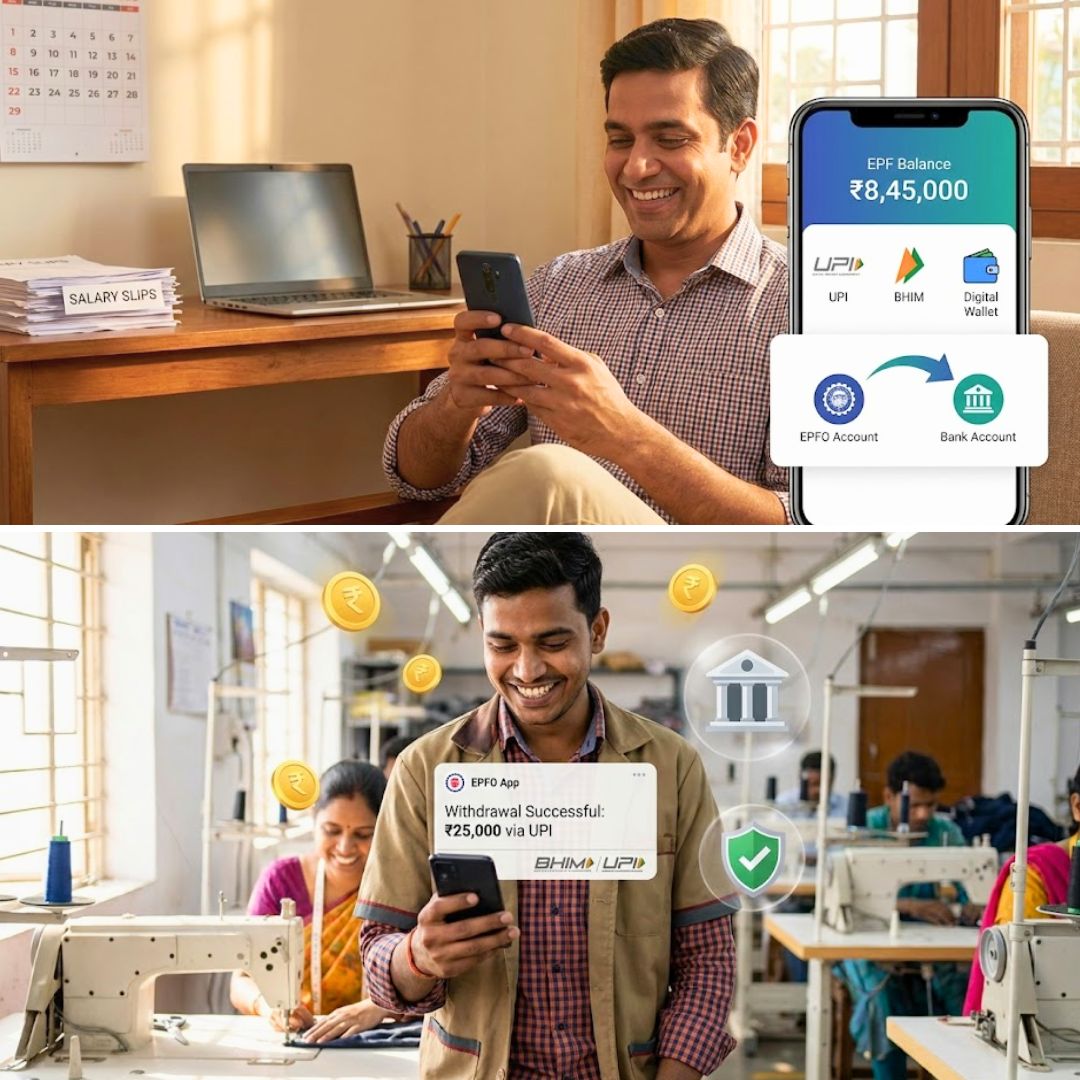

The Union Government is preparing to launch a dedicated Employees’ Provident Fund Organisation (EPFO) mobile application that will allow subscribers to withdraw a part of their provident fund savings directly through the Unified Payments Interface (UPI).

The app, expected to be rolled out by April 2026, will be separate from the existing UMANG platform and will be linked to users’ bank accounts as well as BHIM and other UPI apps. Officials say the new system will enable faster, paperless and more convenient transfers, allowing subscribers to withdraw up to 75 percent of their EPF balance while maintaining the mandatory 25 percent minimum.

With nearly 300 million registered EPFO members across the country, the initiative is being seen as a major step toward simplifying access to social security benefits and strengthening India’s digital financial ecosystem.

A Major Upgrade in Provident Fund Services

The EPFO, which manages retirement savings for millions of salaried Indians, is set to undergo a significant technological transformation with the introduction of its own standalone mobile application. According to senior officials familiar with the development, the app has completed its testing phase and is expected to become operational by the end of March or early April this year.

Unlike the current system, where subscribers must rely on the UAN portal to initiate withdrawals, the new platform will allow users to transfer funds directly into their bank accounts through UPI-linked services.

“This will allow EPFO subscribers to transfer funds from their EPFO account to their respective bank accounts…and then the withdrawal could be done through UPI,” an official explained while requesting anonymity. The aim is to create a smoother, faster, and more user-friendly process that removes unnecessary procedural hurdles and reduces dependence on lengthy paperwork.

The proposed app will function independently of the UMANG application, which currently provides access to a variety of government services, including EPF-related features. By designing a platform exclusively for provident fund transactions, the EPFO hopes to offer a more focused and efficient experience to its members.

Officials have indicated that the application will be linked with BHIM and other popular UPI apps, making it easier for subscribers to manage their funds using familiar digital tools. The integration with India’s well-established UPI infrastructure is expected to ensure quick settlements, real-time transfers and greater transparency in transactions.

How the New System Will Work

Under the existing rules, EPFO members are required to retain at least 25 percent of their provident fund savings as a minimum balance. The upcoming app will continue to follow this regulation, allowing subscribers to withdraw up to 75 percent of their total EPF corpus through the UPI-enabled platform.

This means that a worker facing an urgent financial need will be able to access a substantial portion of their savings almost instantly, without having to navigate complicated procedures or wait for days for approvals. In the event of unemployment or job loss, however, the remaining 25 percent can only be withdrawn after a period of 12 months, in keeping with current EPFO norms.

At present, although online withdrawals are possible through the UAN portal, the process is often considered time-consuming and less intuitive for many users. The absence of a UPI-based withdrawal option has also limited the convenience factor for subscribers accustomed to instant digital payments.

The new initiative seeks to address these gaps by bringing EPFO services closer to everyday banking experiences. Officials believe that this upgrade will particularly benefit young workers and first-time EPF users, who prefer mobile-first solutions over traditional bureaucratic systems.

The scale of the EPFO ecosystem makes this change even more significant. The organisation reportedly manages a total corpus of nearly Rs 26 lakh crore, with around 7.5 crore active contributing members and close to 300 million overall subscribers.

Given these numbers, even small improvements in efficiency can have a massive impact on financial inclusion and ease of living for Indian workers. By leveraging UPI a system already trusted by millions the government hopes to modernise one of the country’s largest social security institutions.

The Logical Indian’s Perspective

The proposed EPFO mobile app represents a meaningful step toward making public services more accessible, transparent and citizen-centric. For decades, provident fund savings have acted as a critical financial safety net for salaried individuals, especially during emergencies such as medical crises, education expenses, or unexpected job loss. Enabling instant access to these funds through a simple UPI-based mechanism acknowledges the real-life needs of workers and respects their right to convenient financial services.

At the same time, the retention of safeguards like the mandatory 25 percent balance reflects a balanced approach that protects long-term retirement security. While quick access to savings is important, it is equally necessary to ensure that provident fund accounts do not get depleted prematurely. The success of this initiative will depend on how well the EPFO communicates these rules to subscribers and ensures that digital literacy gaps do not exclude vulnerable sections of the workforce.