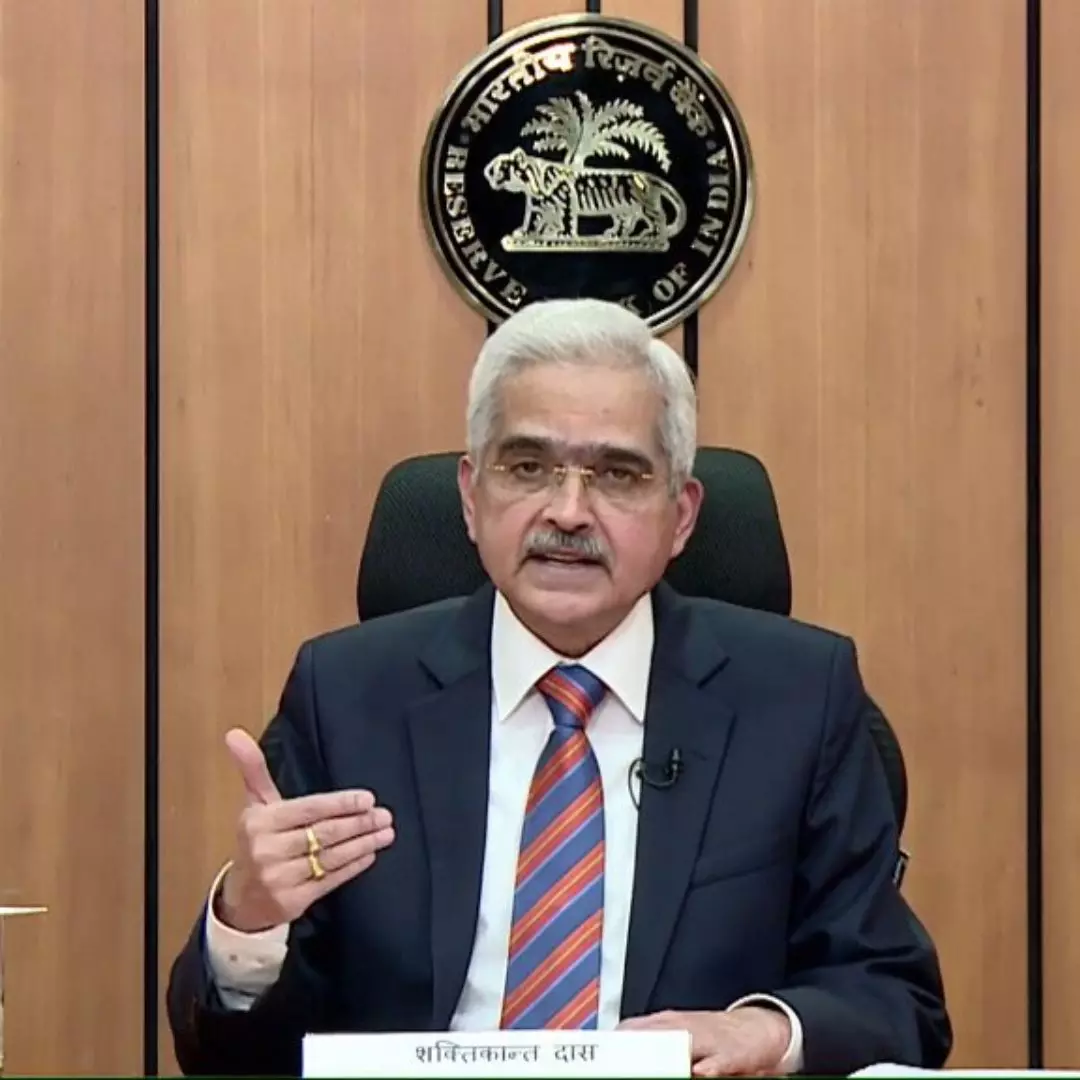

The Reserve Bank of India (RBI) has maintained its key lending rate at 6.5% for the tenth consecutive time, as announced by Governor Shaktikanta Das following the Monetary Policy Committee (MPC) meeting. This decision aims to balance inflationary pressures and robust domestic growth while addressing global economic uncertainties, including rising oil prices due to geopolitical tensions. The RBI’s focus remains on keeping inflation within its target range, with experts predicting potential easing only in December.

Monetary Policy Decision Amid Economic Pressures

During the three-day MPC meeting, Governor Das highlighted that the standing deposit facility (SDF) rate is unchanged at 6.25%, and the marginal standing facility (MSF) and Bank Rate remain at 6.75%. The RBI’s decision comes against a backdrop of an inflation target of 4% and a real GDP forecast of 7.2% for FY25. Despite recent declines in inflation rates, concerns persist about its sustainability, particularly with rising crude oil prices impacting domestic trade and inflation levels124.

Real GDP grew by 6.7% in the first quarter of this financial year, 2024-25. The share of investment in GDP reached its highest level since 2012-13. The govt expenditure has contracted during the first quarter: @RBI Governor Shaktikanta Das pic.twitter.com/ASF6Umbygv

— DD India (@DDIndialive) October 9, 2024

Contextual Background on Interest Rates

The RBI’s repo rate has remained unchanged since February 2023, reflecting a cautious approach in light of both domestic and global economic conditions. The MPC previously raised rates significantly in response to inflation spikes, but now aims for a ‘neutral’ stance to support growth while managing inflation risks. Recent data indicates a cooling economy, with indicators such as vehicle sales and GST collections showing declines, prompting discussions about the sustainability of India’s growth momentum345.

The Logical Indian’s Perspective

At The Logical Indian, we believe that maintaining economic stability is crucial for fostering social harmony and progress. The RBI’s cautious stance reflects a commitment to balancing growth with inflation control, which is vital for ensuring a thriving economy for all citizens. As we navigate these challenging times, how do you think the RBI’s decisions will impact your daily life? We invite our readers to share their thoughts and engage in constructive dialogue on this important issue.