Gold and silver prices collapsed sharply in early February 2026, with both metals shedding significant value on global exchanges and India’s MCX amid profit‑booking, macroeconomic pressures and policy uncertainty – even as experts urge long‑term investors to buy the dip.

According to a report in Mint, Gold and silver – long viewed as safe havens in times of uncertainty – experienced one of their sharpest corrections in recent memory over the past week, dragging global markets into turmoil.

On the Multi Commodity Exchange (MCX) in India, gold futures have fallen roughly 25–30 per cent from recent record highs, while silver futures plunged over 40 per cent from peak levels.

Domestic prices for 24‑carat gold dropped below ₹1.40 lakh per 10 g and silver breached crucial support zones around ₹2.5 lakh per kilogram, hitting lower circuit limits in futures trading as volatility spiked.

Analysts, traders and brokerage houses broadly link this dramatic drop to three core forces:

- Profit‑booking after record rallies: Both metals had surged to unprecedented highs in late January, prompting traders to lock in gains as prices turned volatile.

- Stronger US dollar and macro pressure: Renewed strength in the US dollar – partly tied to global monetary expectations, including leadership changes at the Federal Reserve – made dollar‑priced bullion relatively more expensive for foreign buyers.

- Margin hikes and technical unwind: Exchanges like CME raised margin requirements for commodities futures, pushing leveraged traders to exit positions, which accelerated the sell‑off.

Beyond bullion, broader commodities and equities also felt the shock: copper and other base metals fell sharply, and global stock indices stumbled on mounting risk aversion.

Financial markets in India reacted strongly to these developments. While gold and silver fell, the Sensex saw volatility, rising sharply at points as investors rotated into equity assets and away from beaten‑down metals.

Voices from the Market: Experts and Analysts Weigh In

Market participants are divided over whether this plunge is a temporary correction or signals deeper structural change.

Rahul Kalantri, Vice‑President of Commodities at Mehta Equities, explained that price declines were “supported by a stronger dollar, higher Treasury yields and upbeat economic data,” reflecting global market dynamics rather than a fundamental loss of interest in bullion.

Similarly, many technical analysts described featured selling as a “blow‑off top correction” – a technical reversal after an overextended rally where prices rapidly collapse as traders exit leveraged positions.

Market expert Ponmudi R, CEO of Enrich Money, characterised silver’s fall as an example of volatility‑driven unwinding rather than structural weakness.

Meanwhile, long‑term forecasts from global institutions like J.P. Morgan have remained relatively upbeat on gold’s prospects, predicting strong demand from central banks and investors that could push prices toward historic highs again by year‑end despite the current downturn.

In interview segments, some advisors argue that a balanced 10–15 per cent allocation to precious metals remains appropriate within diversified portfolios – offering hedge value during macroeconomic stress even as prices swing wildly.

Budget, Policy and Domestic Demand: The Indian Angle

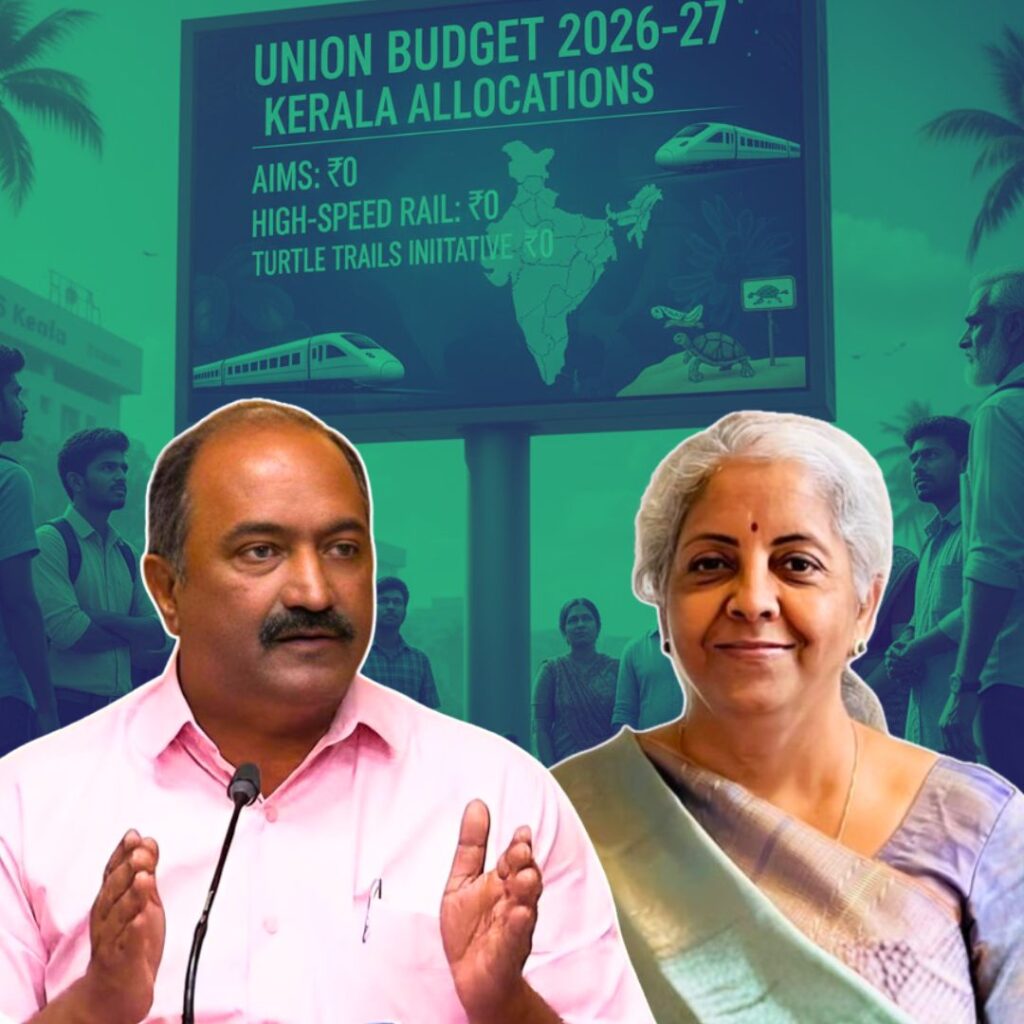

In India, the precious metals correction coincided with the Union Budget 2026‑27 presentation, prompting traders and jewellers to watch for potential policy shifts.

On the budget day, gold and silver prices saw heightened volatility: both futures hit lower circuit limits as markets incorporated Budget news and global price moves.

Jewellery associations and traders had eyed potential cuts to import duty and GST as measures that could improve affordability and rejuvenate domestic demand. However, the absence of immediate policy changes in the Budget left markets without a clear catalyst, amplifying speculative pressure.

Across key Indian cities, the impact is tangible: jewellers reported swift intra‑day price swings that made valuation and sales planning difficult, particularly for small and medium enterprises reliant on stable bullion prices for inventory decisions.

Contextualising the Crash: From Rally to Correction

To understand why this downturn feels so dramatic, it helps to look back at recent market behaviour. In late 2025, precious metals were on an uptrend fuelled by global uncertainties, inflation concerns and sustained demand from central banks and retail investors.

Silver even crossed ₹4 lakh per kilogram on the MCX in late January, while gold hovered near all‑time highs above ₹1.7 lakh per 10 g.

But such parabolic moves often attract leveraged trading, where borrowed money plays a large role. Once price momentum slows or reverses – as occurred with margin hikes and a stronger dollar – forced liquidations at key technical levels can trigger rapid declines that overshoot normal corrective ranges.

This pattern is reminiscent of past commodity cycles, where markets oscillate between exuberant buying and swift corrections – underscoring the importance of risk management and diversification for investors.

The Logical Indian’s Perspective

The recent precious metals crash is a powerful reminder that no asset class is immune to volatility, not even those traditionally perceived as safe havens. While corrections can create buying opportunities for disciplined long‑term investors, they can also inflict sharp losses on those driven by short‑term speculation or herd behaviour.

At The Logical Indian, we see this as more than a financial story – it’s a lesson in financial literacy, risk awareness and informed decision‑making. As communities increasingly engage with markets, understanding the difference between trend fluctuation and structural change is vital.

We also empathise with ordinary savers and small traders who may feel shaken by dramatic price swings. Markets can test patience and resolve, but they also offer teaching moments – about patience, diversified planning, and the value of thoughtful dialogue over emotional reactions