As Union Finance Minister Nirmala Sitharaman presented the Union Budget 2026–27, she focused on a strategic balance between accelerating growth and easing the financial burden on the middle class.

This budget marks her record ninth presentation, aiming to support industry, boost household sentiment, and ensure inclusive development.

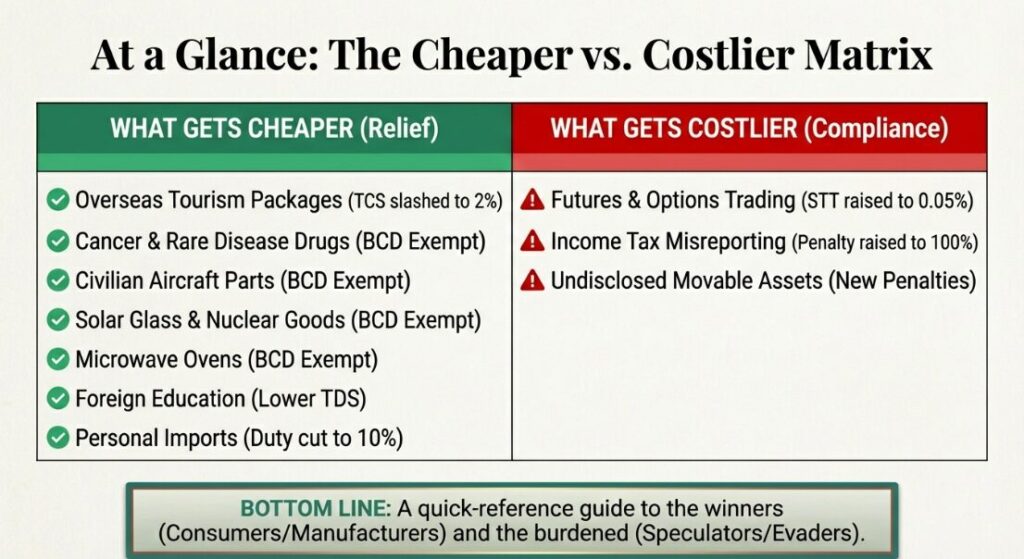

While the government has slashed duties on several essential goods and services, it has also tightened the screws on tax compliance and speculative trading. Here is a comprehensive breakdown of what becomes cheaper and what will cost you more after the Budget 2026 announcements.

What Gets Cheaper?

The Union Budget 2026 has introduced several duty cuts and tax rationalizations to improve the spending power of the growing middle class. From foreign trips to kitchen appliances, here is what is now more affordable.

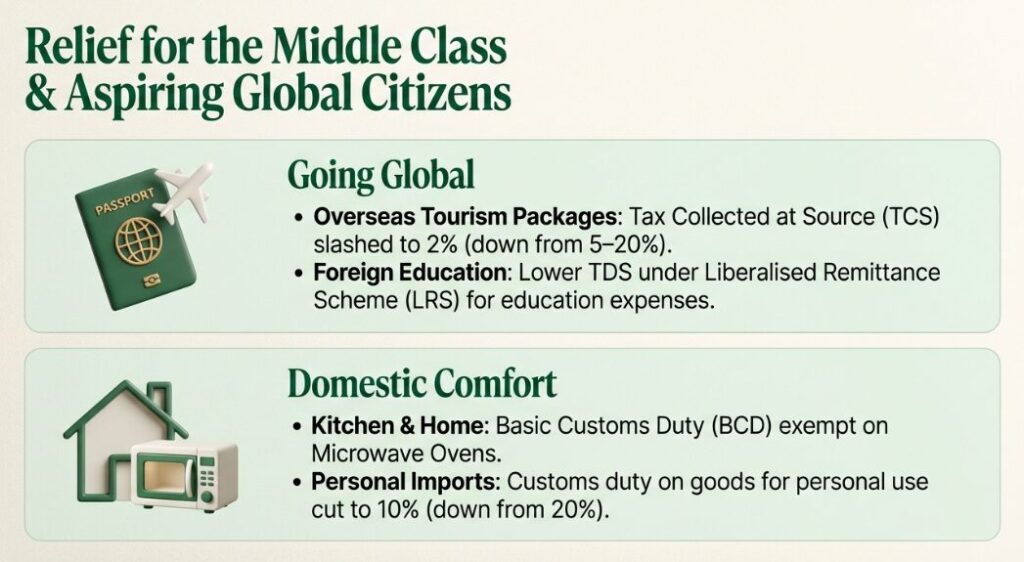

1. Overseas Travel and Foreign Education

If you are planning a vacation abroad or have children studying in foreign universities, this budget brings significant relief.

- Overseas Tourism Packages: The Tax Collected at Source (TCS) has been slashed from a range of 5–20% down to just 2%. This move makes foreign holidays significantly more affordable for families.

- Foreign Education: Students benefit from lower Tax Deducted at Source (TDS) under the Liberalised Remittance Scheme (LRS) for education-related payments, easing the financial load on those pursuing degrees abroad.

2. Healthcare and Life-Saving Drugs

Affordability in healthcare remains a key priority for the government.

- Cancer and Rare Diseases: The budget provides a full Basic Customs Duty (BCD) exemption on drugs used to treat rare diseases and cancer, making these life-saving treatments more accessible to the public.

3. Household Essentials and Personal Imports

- Microwave Ovens: These kitchen appliances are now exempt from Basic Customs Duty, which is expected to lower retail prices for domestic consumers.

- Personal-Use Imports: For those who frequently order goods from abroad for personal use, the customs duty has been halved from 20% to 10%.

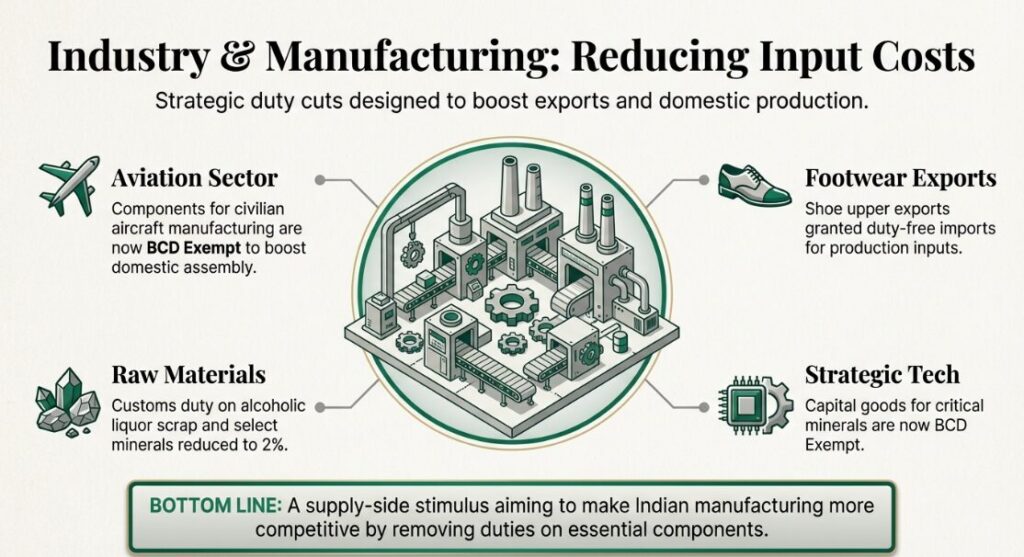

Manufacturing & Green Energy

A major theme of Budget 2026 is lowering costs for growth-driving sectors like manufacturing and clean energy.

Support for Industry and Exports

- Civilian Aircraft Manufacturing: Components and parts for manufacturing civilian aircraft are now exempt from BCD, a move designed to boost India’s domestic aviation sector.

- Shoe Upper Exports: To support the export market, duty-free imports are now allowed for production related to shoe upper exports.

- Minerals and Scrap: Customs duty on alcoholic liquor scrap and certain minerals has been reduced from 5% to 2%.

The Push for Clean Energy

To support India’s transition to a greener economy, several exemptions were announced:

- Energy Transition Equipment: This equipment is now exempt from Basic Customs Duty.

- Solar Glass: Ingredients used in the manufacturing of solar glass are now BCD exempt, lowering costs for the domestic solar industry.

- Nuclear Power Projects: Goods imported for nuclear power projects also receive a BCD exemption to aid large-scale infrastructure.

What Gets Costlier?

While many sectors saw tax relief, the government has taken a firm stance against tax evasion and speculative market activities.

1. Stock Market and Derivatives Trading

Active traders in the stock market will feel the pinch this year.

- STT Hike: The Securities Transaction Tax (STT) on stock options and futures trading has been raised from 0.02% to 0.05%.

- Market Impact: Following this announcement, major indices like the Sensex and Nifty saw significant plunges as investors reacted to the increased cost of trading.

2. Income Tax Penalties and Disclosure

The government has signaled zero tolerance for tax non-compliance through heavy penalties.

- Income Tax Misreporting: If you are found misreporting your income, the penalty has been increased sharply to 100% of the tax amount.

- Movable Assets: For the first time, the non-disclosure of movable assets will attract a penalty, further expanding the compliance net for taxpayers.

Economic Context and Conclusion

The Union Budget 2026 arrives at a time of global uncertainty and a projected domestic GDP growth of 6.8% to 7.2% for FY27. By reducing duties on critical minerals, healthcare, and green energy, the government aims to fuel the next phase of India’s growth.

In summary, while households, students, and travelers enjoy tangible relief, market participants and non-compliant taxpayers will face higher costs. The budget successfully balances the need for industrial reform with the necessity of maintaining strict financial discipline.

The Logical Indian’s Perspective

At The Logical Indian, we believe the true measure of any economic policy lies in its empathy toward the common citizen and its commitment to a harmonious future.

By slashing duties on life-saving cancer drugs and rare disease treatments, the Union Budget 2026 chooses humanity and kindness over mere revenue collection, ensuring that healthcare becomes a right rather than a privilege for the few.

#WATCH: FM @nsitharaman presents the Union Budget 2026-27 in the #LokSabha

— DD News (@DDNewslive) February 1, 2026

LIVE: https://t.co/og5kOntUZc@FinMinIndia @nsitharamanoffc #Budget2026 #Budget #ViksitBharatBudget #Budget2026onDD pic.twitter.com/IVvx5b5OV0