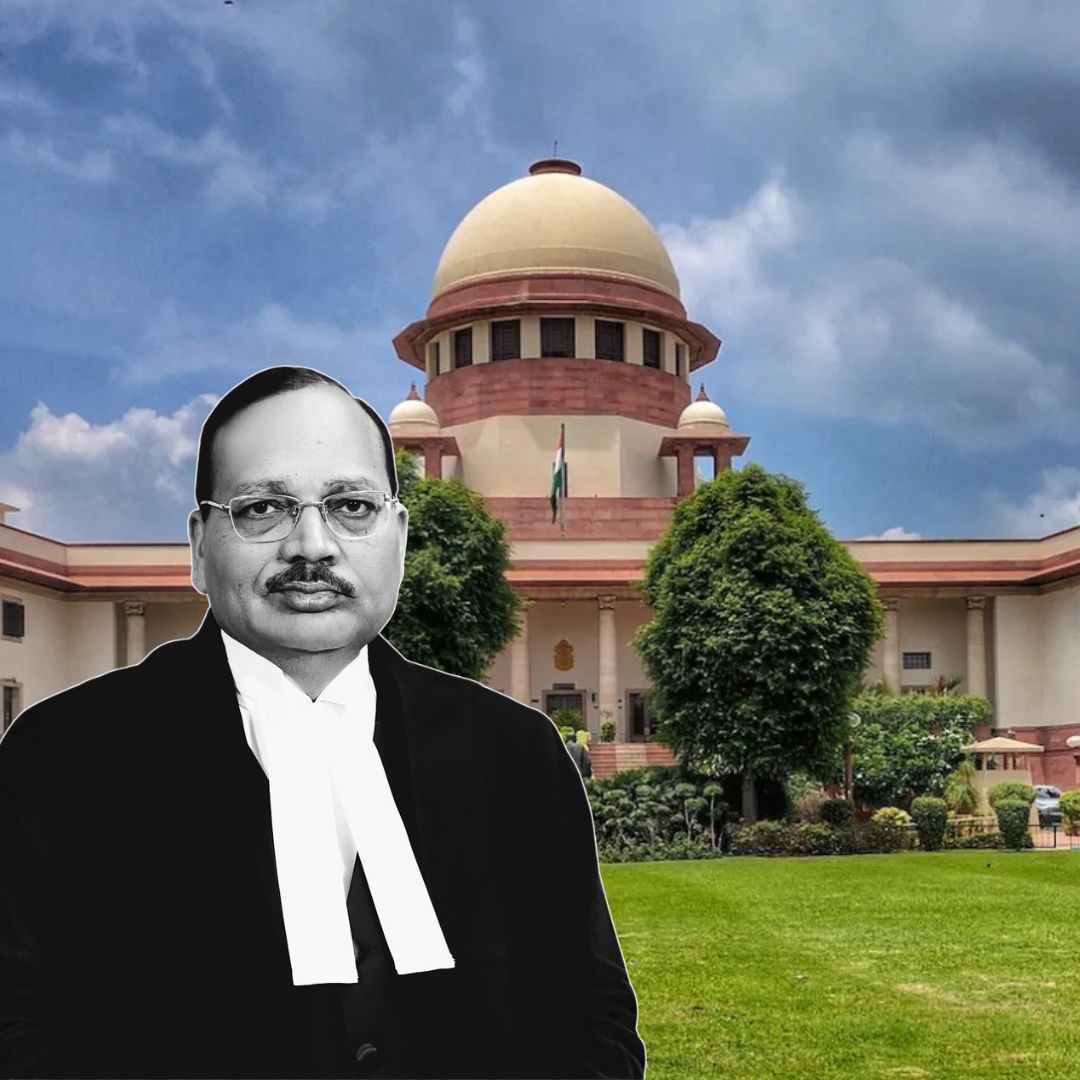

In a landmark ruling on December 5, 2025, the Supreme Court of India, led by Chief Justice Suryakant and Justice Joymalya Bagchi, emphatically declared that temple money belongs exclusively to the deity and cannot be diverted to rescue financially struggling cooperative banks in Kerala.

The judgment came on pleas by Mananthawady Co-operative Urban Society Ltd and Thirunelly Service Cooperative Bank Ltd, which sought to challenge a Kerala High Court directive mandating five local cooperative banks to repay matured fixed deposits to Thirunelly Devaswom within two months and transfer remaining funds to nationalised banks for better financial security.

The apex court dismissed these pleas, underscoring that temple funds are sacred offerings from devotees and must be safeguarded and utilised only for temple-related interests.

The Reserve Bank of India’s warnings on cooperative bank instability were cited as a key concern, with the court allowing banks to seek repayment extensions through the High Court but firmly barring temple funds from becoming a survival source for banks. No further appeals or developments have been reported since the ruling.

Sanctity of Deity’s Funds: A Legal and Moral Imperative

Chief Justice Suryakant’s statement during the judgment crystallised the court’s position: “Temple money, first of all, belongs to the deity. So therefore, this money has to be saved, protected and utilised only for the interest of the temple. It can’t become a source of income or survival for a cooperative bank.”

This declaration reiterates the constitutional and religious principle that offerings made by devotees are not private or commercial funds but sacred trusts held on behalf of the deity, thereby enjoying special protection under Indian law.

The bench recognised the legal personality of a deity under the Hindu Religious and Charitable Endowments Act, granting the deity rights to hold property, including monetary assets.

The court stressed the responsibility of temple authorities and custodians to ensure these funds sustain temple operations, maintenance, worship, and welfare activities for devotees and pilgrims, rather than being risked in the precarious financial milieu of cooperative banks flagged by the RBI.

Banks opposing the directive claimed that the Kerala High Court’s two-month repayment order imposed undue hardship amid liquidity constraints and sought leniency.

However, the Supreme Court countered that the responsibility to preserve depositor trust lies squarely with the banks and that temple funds are inviolable assets not to be exploited for bank bailouts.

The court cautioned that cooperative banks must restore credibility and attract new deposits by sound management practices rather than tapping into religious funds.

Context and Consequences: The Cooperation Bank Saga

This legal battle originated when Thirunelly Devaswom, responsible for managing the famous Thirunelly Temple in Kerala, deposited substantial funds in local cooperative banks to earn comparatively higher interest income.

However, concerns arose when these cooperative banks, including Thirunelly Service Cooperative Bank Ltd, Mananthawady Co-operative Urban Society Ltd, and others, began experiencing financial stress, prompting the Reserve Bank of India to issue warning notices about their stability.

On maturity, when the temple funds became due, these banks hesitated or refused to repay with assurances of extended repayment timelines, triggering concern among temple authorities.

The Kerala High Court intervened to protect the temple’s interests by ordering the repayment of matured deposits within two months and advising that any further temple funds be shifted to nationalised banks known for stability and regulatory robustness.

The Supreme Court’s affirmation of this order sends a powerful message across India’s religious and financial sectors: temple monies are communal assets meant to serve sacred and social objectives and are not fodder for risky financial experiments or bank survival strategies.

This ruling aligns with established precedents that prioritize preservation of religious endowments for worship and community service, rejecting their subversion for external financial rescues.

The Logical Indian’s Perspective

This landmark judgment underscores the vital principle that religious faith contributions deserve utmost respect, protection, and transparency. It strengthens public confidence that sacred offerings will neither be compromised for commercial gain nor extorted for external bailouts. Upholding the deity’s ownership protects not only religious sentiments but also the social fabric of faith communities whose wellbeing depends on honest temple administration.

Moreover, the court’s insistence on cooperative banks restoring operational credibility rather than exploiting temple funds encourages responsible governance and financial prudence. It implicitly calls for enhanced regulatory oversight of cooperative financial institutions to prevent similar crises that threaten public trust.

The Logical Indian views this ruling as a meaningful stride toward balance one that blends devotion with accountability, faith with financial wisdom, and spirituality with societal responsibility. Our stand is clear: protecting sacred resources fosters harmony and nurtures empathy among all stakeholders.