The EPFO introduced new rules in 2025 extending the final settlement periods for provident fund withdrawals to 12 months of unemployment and pension withdrawals to 36 months. While members can immediately withdraw up to 75% of their PF balance upon job loss, they must retain a minimum of 25% until full withdrawal is permitted.

The changes have triggered anger among workers and unions who fear financial hardships during prolonged unemployment. EPFO and the Ministry of Labour defend the rules as necessary to protect long-term retirement corpus and reduce premature withdrawals, promoting better financial security. Simplified withdrawal categories and relaxed documentation also accompany the reforms.

What is EPFO?

The Employees’ Provident Fund Organisation (EPFO) is a statutory body under the Ministry of Labour and Employment, Government of India, established in 1951 to manage social security schemes for employees in the organised sector.

EPFO administers provident funds, pension schemes, and insurance benefits, ensuring retirement savings and social welfare for millions of workers nationwide. Its governance is vested in the Central Board of Trustees, which includes government, employer, and employee representatives.

The organisation operates through zonal and regional offices staffed by commissioners and enforcement officers who oversee contributions, claims, compliance, and member services. EPFO has embraced digitalisation with initiatives like the Universal Account Number (UAN) system that streamlines account management and improves accessibility for beneficiaries.

Extended Waiting Periods and Withdrawal Changes

Under the new policy, members can access 75% of their PF balance immediately after leaving a job, with the rest locked in for up to 12 months of unemployment before full withdrawal is allowed. Pension withdrawals now require a longer wait of 36 months.

The waiting period was increased from 2 months to discourage premature withdrawals that diminish retirement savings. The withdrawal framework was simplified from 13 categories to just three, Essential Needs (illness, education, marriage), Housing Needs, and Special Circumstances, to streamline processes. The minimum service period for partial withdrawals has been standardised to 12 months, easing access under specific conditions such as medical emergencies and housing needs.

While the PF account continues to earn interest at 8.25% annually during the lock-in, workers worry about delayed access to funds during financial crises.

Background and Official Responses

The changes were approved by EPFO’s Central Board of Trustees following data showing many members had inadequate retirement savings due to early withdrawals. Officials argue that extending the final settlement period reduces service discontinuities and helps build a stronger pension corpus, critical for securing workers’ futures. Nearly 75% of members reportedly had less than Rs 50,000 in their PF accounts upon settlement.

The government highlights enhanced ease in withdrawal processes, including relaxed documentation and increased digitalisation for faster claims, as balancing immediate liquidity needs with long-term social security. These rules aim to increase financial discipline while providing limited flexibility to address emergencies responsibly.

Backlash and Clarifications

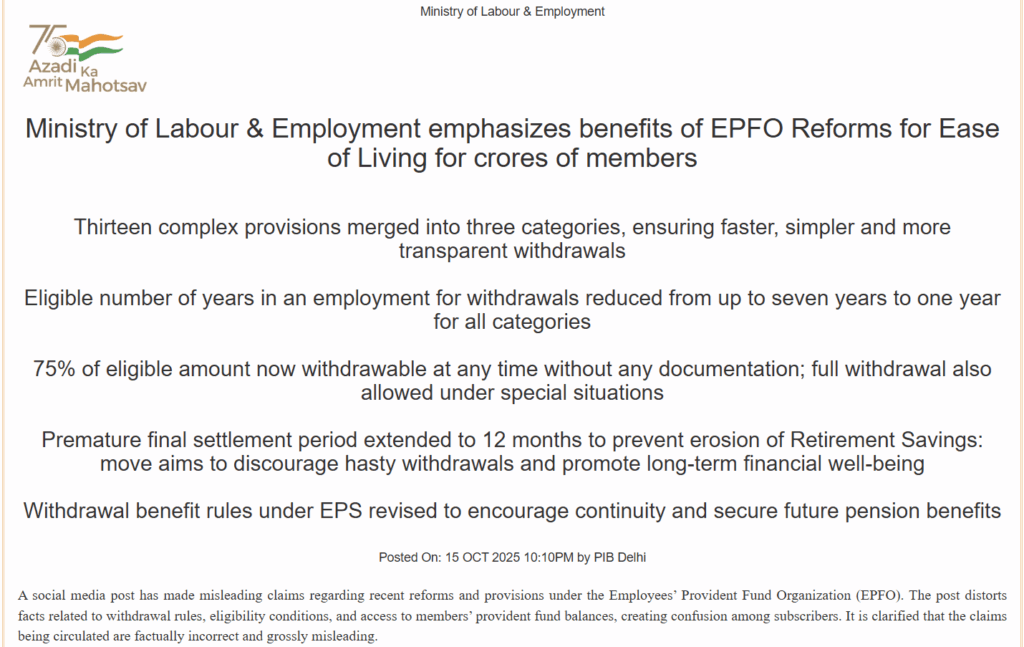

The new EPFO withdrawal rules triggered significant backlash from opposition leaders, workers, and social media users, who criticised the extended waiting periods and the mandate to maintain a 25% minimum balance in PF accounts as unfair restrictions on employees’ access to their own money. Opposition voices described the amendments as “open theft” of hard-earned savings. In response, the Ministry of Labour and Employment and EPFO issued clarifications refuting these claims, calling the circulating information “factually incorrect and grossly misleading.”

The Ministry emphasized that 75% of the PF balance can be withdrawn immediately after leaving a job, while the remaining 25% can be fully withdrawn after 12 months of continuous unemployment. The extended timelines aim to prevent frequent premature withdrawals that previously eroded pensions and leave members with insufficient retirement savings.

The government highlighted that these reforms simplify withdrawal categories, ease documentation requirements, and balance immediate liquidity needs with long-term financial security for workers and their families.

The new EPFO withdrawal rules are unfair and unacceptable.

— Jothimani (@jothims) October 16, 2025

Forcing employees to stay jobless for 1 year to withdraw their own PF, and 3 years for pension, is cruel.

EPF is workers’ hard-earned savings, not Govt money.

I’ve written to the Hon Minister for Labour and Employment… pic.twitter.com/Mea4dFUggQ

Don’t fall for myths! 🚫

— EPFO (@officialepfo) October 15, 2025

Contrary to rumours, the new EPF rules do not stop employees from accessing their money.

✅ Members can withdraw up to 100% of their eligible EPF balance (excluding the mandatory 25% minimum balance)after 12 months of service for purposes like:

🏠… pic.twitter.com/NVBPZatpFy

The Logical Indian’s Perspective

While safeguarding retirement funds is crucial, The Logical Indian stresses that policies must also address the immediate financial challenges faced by unemployed and vulnerable workers.

Prolonged delays in fund access can exacerbate hardships unless supplemented by robust social safety nets. Simplifying EPFO processes is a move forward, yet empathetic governance must ensure workers retain dignity and financial health both today and tomorrow.

Constructive dialogue between policymakers, employees, and unions is essential to refine these rules to secure present needs without compromising future security.

A unified and simplified EPF framework that balances immediate financial access with long-term protection. pic.twitter.com/7E7XJSMqau

— Ministry of Labour & Employment, GoI (@LabourMinistry) October 17, 2025