Indians lost an estimated ₹7,000 crore to online scams in the first five months of 2025, according to the Indian Cyber Crime Coordination Centre (I4C) under the Ministry of Home Affairs (MHA).

These scams ranging from investment cons and fake job offers to digital arrest frauds were traced mainly to operations in Southeast Asia, largely run by Chinese-controlled syndicates.

Many of these cybercrime rings exploit trafficked individuals, including Indians forced to work in scam compounds.

Responding to this alarming surge, Indian banks are now mandated by the Reserve Bank of India (RBI) to deploy a real-time Fraud Risk Intelligence (FRI) system, while cyber experts urge citizens to adopt stronger digital hygiene practices and report suspicious activities promptly.

A Monthly Loss of ₹1,000 Crore and Counting

The financial impact has raised red flags across the country: ₹1,192 crore was lost in January, ₹951 crore in February, followed by nearly ₹1,000 crore monthly through May.

Fraudsters deploy a variety of techniques social engineering, fake apps, phishing alerts, and impersonation that target people with urgent-sounding threats or lucrative returns. Digital arrest scams, for example, have led to over ₹210 crore in losses in 2025 alone.

These cyber schemes are increasingly sophisticated and manipulative, targeting both rural and urban populations. Authorities warn that at the current trend, total losses could exceed ₹1.2 lakh crore by year-end unless immediate preventive action is taken.

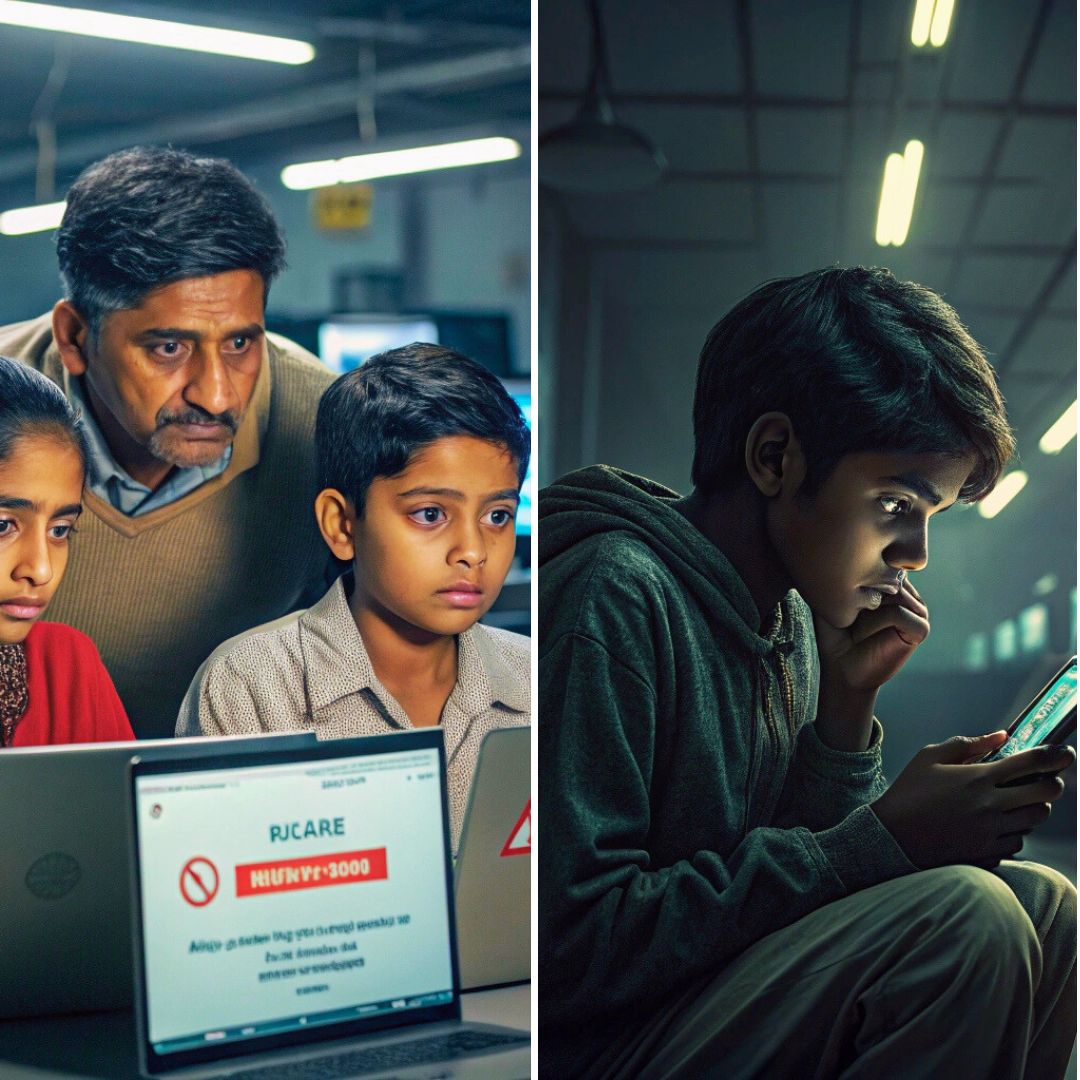

Expert Advice: Simple Habits to Stay Safe Online

With online scams growing in scale and sophistication, staying safe online requires more than just caution it requires conscious daily habits. Here are some expert-recommended practices that every internet user should follow to reduce the risk of cyber fraud:

1. Don’t Trust, Verify: Be wary of unsolicited calls, messages, or emails claiming urgent action is needed whether it’s about a pending legal case, blocked bank account, or too-good-to-be-true deals. Always pause and verify through official websites or customer care channels before responding.

2. Protect Your Personal Information: Never share sensitive details like OTPs, bank account numbers, passwords, or Aadhaar information over phone calls, messages, or unfamiliar websites. Genuine institutions never request such data through these channels.

3. Use Strong Passwords and Two-Factor Authentication (2FA): Set unique passwords for different accounts and update them regularly. Wherever possible, enable 2FA for an added layer of security, especially for banking, email, and financial apps.

4. Download Apps and Software Only from Trusted Sources: Avoid installing applications from unofficial links or third-party app stores. Stick to recognised platforms like Google Play Store or Apple App Store to minimise the risk of malware and fake apps.

5. Be Cautious When Making Online Payments: Before transferring any money, especially for job offers, investment schemes, or purchases from unknown sellers, research the platform or individual thoroughly. Look for verified reviews and double-check payment requests.

6. Stay Informed and Keep Devices Updated: Cybercriminals often exploit outdated apps or software with security vulnerabilities. Regularly update your device and stay informed about trending scams by following trusted cybersecurity advisories.

7. Report Suspected Fraud Immediately: If you suspect that you’ve encountered or fallen prey to a scam, act quickly. Report via the national cybercrime helpline 1930 or file an online complaint at cybercrime.gov.in. Early reporting can often help in freezing fraudulent transactions and limit further damage.

Being alert and informed is the strongest defence against cybercrime. Small efforts in digital awareness today can prevent significant losses tomorrow for yourself and those around you.

Scam Factories Abroad, Recruited from Back Home

Investigations tie more than half of these scams to transnational crime syndicates operating out of Cambodia, Myanmar, Laos, Vietnam, and Thailand.

These criminal gangs run fortified premises where trafficked workers often lured from India on false job promises are forced to conduct scams.

Recruiters in Indian states like Maharashtra, Tamil Nadu, Uttar Pradesh, Delhi, and Jammu & Kashmir play a key role in facilitating their travel.

The Indian government, along with law enforcement agencies, has launched crackdowns on fraudulent recruiters and is working with foreign governments such as Cambodia to address cross-border cybercrime. At least 45 scam centres have been identified in Cambodia alone.

RBI’s Real-Time Fraud Monitoring Push

In a significant move toward consumer protection, the RBI has directed all banks to fully implement the Fraud Risk Intelligence (FRI) system by 30th June 2025.

This system will help banks detect, flag, and block suspicious transactions in real time, using data integration between telecom operators and financial institutions.

The RBI is also working to make online fraud reporting simpler through unified platforms and has called for a “coordinated response mechanism” across banks.

Financial institutions have been asked to prioritise cyber education, set up dedicated fraud management teams, and enhance multilingual support for fraud victims.

The Logical Indian’s Perspective

The ongoing surge in online scams is a serious consumer safety crisis one that calls for collective vigilance, stronger institutional response, and a humane approach toward victims who are often misled or trafficked.

While government initiatives and expert advice provide a crucial first line of defence, the broader community including tech firms, internet users, and regulators must unite to foster a digital environment based on trust, transparency, and ethical use. We urge our readers to be cautious, conscious, and compassionate.

In a world where even a call or a click can cause financial ruin, how can we make digital safety part of everyday conversation in our families, schools, and communities?