The ongoing Videocon Loan Case took a new turn when the Central Bureau of Investigation (CBI) Superintendent of Police Sudhanshu Dhar Mishra probing the Videocon loan case was transferred, further enhancing the veil of doubt. The transfer was allegedly consequence of an inquiry which unveiled that the officer could have leaked information linked to raids carried out last week and that the probe was marked by unnecessary delay, reported the Times Of India.

The sudden move of transferring Mishra also comes after senior minister Arun Jaitley expressed his concern over a list of top bankers named in the FIR. The minister said this amounted to ”investigative adventurism” and further said that the agency should keep its eye on the main target.

SP Sudhanshu was transferred to CBI’s Economic Offences Branch in Ranchi a day after he signed FIR Against Chanda Kochhar on January 22. He was earlier part of the Banking and Securities Fraud Cell (BSFC) of CBI in Delhi, reported The Indian Express.

The CBI accused Mishra, an Indian Revenue Service (IRS) officer of slugging the Chanda Kochhar probe, pointing at the preliminary enquiry was registered in December 2017. However, the investigation was kept pending unnecessarily. Mishra was replaced by another SP Mohit Gupta. He supervised the raids that took place on January 24.

Surprisingly, the CBI refused to provide a formal statement on the matter.

What Has Happened?

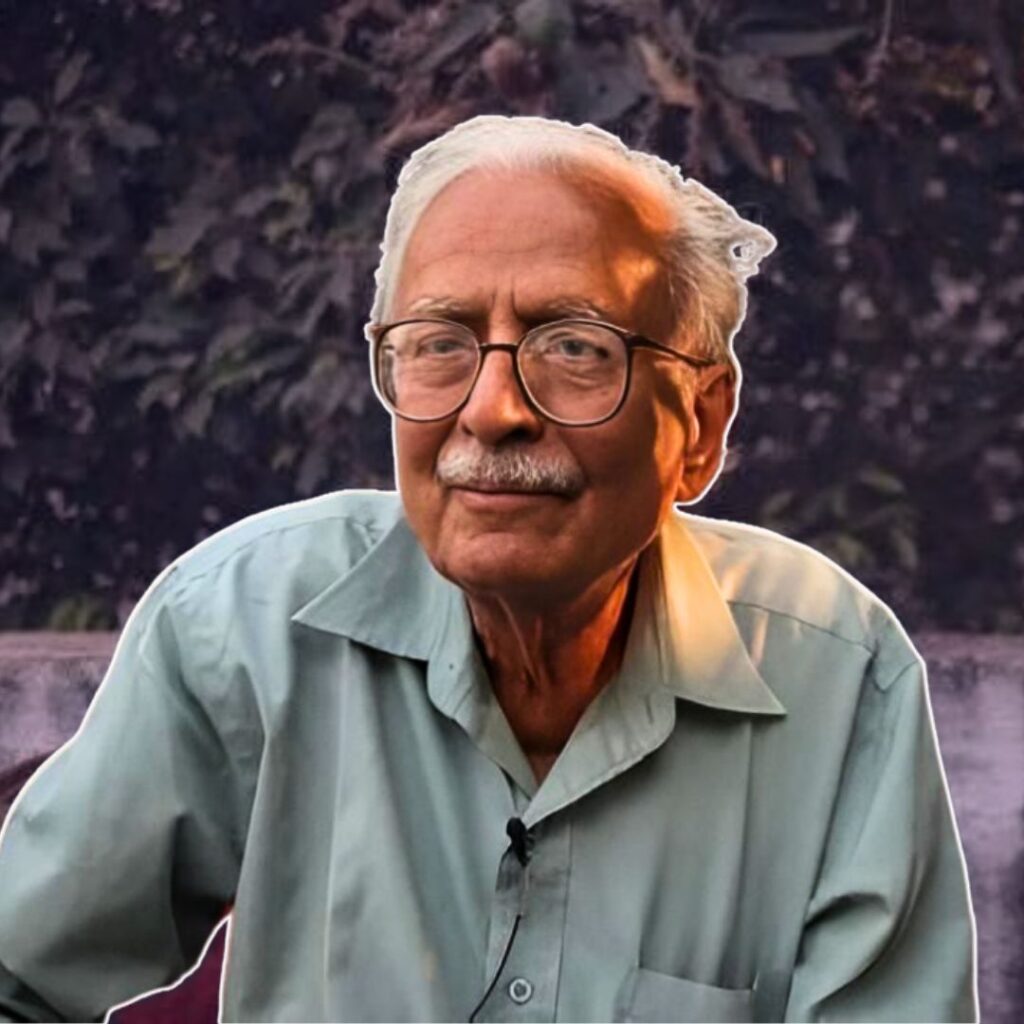

The CBI on January 24, 2019, booked ex ICICI MD and CEO Chanda Kochhar, her husband Deepak Kochhar and Videocon MD Venugopal Dhoot in the ICICI-Videocon cheating case, which led to a loss of Rs 1,730 crore to the bank. Chanda Kochhar led ICICI cleared six loans worth Rs 1875 crore.

CBI booked Chanda Kocchar on charges of criminal conspiracy, cheating and abuse of official position for “dishonestly sanctioning to the Videocon Group”, reported the Economic Times.

Kochhar, who resigned from the CEO posts of ICICI bank on October 2018, has been accused in the CBI FIR of allegedly receiving “illegal gratification through her husband, Deepak Kochhar, from Videocon MD VN Dhoot for sanctioning a term loan of Rs 300 crore to Videocon International Electronics Ltd”.

Apart from registering the First Information Report (FIR) in the ICICI-Videocon loan fraud case, the investigative agency also raided several locations. Of these Mumbai offices of Videocon, Deepak Kochhar’s NuPower Renewables, and Supreme Energy Pvt Ltd were on the top list.

The investigative agency has also mentioned several unknown public servants in the FIR. CBI further mentioned that senior banks officials such as former chairman KV Kamath (current president of New Development Bank), Sandeep Bakshi (current ICICI Bank MD), Sonjoy Chatterjee (CEO, Goldman Sachs India), Zarin Daruwala (CEO, Standard Chartered India), Rajiv Sabharwal (CEO, Tata Capital), Homi Khusrokhan, and K Ramkumar might also be probed related to the case, as they were in the sanctioning committee that cleared loans amounting to Rs 1,575 crore.

Quick Recap:

The ten-month-old report by The Indian Express says that Videocon chairman Dhoot started a joint company, NuPower Renewables Pvt Ltd (NRPL), with Deepak Kochhar and two of the latter’s relatives in December 2008. Dhoot had a 50% share in NRPL whereas the other 50% of shares were owned by Kochhar, and Pacific Capital, a company owned by his father and Chanda Kochhar’s brother’s wife.

After just a month, in January 2009, Dhoot resigned from the position of director of NRPL. He also went on to transfer his 24,999 shares in the company to Kochhar for Rs 2.5 lakh.

Additionally, Supreme Energy Private Limited, a company in which Dhoot reportedly has 99.9% stake, lent a loan of Rs 64 crore to NRPL, in March 2010 and by the end of the month, Supreme Energy went on to become 94.99 % shareholder in NRPL. This step was preceded by a series of transfer of shares first between Dhoot and Kochhar and later between Pacific Capital and Supreme Energy.

In November 2010, as per reports, Dhoot went on to transfer his entire shares in Supreme Energy to Mahesh Chandra Punglia, his associate.

Punglia transferred his holding in Supreme Energy to Pinnacle Energy, where Deepak Kochhar was the managing trustee. The total value of the transfer of shares amounted to Rs 9 lakh.

Supreme Energy then gave a loan of Rs 64 crore to NPRL and then got absorbed into Pinnacle Energy within three years.

As of March 2017, Registrar of Companies records says that Deepak Kochhar held an about 43.4% in NPRL both as direct holding and through Supreme Energy and Pinnacle Energy.

(function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = ‘https://web.archive.org/web/20201031190233/https://connect.facebook.net/kn_IN/sdk.js#xfbml=1&version=v3.2’; fjs.parentNode.insertBefore(js, fjs);}(document, ‘script’, ‘facebook-jssdk’));

Videocon Defaults On Rs 2,810 Cr Loan From ICICI Bank Whose CEO Gets Hus…