Union Finance Minister Nirmala Sitharaman firmly defended the Income Tax Bill, 2025 in Parliament, emphasizing its crucial role in combating tax evasion by leveraging digital evidence. She specifically pointed out that WhatsApp messages were instrumental in uncovering a substantial ₹200 crore in unaccounted wealth connected to cryptocurrency transactions.

The bill, which has now been passed by the Lok Sabha, introduces significant provisions that legally empower tax authorities to access digital records, effectively aligning tax enforcement mechanisms with rapid technological advancements. The bill also includes major reforms designed to simplify tax laws and increase tax rebates for individual taxpayers, set to take effect from April 1, 2025. These changes aim to reduce the burden on taxpayers and enhance overall compliance.

Unearthing Financial Misconduct: The Role of Digital Evidence

During her address to Parliament, Finance Minister Sitharaman underscored the growing importance of encrypted messages and other forms of digital data in exposing financial fraud and tax evasion. She revealed that WhatsApp communications had been pivotal in uncovering ₹200 crore in evaded taxes, particularly linked to complex cryptocurrency dealings, while historical data from Google Maps assisted investigators in pinpointing locations where illicit cash was hidden.

The Finance Bill 2025 also proposes substantial relief for individual taxpayers, raising the income tax rebate threshold to ₹12 lakh annually (and ₹12.75 lakh for salaried individuals). This significant increase is anticipated to benefit millions of taxpayers, considerably reducing their tax liabilities and promoting greater financial stability for middle-income households. In her address, Sitharaman stated, “Digital trails are becoming increasingly critical in tracing financial irregularities. The Income Tax Bill 2025 ensures that we can effectively use this data to enforce compliance and bring tax evaders to justice.”

Modernizing Tax Laws: A Shift Towards Transparency and Efficiency

The Income Tax Bill, 2025, is designed to replace the Income Tax Act of 1961, modernizing India’s tax laws to meet the challenges of a digital economy. In addition to empowering tax authorities to access digital evidence legally, the bill introduces structural reforms such as a unified tax year to simplify compliance. Sitharaman emphasized that the goal is to create a more transparent and efficient tax system, reducing opportunities for evasion.

The bill also retains the revised tax slabs announced in Budget 2025 under the new tax regime, providing continuity for taxpayers while encouraging voluntary compliance. It also includes provisions for streamlining the dispute resolution process, reducing the backlog of pending cases and promoting faster and fairer outcomes for taxpayers. One key aspect is the introduction of a digital platform for taxpayers to manage their tax obligations more easily, from filing returns to tracking refunds.

Stakeholder Reactions: A Mixed Bag of Support and Concerns

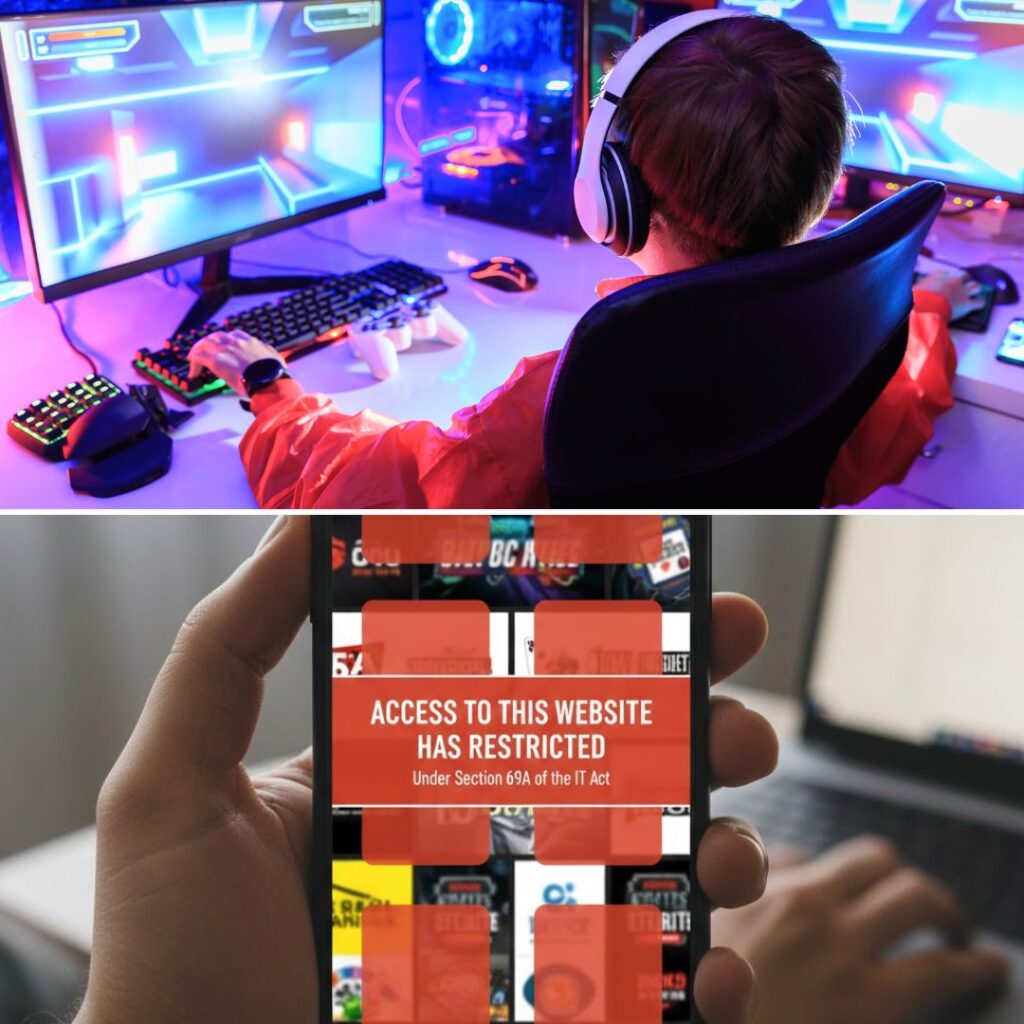

Following the announcement of the Income Tax Bill, various stakeholders expressed their views on its implications. While many taxpayers welcomed the increased rebate thresholds as a much-needed relief amidst rising living costs, some experts raised concerns about privacy issues related to accessing personal digital communications.

Tax consultant Ramesh Gupta noted, “While it is essential to combat tax evasion effectively, we must ensure that citizens’ privacy rights are not compromised in this process.” On the other hand, industry representatives praised the government’s proactive stance on modernising tax laws but urged for clear guidelines on how digital evidence will be handled to prevent misuse.

The Logical Indian’s Perspective

The passage of the Income Tax Bill, 2025 marks a significant stride toward modernizing India’s tax framework by integrating technological advancements to combat tax evasion. While these measures aim to enhance accountability and fairness, it is imperative to address potential concerns regarding privacy and the responsible use of digital evidence through robust safeguards and oversight mechanisms.

The substantial tax relief offered under the new regime is commendable as it promises to ease the financial burden on millions of households and encourage greater compliance. As India embarks on this transformative journey, how can we ensure that the benefits of a modernised tax system are shared equitably while preserving individual liberties and promoting a culture of ethical financial conduct? We invite our readers to share their insights on balancing these critical considerations as we shape the future of taxation in India.