On February 1, 2025, Finance Minister Nirmala Sitharaman presented the Union Budget for the fiscal year 2025-26, marking her record eighth consecutive budget. This budget aims to address pressing economic challenges while fostering growth and development across various sectors.

Economic Context

The Indian economy is projected to grow between 6.3% and 6.8% in FY 2025-26, as highlighted in the Economic Survey. The government is focused on structural reforms in land and labour sectors to enhance growth potential. President Droupadi Murmu’s address to Parliament emphasised the government’s commitment to overcoming “policy paralysis” and ensuring inclusive development.

Key Announcements

Taxation Reforms for Taxpayers

One of the most significant aspects of this budget is the proposed changes to income tax slabs:

- No Income Tax on Income Up to ₹12 Lakh: Individuals earning up to ₹12 lakh will not be required to pay any income tax under the new regime, providing substantial relief to middle-class families.

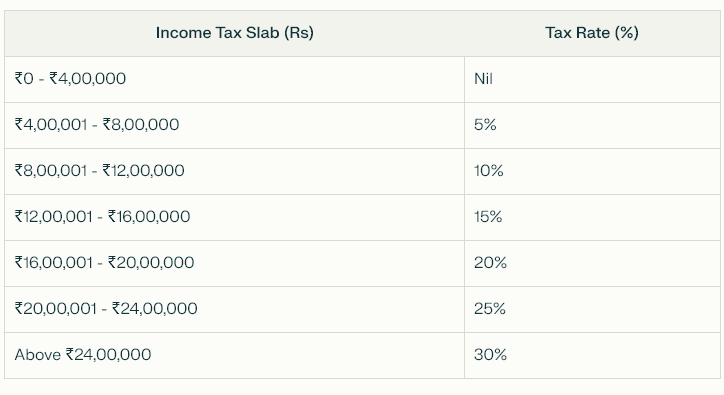

- Revised Tax Slabs: The new tax structure introduces the following income tax slabs:

- Standard Deduction Increase: The standard deduction has been raised to ₹75,000 under the old regime and ₹1 lakh under the new regime.

- Section 87A Rebate Increase: The rebate limit under Section 87A has been increased to ₹30,000 for individuals with an annual income of up to ₹10 lakh under the new regime.

Healthcare Initiatives

Sitharaman announced several healthcare initiatives aimed at improving access and affordability:

- 200 Cancer Daycare Centres: The establishment of 200 cancer daycare centres in district hospitals over three years aims to enhance treatment accessibility for cancer patients across India.

- Exemption of Life-Saving Drugs from Customs Duty: A total of 36 life-saving drugs, particularly those used in cancer treatment, will be exempted from customs duties, reducing costs for patients.

- Ayushman Bharat Funding Increase: An increase in funding for the Ayushman Bharat health insurance scheme is expected, which aims to provide affordable healthcare coverage for low-income families.

- Expansion of Medical Education: Plans include adding 10,000 new medical seats in colleges next year and a total increase of 75,000 seats over five years, addressing concerns about healthcare professional shortages.

Support for Agriculture and MSMEs

The budget emphasises support for agriculture and micro, small, and medium enterprises (MSMEs):

- Direct Income Support for Farmers: The government plans to expand direct income support schemes like PM-KISAN and improve implementation of Minimum Support Price (MSP) policies.

- Financial Inclusion Initiatives: Enhanced access to credit for rural households and small businesses through microfinance institutions and self-help groups is a key focus area.

Infrastructure Development

Sitharaman announced plans for substantial investments in infrastructure:

- Capital Expenditure Plans: The budget outlines a planned capital expenditure of ₹11.1 lakh crore aimed at enhancing infrastructure across sectors.

Industry Reactions

The budget has elicited mixed reactions from industry stakeholders:

- Positive Outlook on Tax Reforms: Business leaders welcomed the proposed adjustments in income tax slabs as a means to enhance disposable income for consumers.

- Concerns Over Inflation: Despite positive reactions regarding tax reforms, industry experts expressed concerns about persistent inflation affecting operational costs.

- Support for MSMEs: Enhanced credit guarantees for micro, small, and medium enterprises (MSMEs) received widespread support as a vital step towards fostering entrepreneurship and job creation.

The Logical Indian’s Perspective

At The Logical Indian, we believe that Budget 2025 presents an opportunity not only for economic recovery but also for fostering a society rooted in kindness, empathy, and harmony. As we navigate these challenging times, it is crucial that our policies reflect a commitment to coexistence and positive social change. By prioritising healthcare access—especially in cancer treatment—alongside robust support for agriculture and small businesses, we can build a more equitable future.

How do you think these budget measures will impact your community? We invite you to share your thoughts and engage in constructive dialogue that promotes understanding and unity among us all.

LIVE: Finance Minister Smt @nsitharaman presents Union Budget 2025-26. #ViksitBharatBudget2025 https://t.co/zyT9PFmpUJ

— BJP (@BJP4India) February 1, 2025