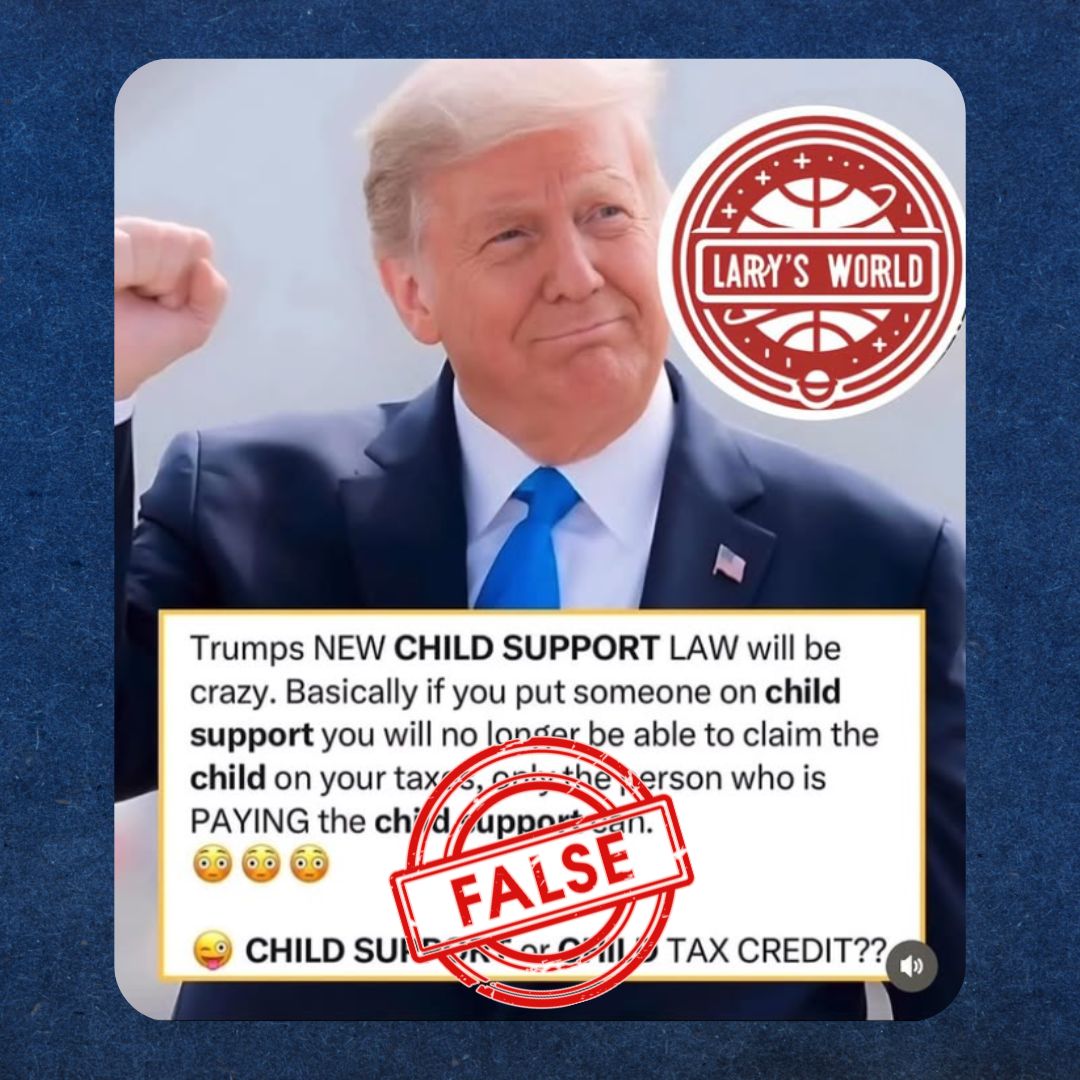

This fact-check article addresses a claim that surfaced regarding former President Donald Trump allegedly announcing a new tax law related to child support, slated to take effect in 2025. The claim gained traction in various online discussions and social media platforms, leading to confusion among the public about potential changes in child support regulations and tax implications for families. Given the importance of accurate information in discussions about tax laws and family welfare, this claim warranted careful scrutiny.

Claim

The specific claim under investigation is that Donald Trump has made an official announcement regarding a new tax law that would alter child support payments starting in 2025. This assertion implies significant changes to the existing tax framework affecting how child support is calculated or reported, which could have far-reaching consequences for parents and guardians involved in child support arrangements.

Fact

After thorough investigation, it has been confirmed that Donald Trump did not make any announcement regarding a new tax law related to child support. The claim is unfounded and lacks any credible evidence or official communication from Trump or his representatives.

Key sources affirming this fact include:

- Reuters: Their fact-checking report highlights the absence of any official announcement from Trump concerning changes to child support laws.

- FactCheck.org: This organization examined the claim and found no substantiation for the assertion, emphasizing the importance of verifying such statements before dissemination.

- Snopes: Known for its rigorous fact-checking, Snopes also addressed this claim, concluding that it is false and highlighting the potential for misinformation to spread rapidly online.

These sources collectively underscore that the claim is not only untrue but also potentially misleading for those who may be impacted by actual changes in tax law.

Conclusion

The classification of this fact check falls under False Content. The assertion that Donald Trump announced a new tax law regarding child support is entirely false and misleading. It showcases how misinformation can circulate, particularly in politically charged contexts, and emphasizes the necessity for critical evaluation of claims before accepting them as fact. This situation serves as a reminder of the importance of relying on credible sources for information, especially when it pertains to legal and financial matters affecting families.