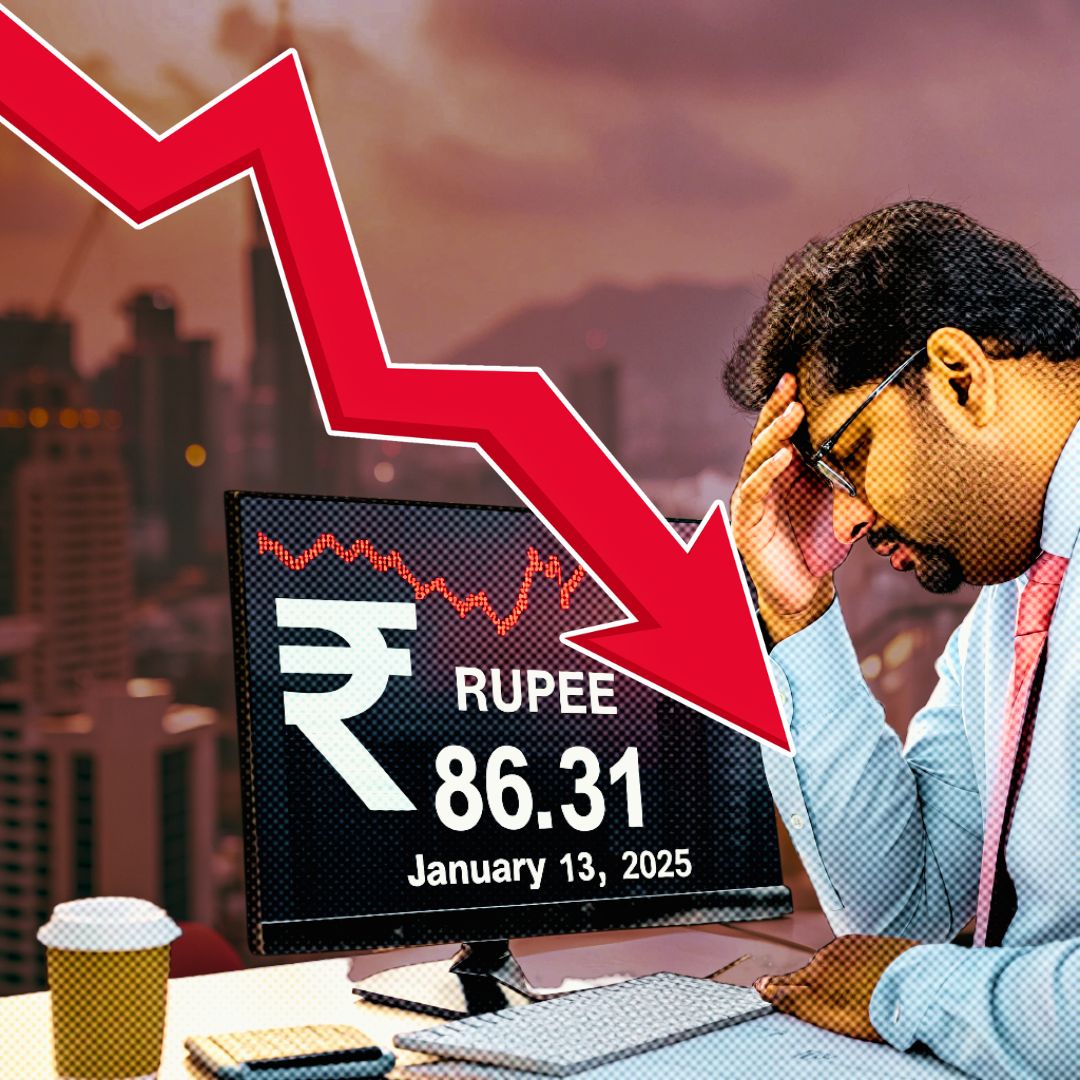

On January 13, 2025, the Indian Rupee fell to ₹86.31 against the U.S. dollar, marking a historic low. This sharp depreciation is largely attributed to a combination of rising crude oil prices, continued foreign capital outflows, and a downturn in domestic equity markets. Experts warn that these pressures could lead to inflationary challenges and slow economic growth, raising concerns about the Rupee’s stability in the long term.

Background Context: Economic Trends and Market Reactions

The recent depreciation of the Rupee is part of a broader trend influenced by several key factors. In the global market, Brent crude oil prices surged by 1.44% to $80.91 per barrel due to geopolitical tensions and supply disruptions, raising alarms about India’s trade deficit and inflation rates. As India imports over 80% of its oil needs, fluctuations in global oil prices have a direct impact on the country’s economic stability.

At the same time, foreign institutional investors (FIIs) have been withdrawing funds from Indian markets, prompted by concerns over slowing economic growth and rising inflation. On January 10 alone, FIIs sold ₹2,254.68 crore worth of equities, contributing further to the Rupee’s weakening. Domestic equity markets mirrored this sentiment, with major indices like the BSE Sensex dropping by 550.49 points to 76,828.42 and the Nifty sliding 182.45 points to 23,249.05 during early trade.

The Impact of Oil Prices on Inflation

The surge in crude oil prices has significant implications for inflation in India. Higher oil prices lead to increased costs for transportation and production across various sectors, ultimately affecting consumer prices. Analysts predict that if oil prices remain elevated, it could push inflation rates beyond the Reserve Bank of India’s comfort zone of 2-6%. This scenario would necessitate tighter monetary policy measures that could further strain economic growth.

Capital Flight and Its Consequences

The outflow of foreign capital has compounded the challenges facing the Rupee. The withdrawal of ₹2,254.68 crore by FIIs is indicative of a broader trend where investors seek safer havens for their capital. This capital flight not only weakens the currency but also raises concerns about liquidity in domestic markets, potentially leading to higher borrowing costs for businesses and consumers alike.

Expert Insights

Rajesh Kumar, a senior forex analyst, stated, “The combination of rising oil prices and capital flight is creating a perfect storm for the Rupee. If these trends continue unchecked, we could see significant inflationary pressures that will affect everyday consumers.” His comments underscore the urgency of addressing these economic challenges.

Government Response: Potential Policy Measures

In light of these developments, there are growing calls for government intervention to stabilize the currency and restore investor confidence. Potential measures could include:

- Monetary Policy Adjustments: The Reserve Bank of India (RBI) may need to consider interest rate hikes or other tools to counter inflationary pressures.

- Fiscal Stimulus: Implementing targeted fiscal measures could help stimulate economic growth while addressing immediate concerns related to currency stability.

- Strategic Reserves Management: Strengthening foreign exchange reserves could provide a buffer against volatility in global markets.

The Logical Indian’s Perspective

The current situation surrounding the Rupee highlights the interconnectedness of global economies and the vulnerabilities that arise from external shocks. As citizens, it is essential to engage in constructive dialogue about how to tackle these challenges. While immediate steps may be necessary to stabilize the currency, we must also consider long-term strategies that promote economic resilience.

The government must adopt policies that not only address current currency concerns but also support sustainable economic growth and protect vulnerable communities from adverse effects.

As we navigate these turbulent times, how can we ensure that our economy remains resilient while safeguarding those most affected by these changes?