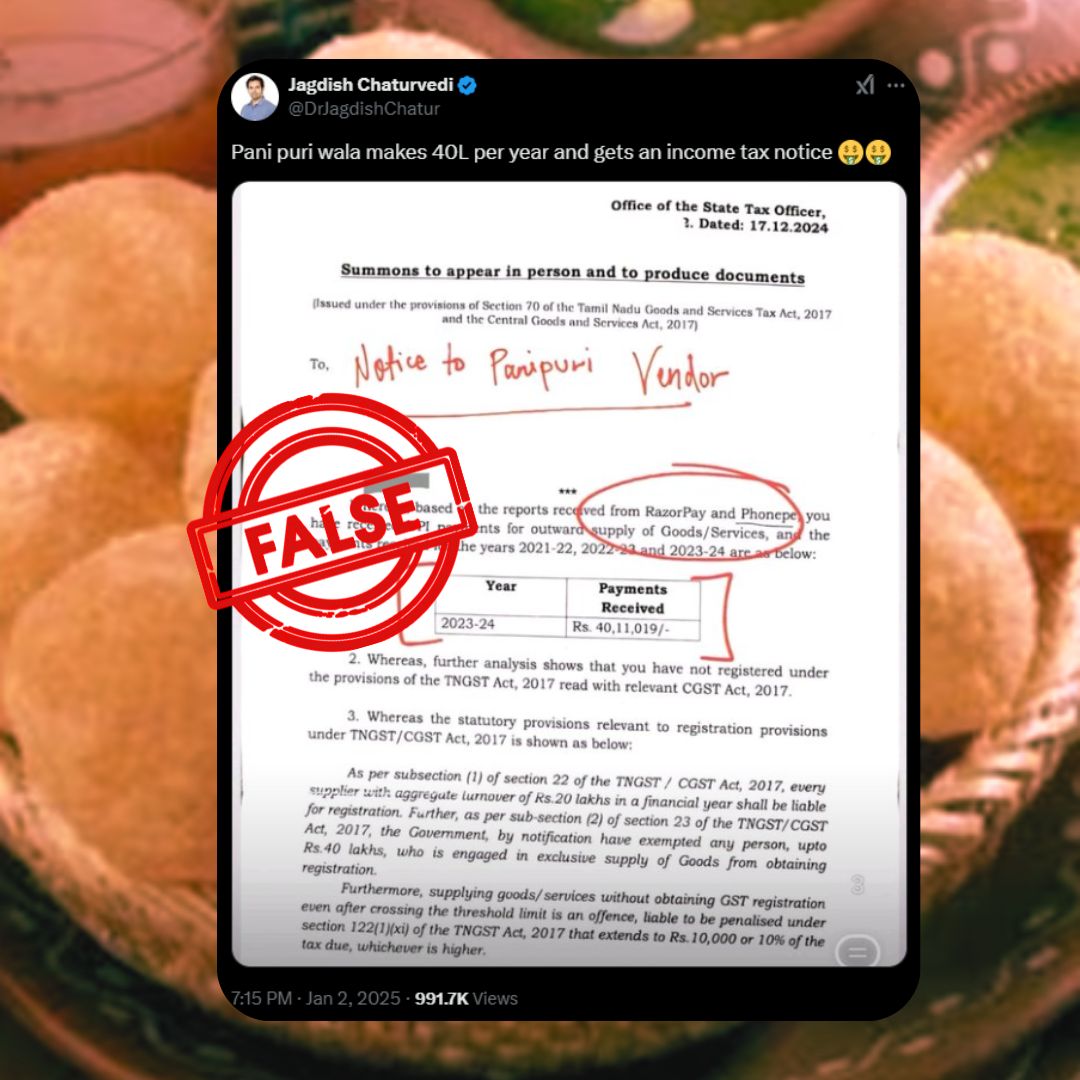

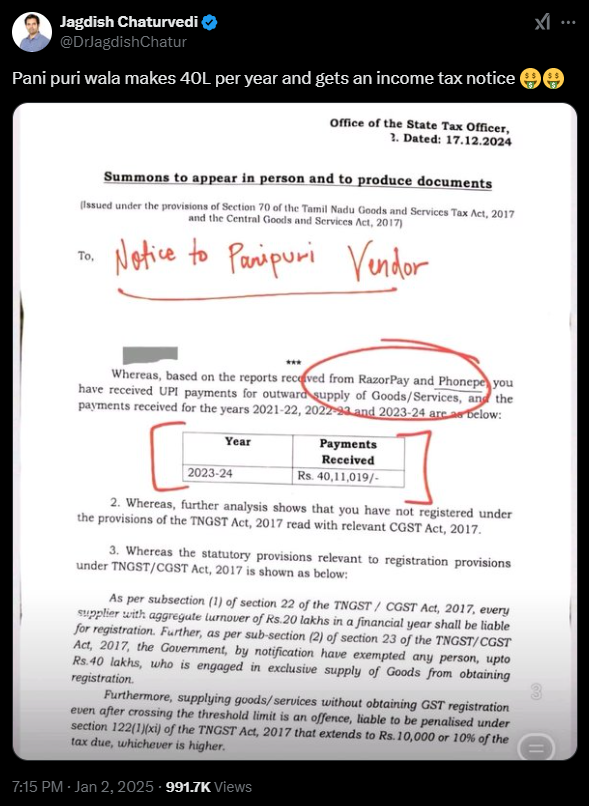

In early January 2025, a story began circulating on social media claiming that a panipuri vendor from Tamil Nadu had received a Goods and Services Tax (GST) notice for allegedly earning ₹40 lakh in a single financial year. This claim quickly gained traction, prompting widespread discussion about the challenges faced by small vendors under India’s GST framework.

Many people expressed concern over the implications of such taxation on small businesses, fearing that stringent tax regulations could threaten their livelihoods. The story raised important questions about income thresholds for GST registration and the treatment of small vendors in the tax system.

Claim

The claim in the viral story is that a panipuri vendor was issued a GST notice due to reported earnings of ₹40 lakh. This assertion suggests that the vendor was subject to tax scrutiny because of high income, which could imply that many small vendors might face similar issues if they exceed certain income thresholds.

Fact

Upon investigation, it was determined that the claim is false. The panipuri vendor did not receive any GST notice, and the reported income was significantly lower than the claimed ₹40 lakh. In reality, the vendor’s income was approximately ₹1.5 lakh, which is well below the threshold for mandatory GST registration (currently set at ₹20 lakh for most states in India). This clarification dispels fears about small vendors being unfairly targeted by tax authorities based on inflated income claims.

The facts were corroborated by several reputable sources:

- India Today – Provided detailed coverage and verification of the vendor’s actual earnings.

- The Hindu – Reported on the misunderstanding surrounding GST regulations and small businesses.

- Times of India – Offered insights into the broader context of tax compliance for small vendors.

Conclusion

This fact-check is classified as False Content. The original claim about the panipuri vendor receiving a GST notice for earning ₹40 lakh is entirely inaccurate. It misrepresents both the vendor’s actual income and their tax obligations, thereby misleading readers about the realities faced by small vendors under India’s GST system. Such misinformation can create unnecessary panic and misunderstanding among small business owners regarding their tax responsibilities.