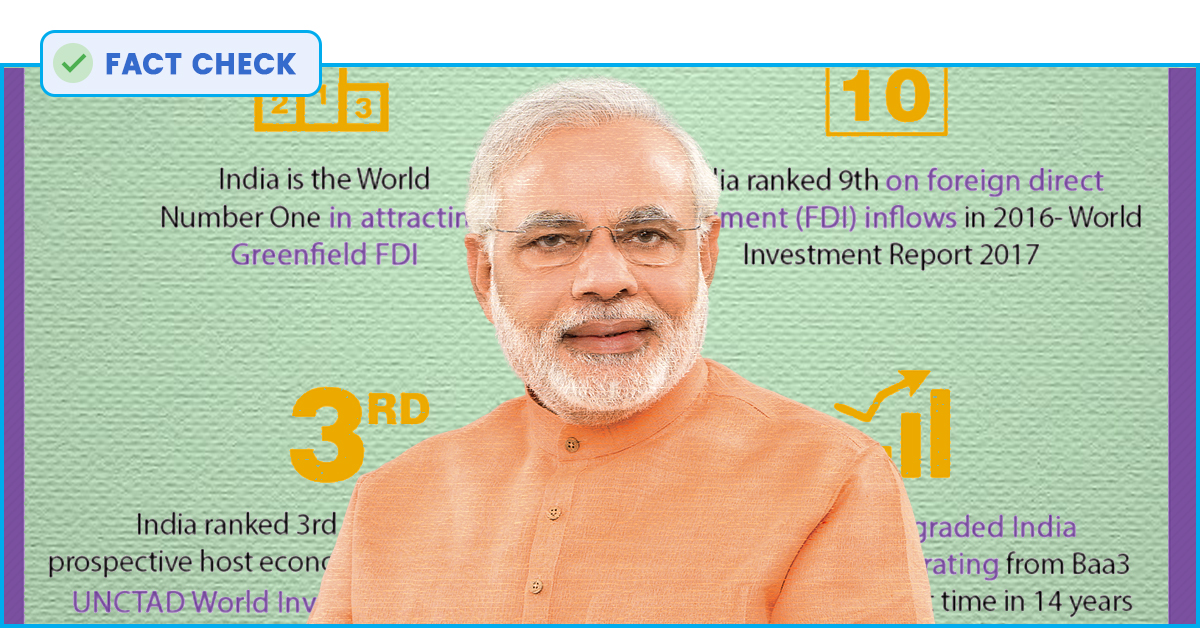

In an infographic uploaded on the 48 months website, the government made claims about India’s global standing in terms of FDI inflows. Here is a fact check of these claims.

What is Foreign Direct Investment (FDI)?

As per the International Monetary Fund (IMF), FDI refers to an investment made to acquire lasting interest in enterprises operating outside of the economy of the investor. Greenfield FDI is foreign investment in new assets/projects that the acquisition of existing assets.

Is India the number one in the world for attracting Greenfield FDI?

The first claim is that India is the world number one in attracting Greenfield FDI. Greenfield FDI is foreign investment in new assets/projects that the acquisition of existing assets. This claim has been made on the basis of the report by fDi Intelligence which is, according to the same report, the most comprehensive service tracking cross-border Greenfield investment across all countries and sectors worldwide. According to the fDi report 2017, ‘For the second year running, India was the highest ranked country by capital investment, with $62bn-worth of FDI projects announced in 2016. India retained its top spot for FDI by capital investment following an increase in investment of 2% to $62.3bn.’

However, as per the fDi report 2018, ‘In 2017, India was replaced by the US as the highest ranked country for FDI by capital investment, with $87.4bn recorded, boosted by major announcements from Foxconn and Saudi Basic Industries to invest billions in single plants.’

What is India’s ranking on FDI inflows?

The second claim is that India is ranked 9th on the foreign direct investment (FDI) inflows in 2016 as per the World Investment Report 2017, published by the UNCTAD. The United Nations Conference on Trade & Development (UNCTAD), a division of the UN, tracks FDI investments across economies. The Division on Investment and Enterprise of UNCTAD serves as the focal point for all matters related to FDI and multinational enterprises in the United Nations System.

The World Investment Report 2017 shows that India is indeed ranked 9th in the list for the year 2016. As per the FDI figures compiled by UNCTAD, FDI in India has been increasing over the years. The greatest increase in FDI inflows was witnessed between 2005-2008, before the global financial crisis. From $ 7.6 billion in 2005, the FDI inflows to India increased more than 6 times to $ 47.1 billion in 2008. The FDI inflows in 2008 are highest ever for India. The inflows almost halved by 2012 when the FDI inflows were $ 24.2 billion. The FDI inflows have again witnessed an increasing trend from 2012 till 2016. However, in 2017, the FDI inflows decreased to $ 39.9 billion from $ 44.5 billion in 2016. As per the World Investment Report of 2018, India is ranked 10th for the year 2017.

What is India’s rank in the list of prospective host economies?

The third claim is that India is ranked 3rd in the list of top prospective host economies for 2016-18 in the UNCTAD World Investment Report (WIR). The World investment report 2016 says ‘MNEs’ three top prospective host countries – China, India and the United States – remain unchanged in this year’s survey.’India is ranked third among the three countries and it remains so even according to The World Investment Report 2017. The report also claims that the renewed efforts of countries such as India, China and the United States to attract foreign direct investment could increase the absolute amounts of money flowing in. India was in the 3rd position even during the UPA, but fell to the 4th position in as per the 2014 report.

What is India’s sovereign credit rating?

The fourth claim is that Moody’s upgraded India sovereign credit rating from Baa3 to Baa2 for the first time in 14 years. According to Moody’s website, ‘Moody’s is an essential component of the global capital market s, providing credit ratings, research, tools and analysis that contribute to transparent and integrated financial markets.’

According to Moody’s website, ‘Moody’s Investors Service (“Moody’s”) has upgraded the Government of India’s local and foreign currency issuer ratings to Baa2 from Baa3 and changed the outlook on the rating to stable from positive. Moody’s has also upgraded India’s local currency senior unsecured rating to Baa2 from Baa3 and its short-term local currency rating to P-2 from P-3.’ The Press Information Bureau has said that ‘India’s rating has been upgraded after a period of 13 years. India’s sovereign credit rating was last upgraded in January 2004 to Baa3 (from Ba1).’

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here.

Published with the permission from Factly