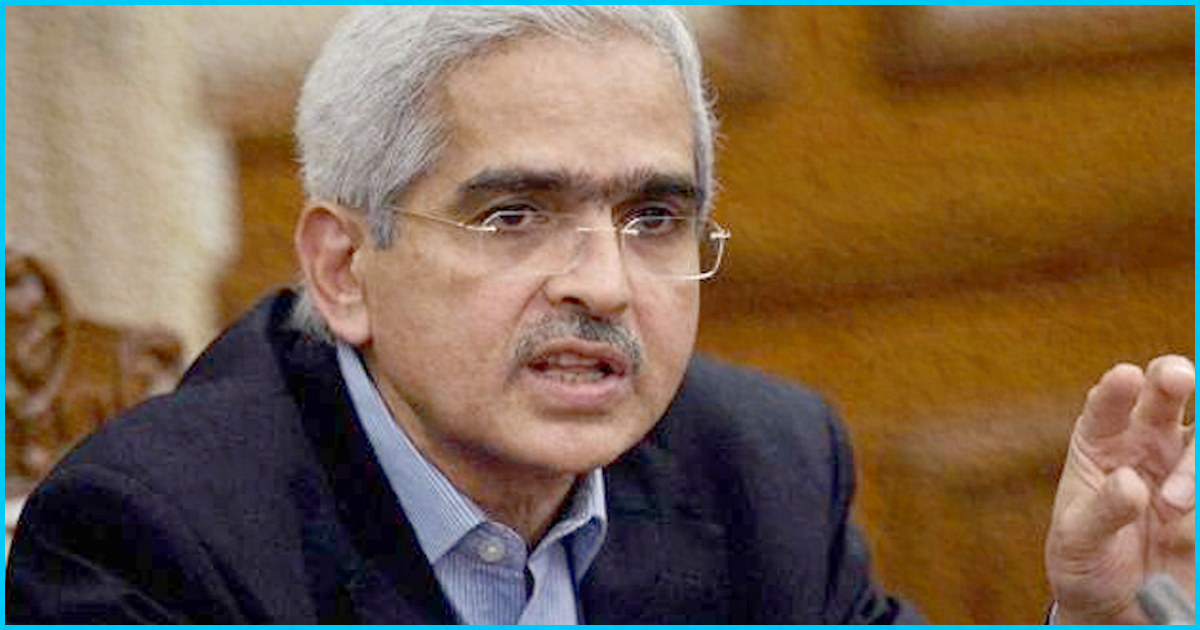

Former finance secretary and member of the Finance Commission, Shaktikanta Das has been appointed as the new governor of the Reserve Bank of India. His appointment came within 24 hours of former RBI governor Urjit Patel’s resignation.

Urjit Patel has been on tumbling terms with the Finance Ministry for some time now. Although he cited personal reasons for his resignation.

Insolvency law, FDI and budget reforms, National Infrastructure Investment Fund, fiscal framework, ease of doing business initiatives and agreements to trace foreign black money are some of the agreements that bear Shaktikanta Das’s signature.

Centre’s Face During Demonetisation

The 25th governor of RBI, Shaktikanta Das is the first non-economist since 1990 to be appointed as the RBI governor. He is a 1980 batch of IAS officer from the Tamil Nadu cadre, has a masters degree in History from Delhi University with an advanced financial management course degree from IIM Bangalore. In his 37-year-long tenure, he has mostly worked in economic and finance departments with the government. He was also appointed as India’s guide or Sherpa at G20 where Shaktikanta was involved in building strategic relations with global powers.

He is also the first one who fielded the initial questions during demonetisation. During November 2016, he held press conferences on a regular basis to answer questions regarding the banning of Rs 500 and Rs 1000 as legal tender. He spearheaded the remonetisation process, where he made sure that newly printed notes were available as to prevent a cash crunch.

Das was initially appointed by the Narendra Modi government to head the revenue department in the finance ministry. He was then moved to economic affairs and he helped by taking charge of demonetisation implementation, reported The Wire. He also helped the Modi government prepare for the rollout of Goods and Services Tax (GST).

On February 2017, Das gave a speech and predicted how the positive effects of demonetisation would be felt from April 2017. Downplaying the negative effects, he said, “from the next quarter, long-term and medium benefits and outcomes are going to be very positive.”

Course of action

According to RBI board member Satish Marathe, a circular has already been issued regarding the future course of action for the newly appointed governor. The business of order is an RBI board meeting scheduled for December 14, where they will discuss the size of the central bank’s balance sheet and its governance structure.

“If the (new) governor feels he needs time, those can be deferred and be taken up at a subsequent meeting. It is not a big thing,” Marathe told reporters.

Also Read: Rupee Opens 114 Paise Lower After Urjit Patel’s “Unfortunate” Resignation