Note – Analysis based on Delhi prices The climate of hope and excitement that was apparent when this government took power has since been replaced by an unsettling desperation for some change. The economy is in dire need of what analysts term a big bang reform. Here we look at whether cutting taxes on petrol and diesel might be the reform the government is looking for. The petrol and diesel prices were hiked by a steep Rs 3.07 per ltr and Rs 1.90 per ltr respectively on 16th March 2016 by the oil marketing companies citing a sharp increase in international crude oil prices. This argument looks fine if the same set of consumers were being benefited by lower international crude oil prices.

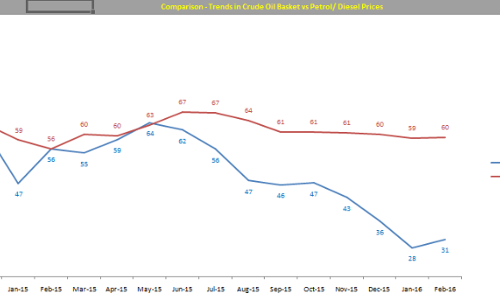

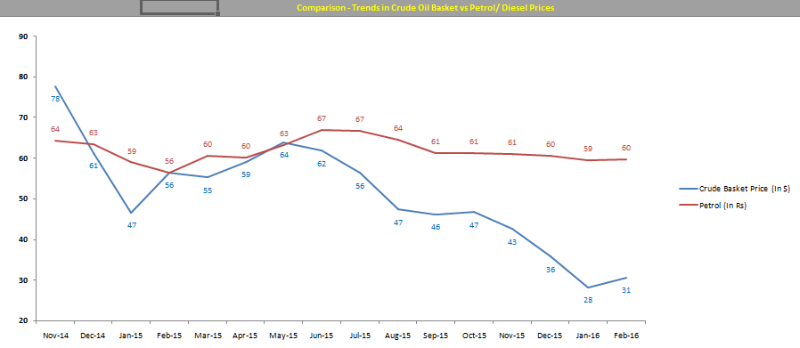

As we see, the drop in oil price from $100 to $30 has not been passed onto the consumers. The break up of the landed fuel cost to the consumer is given in the following link – Fuel cost decoded

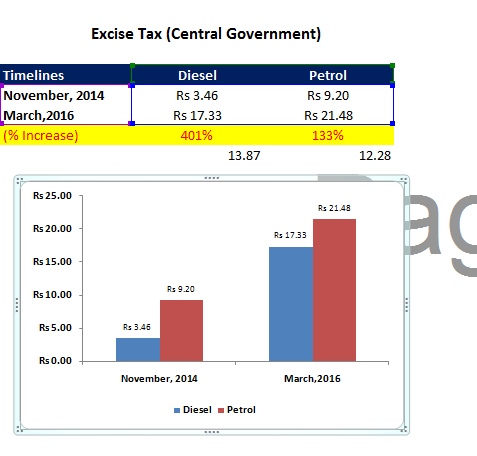

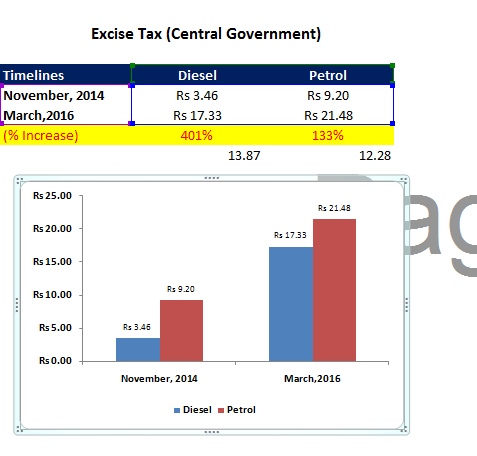

- The central government has been consistently hiking excise and other levies to increase its tax kitty. The total levy on unbranded diesel is Rs 17.33 per ltr and for unbranded petrol it is Rs 21.48 per ltr today versus Rs 3.43 per ltr for diesel and Rs 9.20 per ltr. for petrol in November 2014 a hike of 400% and 133% on diesel and petrol respectively.

-

The state governments also use VAT on fuel to increase tax revenues. Let us have a look on the figures for Delhi (November 2014 vs March 2016)

- VAT on petrol has been raised from 20% to 27%

- VAT on diesel has been increased from 12.5% to 18%

Very little to cheer for the common man

- The government has passed on the large amount of oil fall benefit to the end consumers. Is this really the case?

- The petrol price was Rs 64.24 per ltr in November 2014 vs. Rs 59.68 per ltr today (only 7% lower as compared to 70% drop in international prices)

- The diesel price was Rs 53.35 per ltr in November 2014 vs Rs 48.33 per ltr today (only 9% lower as compared to 70% drop in international prices)

The common man has to still pay a very high price at the pump, even though international oil prices have fallen off the cliff. The current diesel price and petrol price are Rs 48.33 per ltr and Rs 59.68 per ltr respectively. If the central government had not increased excise duty over the past 15 months, then diesel and petrol prices would have been lower by Rs 13.87 per ltr and Rs 12.28 per ltr respectively.

Government view for not passing benefit to end users

- The primary reason is to reduce consumption. India already suffers a lot from environmental problems with its major cities already among the most polluted in the world.

- The government also says we are spending this money saved in infrastructure. But, can they tell what extra roads/highways they have constructed using this huge amount of money? A study once done by the European transport federation found that “Every billion of tax revenue shifted from labour onto fuel can be estimated to create some 11,000 jobs”, http://www.transportenvironment.org/sites/te/files/media/2011%2004%2013%20fuel%20tax%20report%20final%20merged.pdf

- India like many European countries with high fuel taxes has a negative balance of trade, a chunk of which is due to oil imports.Keeping the prices high reduces the consumption and hence lowers impact.

- Last but not the least; the government also says we are cutting down on subsidies in a deregulated price regime. This is something on which we can have a good laugh. Let me explain why – The cost of petrol and diesel is around Rs 25 per ltr to the government and it is earning huge amount of money via excise tax. It would have been a subsidy if the government would have sold it below cost say at Rs 18 per ltr. Hence, this propaganda that government provides subsidy on fuel is completely false. In fact, fuel is the government’s cash cow.

Government must pass on the benefits to end customers . Here are a few reasons why

- Inflation will fall sharply if the retail fuel prices are lower. This will give room for the RBI to cut benchmark rates and lower the cost of borrowing. This is exactly what the finance ministry and RBI have been at loggerheads for a long while

- The disposable income in the hands of the consumers will increase. This will help revive consumer sentiment and increase sales across companies across sectors

- The government is a very poor allocator of scarce capital due to leakages and corruption. The same money in the hands of actual customers will boost consumption and higher economic growth

- This is a very lazy policy by the government to cover the fiscal deficit by increasing excise tax. What if suddenly the oil prices shoot up to say 60$ or even 80$ per barrel? Will they cut excise duty to compensate for the increase in prices by Oil Marketing Companies ? If they don’t then inflation will shoot up

- The government urgently should look at avenues to bolster direct and indirect tax collection because the windfall from low international prices won’t be for eternity

Direct Taxes

- Increase tax base by getting more working population under income tax net. Currently, less than 4% of the population is paying income taxes.

- Make policies where the rich have to pay higher taxes. Currently, the economic inequality is increasing because the rich don’t have to pay high-income taxes due to tax loopholes, but the middle class is overburdened

Indirect Taxes

- It is a well-known fact that a large number of business establishments are collecting VAT/Service tax from their customers, but are not depositing the full amount with the government. The solution to this is very simple and the AAP government in Delhi has come out with a DVAT mobile app in which customers can upload their bills and lucky 1% will get 5x bill amount as reward. This will create fear in mind of business establishments and increase indirect tax collections (App link – DVAT APP)

- Simplify the process of registration and compliance for business establishments. But in case of violations take strict action

It will be interesting to see how the international prices shape up over the next 12 months and how our government responds. The excel file containing all the data and charts can be downloaded from this link – Download here