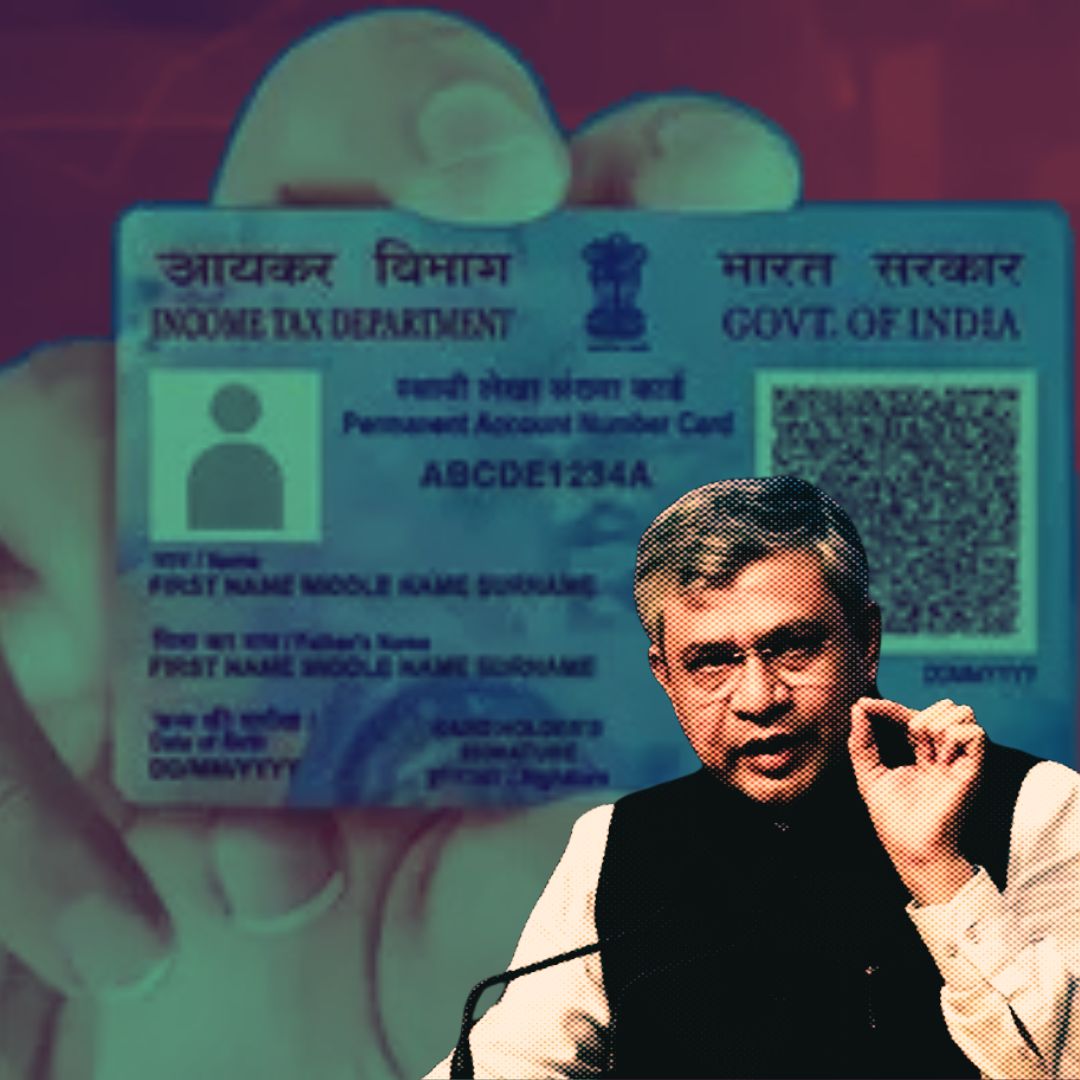

The Indian government has officially approved the PAN 2.0 project, a significant initiative aimed at modernising the Permanent Account Number (PAN) system. With a financial outlay of ₹1,435 crore, this project is set to transform taxpayer registration services, enhancing accessibility and security for approximately 78 crore PAN cardholders across the country.

What is PAN 2.0?

The PAN 2.0 project is designed to create a more efficient and secure tax identification system by integrating advanced technology into existing processes. The initiative will introduce features such as QR code-enabled PAN cards, a unified digital portal, and improved grievance redressal mechanisms. Union Minister Ashwini Vaishnaw emphasized that the upgraded system will not require existing cardholders to reapply for new PAN cards; instead, they will receive enhanced cards at no additional cost.

Why is PAN 2.0 Necessary?

The introduction of PAN 2.0 comes amid growing concerns about tax evasion and the need for a more efficient taxation framework in India. The existing system has faced challenges related to outdated technology and inadequate data management, which have hindered compliance efforts. Previous reforms, such as the implementation of the Goods and Services Tax (GST), have laid the groundwork for modernising tax collection but highlighted the necessity for further improvements in taxpayer identification and data security.

Key Features of PAN 2.0

1. QR Code Integration: The new PAN cards will feature QR codes for easier verification and digital use.

2. Unified Business Identifier: PAN will serve as a common identifier across various government digital platforms.

3. Enhanced Security Measures: Robust cybersecurity protocols will be implemented to protect sensitive taxpayer data.

4. Paperless Operations: The project aims to establish a fully online and eco-friendly service delivery system.

5. Streamlined Grievance Redressal: A dedicated system will be put in place to address taxpayer complaints efficiently.

When Will PAN 2.0 Be Implemented?

The government has set an ambitious timeline for the implementation of PAN 2.0, with plans to roll out the new system by the end of 2025. This timeline reflects a commitment to ensuring that all necessary technologies are in place and that stakeholders are adequately prepared for the transition. Officials are optimistic that this project will lead to a significant reduction in tax evasion while making it easier for taxpayers to comply with their obligations.

Benefits for Tax Payers

The PAN 2.0 project promises numerous advantages for taxpayers:

1. Greater Accessibility: The unified portal will simplify access to various taxpayer services, making it easier for users to navigate the system.

2. Faster Service Delivery: The integration of technology will significantly speed up the processing of tax-related services, making it easier for individuals and businesses to comply with their tax obligations.

3. Improved Data Accuracy: Enhanced data management practices will ensure that taxpayer information is accurate and up-to-date, reducing errors and discrepancies.

4. Cost Savings: The transition to a digital system is expected to lower operational costs for both the government and taxpayers, as paper usage decreases and processes become more efficient.

5. Eco-Friendly Approach: By promoting paperless operations, the project aligns with sustainability goals, contributing to environmental conservation.

The Logical Indian’s Perspective

At The Logical Indian, we believe that initiatives like PAN 2.0 are crucial for fostering transparency and accountability in governance. As technology continues to evolve, it is essential that our systems adapt to ensure fairness and equity in tax collection. This project not only promises enhanced efficiency but also reflects a commitment to empowering citizens through better access to information and services. How do you think technology can further improve our tax systems? Share your thoughts in the comments below!

#WATCH | Delhi | Union Minister Ashwini Vaishnaw says, "PAN card is part of our life which is important for the middle class and small business – it has been highly upgraded and PAN 2.0 has bee approved today. The existing system will be upgraded and the digital backbone will be… pic.twitter.com/E2gjhnHYgz

— ANI (@ANI) November 25, 2024