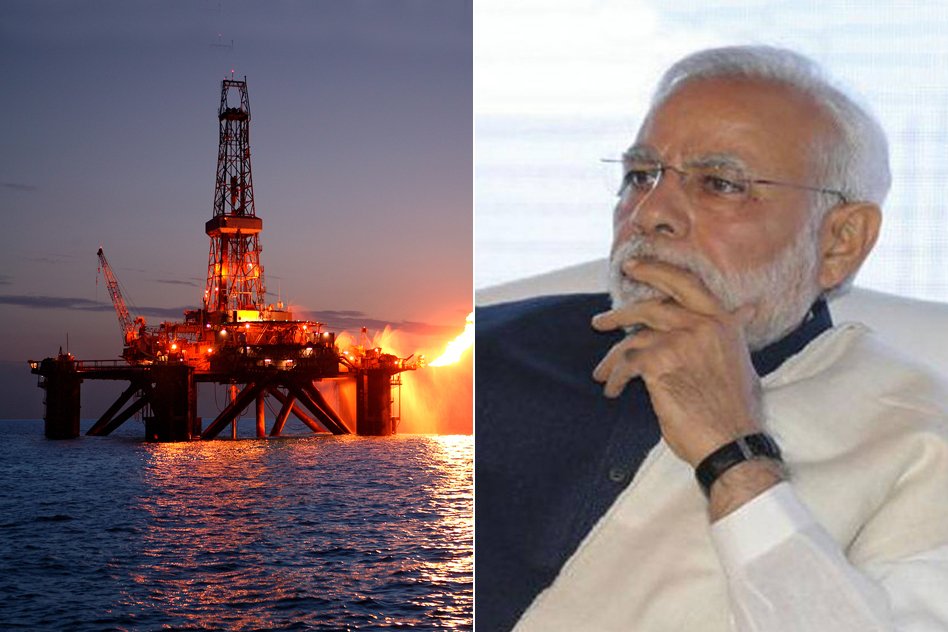

KG Basin Scam - Gujarat State Government & Narendra Modi Are Unaware ? Or At The Center Of It?

19 April 2016 1:35 PM GMT

There has barely been any media coverage of the affairs of the Gujarat State Petroleum Corporation (GSPC). GSPC, for the past five to six years, siphoned off many thousands of crores from public sector banks without unearthing any gas as promised by GSPC and Mr. Narendra Modi (then Gujarat Chief Minister). The Comptroller and Auditor General of India (CAG), has rapped the state government in successive years for the spending of around Rs 19,700 crore, without any production, reports of this scam haven’t penetrated much into the media, thus hardly anyone knows about it. Gujarat assembly has been notorious for not placing the CAG reports in the state assembly as mandated by the Indian Constitution.

How it all started?

During 2005, Narendra Modi was the Chief Minister of Gujarat. In June that year, he had emphatically announced that the GSPC had discovered India’s largest reserve of natural gas in the Krishna-Godavari (KG) basin. It caught the surprise of the entire nation because it estimated 20 trillion cubic feet (TCF) of gas worth Rs 2,20,000 crore, which was bigger than Reliance’s discovery of 14 TCF in 2002. Modi had also promised that the production will start by December 2007, which will make the country energy independent, eventually by reducing the import bills. Over a decade after Modi’s declaration, the grim reality is that the GSPC haven’t yet started its commercial production. Years of looking out for gas the company could not find anything.

Murky Dealings of the GSPC

- GSPC, which was formed in 1979, did not have any loans to pay till 2007. But after the exploration of the KG Basin, the company partnered with GeoGlobal Resources of Barbados.

- GeoGlobal again partnered with Roy Group in Mauritius, a country which is most famous as a tax haven.

- For the project, GSPC had borrowed a sum of RS 19,720 crore in loans from public sector banks and other financial institutions.

- To procure platform rigs to take out gas in KG Basin, it gave the contract to a company called Tuff Drilling which was an inexperienced company set up in 2007. More than Rs. 5,000 crore had been spent in expenses to Tuff Drilling and other such entities.

With all of this, the GSPC came out with only a development plan report for recovering gas from the basin. So, a full four years after the announcement and two years after the expected production year, GSPC produced a report of few hundred pages that supposedly articulated how it planned to extract gas from the KG basin. And what more the report itself hinted on the inviability of the project.

Why was the plan not viable?

- Every company that engages in deepwater gas exploration has to factor in the government’s gas pricing policy. According to the report, GSPC assumed a gas price of $5.7 per million British thermal unit (MMBTU) even though the prevailing government-approved formula was $4.20 per MMBTU. This means that at the time the field development plan was written and proposed, it wasn’t economically viable.

- There was a lot of technological challenges to extract gas from the basin. The basin falls under high pressure, high temperature (HPHT) conditions. Procuring gas from those areas has been difficult because of the low permeability of reservoir fluid from the rocks.

What could have been done?

Oil exploration is always an expensive and risky proposition. Yet, it is also the norm that when one realises that there is no or minimum oil or gas to be found, one either stops exploration immediately or reduces costs appropriately. GSPC did neither. The state-based PSU continued to extract money from public banks, which was used for fake claims of gas discovery and giving out contracts to doubtful entities. The CAG has continuously reported over several years about the wrongful ventures of the GSPC, but everyone in the government went mum over the issue.

Bad loans and Debts of Public Banks

It’s not a new fact that the Public sector Banks are sometimes controlled by people who are in power. Politicians often create pressure over these banks to milk money for their favoured industries and businessmen. Thus, the banks have to give loans and now bleeding due to these bad loans. Not only a Vijay Mallaya, but companies like GSPCs are also on the verge of being loan defaulters since it has not produced anything till now and at a staggering price of Rs 19,700 crores.

The Logical Indian urges the government to come clean on this. We demand that the parliament takes up the CAG reports and place it in the parliament. We request the mainstream media to take this issue on high priority and reach out to the people on the wrong doings.

All section

All section