Read To Know How Bigger Companies Pay Lower Tax Rate Than Smaller Companies

11 March 2016 12:02 PM GMT

Image Courtesy: ibtimes forbesimg

The major press coverage on the budget has not revealed insight on some critical aspects of the budget.

In the Union website, the document “Revenue impact of Tax incentives under the Central Tax System: Financial Years 2014-15 and 2015-16”, contains some fascinating but little-covered details of the budget in the mainstream media. This article focuses on money lost in providing ‘incentives’ (subsidies) to corporates. As PM Modi had said at an event earlier this year, “Why is it that subsidies going to the well-off are portrayed in a positive manner?”. P Sainath, mentioned in an article earlier that India has allowed corporate income tax foregone of over Rs 6 lakh crore from 2005-06 to 2014-15. The trend continues this year as well.

India loses crores of money on corporate subsidies

India has lost over Rs 65,067 crore in corporate subsidies in 2014-15 and is expected to lose Rs 68,710 crore in 2015-16. Further if you look at the data, there is a big (and for some reason under-reported) issue regarding the proportional benefits of these subsidies to the bigger corporates. Compare this with the agriculture and farmers welfare budget itself which is Rs 35,984 crore and the NREGA budget being at Rs 38,500 crore and we find ourselves asking if the taxpayer money is being spent for the right subsidies/incentives.

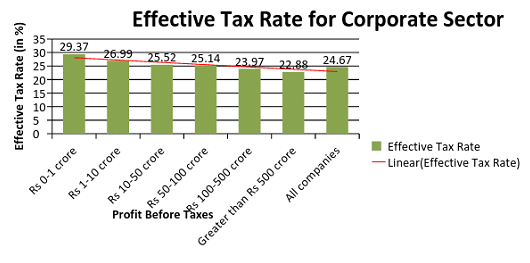

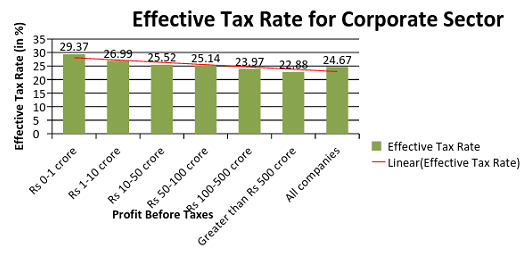

Sample this – corporates have a statutory tax rate of 33.84% assigned to them which they have to pay on their profits. However, the effective tax rate as observed in 2014-15 was just 24.67%. Although this number is higher than in 2013-14 which was 23.22%, we are still losing greater amounts in subsidies to the corporates every year. This data was taken from the 5,82,889 corporate returns that the Income Tax department had received from corporates by 30th Nov, 2015.

The bigger the profit, the lower the tax rate paid

The stunning data shows, that the companies making bigger profit are paying a lower rate of effective tax. The effective tax rate is calculated by the IT department as by taking the profit to tax ratio. For instance a company making profit between Rs 0-1 crore paid was 29.67%, however for that which made profit greater than Rs 500 crore paid corporate tax of just 22.88%. This means that for the smaller organization (making a smaller profit), there is no level-playing field.

Further the data shows that in 2014-15, 43.6% of the corporates made losses, 3% companies made 0 profit and a further 47.4% of companies made profits between Rs 0-1 crore.

Less than 6% companies recorded profits in excess of 1 crore.

Companies that made profit but received money from the government

34,831 companies made profits but either paid no corporate tax or in some cases paid negative tax (i.e. they get money from the government rather than paying to the government).

Public companies pay higher tax than private companies

Public companies (25.03%) have paid higher effective tax rates than private companies (23.36%).

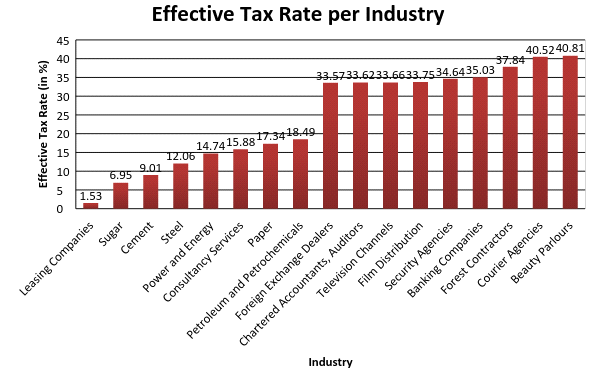

It pays to be in Leasing Companies, Sugar, Cement, Steel and Power & Energy

Corporate tax rates are generally kept low when the government wants to stimulate demand or when the industry is unattractive in certain departments and high when government wants to curb demand or when it anticipates a significant amount of money to be made in those industries.

Given this it might seem that Indian government greatly wants to support its leasing, sugar, cement companies et al. However in 2015-16, India is expected to produce excess sugar for its sixth consecutive year. Similarly for the cement industry, the supply for cement is greater than its demand with global slowdown affecting its demand. Given this, the government needs to revisit the corporate tax rates as to if the tax rates on courier agencies, beauty parlours being more than 500% of sugar is justified.

The graph shows the effective tax rate for the highest and lowest tax paying industries (all other industries, not covered in this graph fall in between). The details can be obtained in the last pages of the report.

As taxpayers, we need to seek greater transparency on the reasons for such corporate incentives/subsidies. We hope the government provides greater clarity on the same and works hard to ensure that subsidies are focused only on the needy sections of the society.

Written By Rohit Parakh

All section

All section